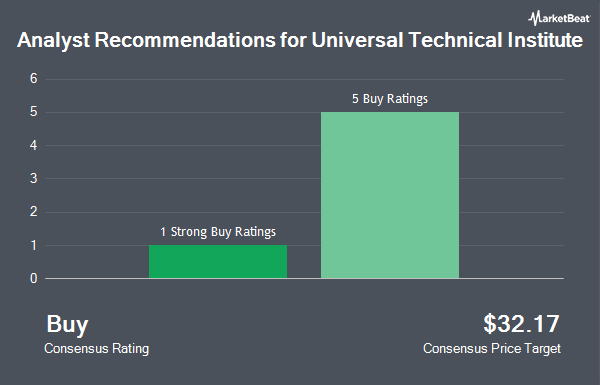

Shares of Universal Technical Institute, Inc. (NYSE:UTI - Get Free Report) have been assigned an average recommendation of "Buy" from the six brokerages that are currently covering the company, Marketbeat.com reports. Five research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company. The average twelve-month target price among analysts that have covered the stock in the last year is $32.17.

A number of equities analysts have commented on UTI shares. B. Riley started coverage on Universal Technical Institute in a report on Friday, March 28th. They set a "buy" rating and a $31.00 target price for the company. Lake Street Capital upped their target price on shares of Universal Technical Institute from $22.00 to $31.00 and gave the stock a "buy" rating in a report on Thursday, February 6th. Rosenblatt Securities raised their price target on shares of Universal Technical Institute from $30.00 to $36.00 and gave the stock a "buy" rating in a research note on Thursday, February 6th. Northland Securities upped their price objective on shares of Universal Technical Institute from $30.00 to $34.00 and gave the company an "outperform" rating in a research note on Thursday, February 6th. Finally, Barrington Research raised their target price on shares of Universal Technical Institute from $30.00 to $35.00 and gave the stock an "outperform" rating in a research note on Thursday, February 6th.

Read Our Latest Research Report on UTI

Insider Activity at Universal Technical Institute

In other news, EVP Sherrell Smith sold 10,000 shares of Universal Technical Institute stock in a transaction on Friday, March 21st. The stock was sold at an average price of $26.95, for a total value of $269,500.00. Following the completion of the sale, the executive vice president now directly owns 157,663 shares of the company's stock, valued at approximately $4,249,017.85. The trade was a 5.96 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, Director George W. Brochick sold 8,000 shares of the stock in a transaction dated Wednesday, February 26th. The stock was sold at an average price of $27.59, for a total value of $220,720.00. Following the transaction, the director now directly owns 34,917 shares in the company, valued at approximately $963,360.03. The trade was a 18.64 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 94,427 shares of company stock worth $2,575,729. Insiders own 15.10% of the company's stock.

Hedge Funds Weigh In On Universal Technical Institute

Several institutional investors have recently modified their holdings of UTI. Charles Schwab Investment Management Inc. increased its position in shares of Universal Technical Institute by 198.0% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 345,772 shares of the company's stock valued at $5,622,000 after purchasing an additional 229,738 shares during the last quarter. BNP Paribas Financial Markets increased its holdings in Universal Technical Institute by 9.5% in the third quarter. BNP Paribas Financial Markets now owns 23,928 shares of the company's stock valued at $389,000 after buying an additional 2,083 shares during the last quarter. Verition Fund Management LLC acquired a new stake in Universal Technical Institute in the third quarter valued at $298,000. Morse Asset Management Inc purchased a new stake in Universal Technical Institute during the 3rd quarter worth about $152,000. Finally, State Street Corp increased its holdings in shares of Universal Technical Institute by 3.6% in the 3rd quarter. State Street Corp now owns 856,091 shares of the company's stock valued at $13,920,000 after acquiring an additional 29,461 shares during the last quarter. Institutional investors and hedge funds own 75.67% of the company's stock.

Universal Technical Institute Price Performance

NYSE UTI traded down $0.14 during trading hours on Friday, reaching $27.97. The company's stock had a trading volume of 32,489 shares, compared to its average volume of 554,461. The company has a debt-to-equity ratio of 0.42, a current ratio of 1.14 and a quick ratio of 1.14. Universal Technical Institute has a 1-year low of $13.66 and a 1-year high of $30.56. The company's 50-day moving average is $27.13 and its two-hundred day moving average is $24.10. The firm has a market capitalization of $1.52 billion, a price-to-earnings ratio of 28.88, a P/E/G ratio of 1.92 and a beta of 1.48.

Universal Technical Institute (NYSE:UTI - Get Free Report) last issued its quarterly earnings results on Wednesday, February 5th. The company reported $0.40 EPS for the quarter, topping the consensus estimate of $0.18 by $0.22. Universal Technical Institute had a net margin of 7.08% and a return on equity of 21.25%. On average, equities analysts predict that Universal Technical Institute will post 1 EPS for the current year.

About Universal Technical Institute

(

Get Free ReportUniversal Technical Institute, Inc provides transportation, skilled trades, and healthcare education programs in the United States. The company operates in two segments, UTI and Concorde. It offers certificate, diploma, or degree programs under various brands, such as Universal Technical Institute, Motorcycle Mechanics Institute, Marine Mechanics Institute, NASCAR Technical Institute, and MIAT College of Technology.

See Also

Before you consider Universal Technical Institute, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Technical Institute wasn't on the list.

While Universal Technical Institute currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.