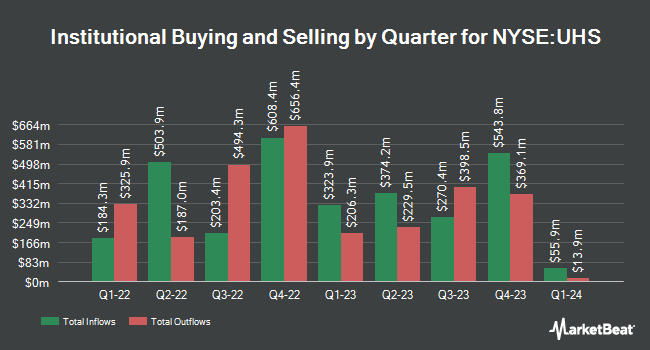

Versor Investments LP cut its stake in Universal Health Services, Inc. (NYSE:UHS - Free Report) by 63.8% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,900 shares of the health services provider's stock after selling 5,102 shares during the quarter. Versor Investments LP's holdings in Universal Health Services were worth $664,000 at the end of the most recent reporting period.

Several other institutional investors also recently bought and sold shares of the company. Financial Management Professionals Inc. purchased a new position in Universal Health Services in the 3rd quarter valued at $32,000. Blue Trust Inc. boosted its position in Universal Health Services by 1,284.6% during the second quarter. Blue Trust Inc. now owns 180 shares of the health services provider's stock worth $33,000 after acquiring an additional 167 shares during the last quarter. Innealta Capital LLC purchased a new stake in Universal Health Services during the 2nd quarter valued at about $35,000. Headlands Technologies LLC acquired a new stake in Universal Health Services in the 1st quarter valued at about $36,000. Finally, LRI Investments LLC purchased a new position in Universal Health Services in the 1st quarter worth approximately $43,000. 86.05% of the stock is currently owned by institutional investors and hedge funds.

Universal Health Services Trading Down 0.9 %

Shares of UHS stock traded down $1.76 on Thursday, reaching $200.99. 699,910 shares of the stock were exchanged, compared to its average volume of 680,407. The company has a quick ratio of 1.28, a current ratio of 1.39 and a debt-to-equity ratio of 0.69. The stock has a market cap of $13.41 billion, a P/E ratio of 13.36, a price-to-earnings-growth ratio of 0.65 and a beta of 1.29. The firm has a 50 day moving average of $221.73 and a two-hundred day moving average of $204.89. Universal Health Services, Inc. has a 1-year low of $132.38 and a 1-year high of $243.25.

Universal Health Services (NYSE:UHS - Get Free Report) last released its quarterly earnings data on Thursday, October 24th. The health services provider reported $3.71 earnings per share for the quarter, missing the consensus estimate of $3.75 by ($0.04). The firm had revenue of $3.96 billion during the quarter, compared to analyst estimates of $3.90 billion. Universal Health Services had a net margin of 6.66% and a return on equity of 15.75%. The business's revenue for the quarter was up 11.3% on a year-over-year basis. During the same period in the prior year, the firm earned $2.55 earnings per share. On average, research analysts anticipate that Universal Health Services, Inc. will post 15.93 EPS for the current year.

Universal Health Services declared that its Board of Directors has approved a share buyback program on Wednesday, July 24th that authorizes the company to buyback $1.00 billion in outstanding shares. This buyback authorization authorizes the health services provider to buy up to 8% of its stock through open market purchases. Stock buyback programs are typically an indication that the company's board of directors believes its stock is undervalued.

Analysts Set New Price Targets

Several research firms recently commented on UHS. The Goldman Sachs Group increased their price target on Universal Health Services from $200.00 to $229.00 and gave the company a "buy" rating in a report on Tuesday, July 30th. KeyCorp began coverage on shares of Universal Health Services in a research note on Friday, October 11th. They set a "sector weight" rating for the company. Stephens reaffirmed an "equal weight" rating and set a $200.00 price objective on shares of Universal Health Services in a report on Thursday, July 25th. Wells Fargo & Company upped their price objective on shares of Universal Health Services from $275.00 to $285.00 and gave the stock an "overweight" rating in a research report on Wednesday, November 6th. Finally, TD Cowen reduced their price target on Universal Health Services from $283.00 to $275.00 and set a "buy" rating for the company in a report on Monday, October 28th. Six equities research analysts have rated the stock with a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, Universal Health Services currently has an average rating of "Moderate Buy" and an average target price of $231.14.

Read Our Latest Report on UHS

About Universal Health Services

(

Free Report)

Universal Health Services, Inc, through its subsidiaries, owns and operates acute care hospitals, and outpatient and behavioral health care facilities. It operates through Acute Care Hospital Services and Behavioral Health Care Services segments. The company's hospitals offer general and specialty surgery, internal medicine, obstetrics, emergency room care, radiology, oncology, diagnostic and coronary care, pediatric services, pharmacy services, and/or behavioral health services.

Read More

Before you consider Universal Health Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Health Services wasn't on the list.

While Universal Health Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.