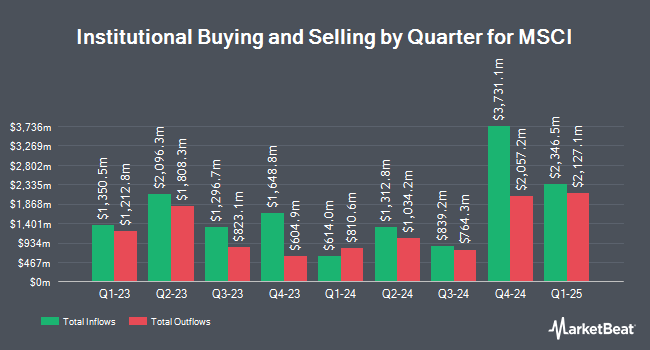

United Super Pty Ltd in its capacity as Trustee for the Construction & Building Unions Superannuation Fund raised its position in MSCI Inc. (NYSE:MSCI - Free Report) by 34.4% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 54,462 shares of the technology company's stock after purchasing an additional 13,931 shares during the quarter. United Super Pty Ltd in its capacity as Trustee for the Construction & Building Unions Superannuation Fund owned about 0.07% of MSCI worth $31,748,000 as of its most recent SEC filing.

Several other large investors have also recently made changes to their positions in the stock. Rothschild Investment LLC acquired a new stake in MSCI during the 2nd quarter worth approximately $26,000. HWG Holdings LP acquired a new stake in MSCI during the 2nd quarter worth approximately $27,000. Crewe Advisors LLC acquired a new stake in MSCI during the 1st quarter worth approximately $34,000. Ridgewood Investments LLC acquired a new stake in MSCI during the 2nd quarter worth approximately $40,000. Finally, Ashton Thomas Securities LLC acquired a new stake in MSCI during the 3rd quarter worth approximately $40,000. 89.97% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of equities research analysts have issued reports on the stock. Barclays increased their target price on shares of MSCI from $650.00 to $700.00 and gave the stock an "overweight" rating in a report on Friday, September 13th. Wells Fargo & Company increased their price objective on shares of MSCI from $570.00 to $600.00 and gave the company an "equal weight" rating in a research report on Friday, October 11th. Argus increased their price objective on shares of MSCI from $520.00 to $600.00 and gave the company a "buy" rating in a research report on Friday, July 26th. Redburn Atlantic raised shares of MSCI from a "neutral" rating to a "buy" rating and set a $680.00 price objective on the stock in a research report on Wednesday, October 9th. Finally, Evercore ISI assumed coverage on shares of MSCI in a research report on Wednesday, October 2nd. They issued an "outperform" rating and a $690.00 price objective on the stock. Seven equities research analysts have rated the stock with a hold rating and nine have issued a buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $631.83.

Get Our Latest Research Report on MSCI

MSCI Stock Performance

MSCI stock traded down $4.39 during midday trading on Thursday, reaching $606.14. The stock had a trading volume of 354,296 shares, compared to its average volume of 542,492. MSCI Inc. has a twelve month low of $439.95 and a twelve month high of $631.70. The stock has a market capitalization of $47.50 billion, a PE ratio of 39.80, a price-to-earnings-growth ratio of 3.13 and a beta of 1.11. The stock's 50-day simple moving average is $582.23 and its 200 day simple moving average is $536.05.

MSCI (NYSE:MSCI - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The technology company reported $3.86 EPS for the quarter, topping analysts' consensus estimates of $3.77 by $0.09. The company had revenue of $724.70 million for the quarter, compared to analysts' expectations of $716.15 million. MSCI had a negative return on equity of 162.06% and a net margin of 43.06%. The firm's quarterly revenue was up 15.9% on a year-over-year basis. During the same quarter in the previous year, the firm posted $3.45 earnings per share. Equities analysts predict that MSCI Inc. will post 14.98 earnings per share for the current fiscal year.

MSCI Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, November 29th. Shareholders of record on Friday, November 15th will be paid a dividend of $1.60 per share. This represents a $6.40 dividend on an annualized basis and a dividend yield of 1.06%. The ex-dividend date of this dividend is Friday, November 15th. MSCI's dividend payout ratio is presently 42.02%.

MSCI Company Profile

(

Free Report)

MSCI Inc, together with its subsidiaries, provides critical decision support tools and solutions for the investment community to manage investment processes worldwide. The Index segment provides indexes for use in various areas of the investment process, including indexed financial product, such as ETFs, mutual funds, annuities, futures, options, structured products, and over-the-counter derivatives; performance benchmarking; portfolio construction and rebalancing; and asset allocation, as well as licenses GICS and GICS Direct.

See Also

Before you consider MSCI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSCI wasn't on the list.

While MSCI currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.