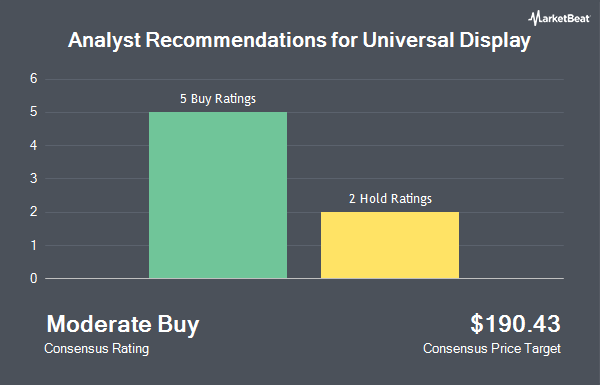

Universal Display Co. (NASDAQ:OLED - Get Free Report) has been assigned an average rating of "Moderate Buy" from the seven research firms that are currently covering the firm, Marketbeat.com reports. Two analysts have rated the stock with a hold recommendation and five have given a buy recommendation to the company. The average 12-month target price among analysts that have covered the stock in the last year is $210.71.

A number of equities research analysts have recently issued reports on the stock. TD Cowen cut their target price on shares of Universal Display from $250.00 to $225.00 and set a "buy" rating on the stock in a research note on Thursday, October 31st. Needham & Company LLC reduced their target price on Universal Display from $242.00 to $215.00 and set a "buy" rating on the stock in a report on Thursday, October 31st. Finally, Oppenheimer decreased their target price on Universal Display from $240.00 to $220.00 and set an "outperform" rating for the company in a research report on Thursday, October 31st.

Read Our Latest Analysis on OLED

Universal Display Price Performance

OLED traded up $1.48 on Thursday, reaching $150.59. The company's stock had a trading volume of 538,442 shares, compared to its average volume of 401,540. Universal Display has a 1 year low of $148.09 and a 1 year high of $237.00. The business's 50 day moving average is $176.86 and its 200 day moving average is $193.47. The stock has a market cap of $7.15 billion, a price-to-earnings ratio of 30.24, a price-to-earnings-growth ratio of 1.74 and a beta of 1.39.

Universal Display (NASDAQ:OLED - Get Free Report) last released its earnings results on Wednesday, October 30th. The semiconductor company reported $1.40 EPS for the quarter, beating the consensus estimate of $1.19 by $0.21. The company had revenue of $161.63 million during the quarter, compared to analysts' expectations of $165.28 million. Universal Display had a return on equity of 15.75% and a net margin of 36.98%. The business's revenue was up 14.6% on a year-over-year basis. During the same period in the prior year, the business posted $1.08 EPS. As a group, research analysts forecast that Universal Display will post 4.8 earnings per share for the current fiscal year.

Universal Display Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Tuesday, December 17th will be paid a dividend of $0.40 per share. This represents a $1.60 dividend on an annualized basis and a yield of 1.06%. The ex-dividend date is Tuesday, December 17th. Universal Display's payout ratio is 32.13%.

Insider Buying and Selling at Universal Display

In related news, Director Lawrence Lacerte acquired 742 shares of the firm's stock in a transaction dated Monday, November 4th. The stock was acquired at an average cost of $180.89 per share, for a total transaction of $134,220.38. Following the completion of the acquisition, the director now directly owns 122,372 shares of the company's stock, valued at approximately $22,135,871.08. The trade was a 0.61 % increase in their position. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. 1.90% of the stock is owned by company insiders.

Institutional Investors Weigh In On Universal Display

Institutional investors have recently added to or reduced their stakes in the company. Kayne Anderson Rudnick Investment Management LLC bought a new stake in shares of Universal Display in the 2nd quarter worth approximately $127,668,000. Citigroup Inc. grew its holdings in shares of Universal Display by 1,387.6% in the 3rd quarter. Citigroup Inc. now owns 261,723 shares of the semiconductor company's stock worth $54,936,000 after acquiring an additional 244,129 shares during the last quarter. Raymond James & Associates raised its position in shares of Universal Display by 629.9% during the third quarter. Raymond James & Associates now owns 269,414 shares of the semiconductor company's stock worth $56,550,000 after purchasing an additional 232,503 shares during the period. Barclays PLC lifted its holdings in shares of Universal Display by 753.8% during the third quarter. Barclays PLC now owns 212,518 shares of the semiconductor company's stock valued at $44,608,000 after purchasing an additional 187,627 shares during the last quarter. Finally, CloudAlpha Capital Management Limited Hong Kong acquired a new position in shares of Universal Display in the 2nd quarter valued at $34,558,000. 78.19% of the stock is currently owned by institutional investors and hedge funds.

Universal Display Company Profile

(

Get Free ReportUniversal Display Corporation engages in the research, development, and commercialization of organic light emitting diode (OLED) technologies and materials for use in display and solid-state lighting applications in the United States and internationally. The company offers PHOLED technologies and materials for displays and lighting products under the UniversalPHOLED brand.

Further Reading

Before you consider Universal Display, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Display wasn't on the list.

While Universal Display currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.