The Goldman Sachs Group cut shares of Universal Health Services (NYSE:UHS - Free Report) from a buy rating to a neutral rating in a report published on Monday morning, Marketbeat.com reports. The brokerage currently has $198.00 target price on the health services provider's stock, down from their prior target price of $228.00.

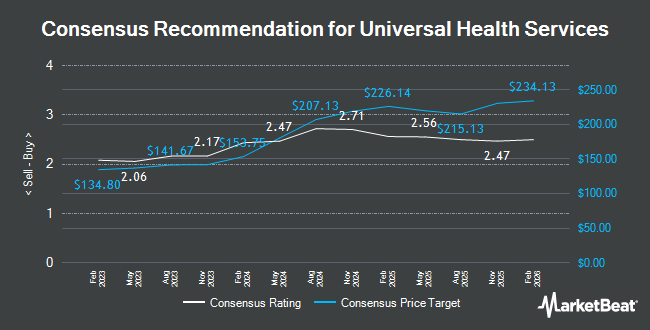

UHS has been the subject of a number of other research reports. StockNews.com cut shares of Universal Health Services from a "strong-buy" rating to a "buy" rating in a research report on Saturday, November 9th. KeyCorp began coverage on Universal Health Services in a research note on Friday, October 11th. They issued a "sector weight" rating for the company. Barclays raised their price objective on Universal Health Services from $256.00 to $271.00 and gave the stock an "overweight" rating in a research note on Friday, October 25th. Bank of America assumed coverage on Universal Health Services in a research report on Wednesday, November 6th. They set a "neutral" rating and a $223.00 target price for the company. Finally, Wells Fargo & Company decreased their price target on Universal Health Services from $285.00 to $230.00 and set an "overweight" rating on the stock in a research report on Monday, November 25th. Seven analysts have rated the stock with a hold rating, nine have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $223.29.

Get Our Latest Research Report on Universal Health Services

Universal Health Services Stock Performance

NYSE:UHS traded down $3.24 during mid-day trading on Monday, hitting $184.16. The stock had a trading volume of 671,790 shares, compared to its average volume of 679,360. Universal Health Services has a twelve month low of $147.33 and a twelve month high of $243.25. The company has a debt-to-equity ratio of 0.69, a quick ratio of 1.28 and a current ratio of 1.39. The stock has a market cap of $12.15 billion, a price-to-earnings ratio of 12.42, a PEG ratio of 0.60 and a beta of 1.28. The company's 50 day simple moving average is $207.54 and its 200 day simple moving average is $208.56.

Universal Health Services (NYSE:UHS - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The health services provider reported $3.71 earnings per share for the quarter, missing analysts' consensus estimates of $3.75 by ($0.04). The business had revenue of $3.96 billion during the quarter, compared to the consensus estimate of $3.90 billion. Universal Health Services had a net margin of 6.66% and a return on equity of 15.75%. The firm's revenue was up 11.3% on a year-over-year basis. During the same quarter last year, the company posted $2.55 EPS. On average, equities research analysts forecast that Universal Health Services will post 15.88 earnings per share for the current year.

Universal Health Services Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 17th. Investors of record on Tuesday, December 3rd will be issued a $0.20 dividend. This represents a $0.80 annualized dividend and a yield of 0.43%. The ex-dividend date is Tuesday, December 3rd. Universal Health Services's payout ratio is presently 5.32%.

Insider Transactions at Universal Health Services

In other Universal Health Services news, Director Maria Ruderman Singer sold 1,614 shares of the firm's stock in a transaction on Wednesday, December 11th. The shares were sold at an average price of $191.15, for a total value of $308,516.10. Following the completion of the sale, the director now directly owns 5,879 shares in the company, valued at approximately $1,123,770.85. This trade represents a 21.54 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Corporate insiders own 16.10% of the company's stock.

Institutional Trading of Universal Health Services

Several hedge funds have recently bought and sold shares of UHS. Financial Management Professionals Inc. bought a new stake in Universal Health Services during the third quarter worth $32,000. Blue Trust Inc. grew its stake in shares of Universal Health Services by 1,284.6% in the 2nd quarter. Blue Trust Inc. now owns 180 shares of the health services provider's stock worth $33,000 after acquiring an additional 167 shares in the last quarter. Innealta Capital LLC purchased a new stake in shares of Universal Health Services in the second quarter valued at about $35,000. True Wealth Design LLC bought a new position in shares of Universal Health Services during the third quarter valued at about $39,000. Finally, Huntington National Bank grew its position in Universal Health Services by 414.3% in the 3rd quarter. Huntington National Bank now owns 180 shares of the health services provider's stock worth $41,000 after purchasing an additional 145 shares in the last quarter. Institutional investors and hedge funds own 86.05% of the company's stock.

About Universal Health Services

(

Get Free Report)

Universal Health Services, Inc, through its subsidiaries, owns and operates acute care hospitals, and outpatient and behavioral health care facilities. It operates through Acute Care Hospital Services and Behavioral Health Care Services segments. The company's hospitals offer general and specialty surgery, internal medicine, obstetrics, emergency room care, radiology, oncology, diagnostic and coronary care, pediatric services, pharmacy services, and/or behavioral health services.

Featured Articles

Before you consider Universal Health Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Health Services wasn't on the list.

While Universal Health Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.