Barclays PLC reduced its stake in Universal Technical Institute, Inc. (NYSE:UTI - Free Report) by 12.7% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 217,157 shares of the company's stock after selling 31,459 shares during the quarter. Barclays PLC owned about 0.40% of Universal Technical Institute worth $3,531,000 at the end of the most recent reporting period.

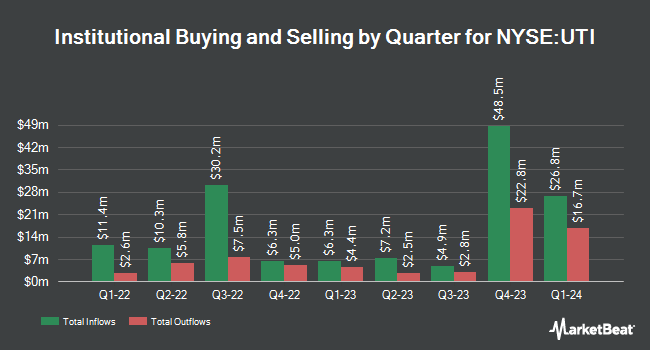

Several other institutional investors have also added to or reduced their stakes in UTI. Covestor Ltd increased its position in shares of Universal Technical Institute by 6,256.0% during the third quarter. Covestor Ltd now owns 1,589 shares of the company's stock worth $26,000 after buying an additional 1,564 shares during the period. Quarry LP grew its stake in Universal Technical Institute by 380.6% during the third quarter. Quarry LP now owns 3,859 shares of the company's stock worth $63,000 after purchasing an additional 3,056 shares during the period. International Assets Investment Management LLC increased its holdings in Universal Technical Institute by 1,526.0% in the third quarter. International Assets Investment Management LLC now owns 4,065 shares of the company's stock worth $66,000 after purchasing an additional 3,815 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank lifted its stake in Universal Technical Institute by 95,120.0% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 9,522 shares of the company's stock valued at $150,000 after buying an additional 9,512 shares during the period. Finally, Morse Asset Management Inc acquired a new stake in shares of Universal Technical Institute during the 3rd quarter worth approximately $152,000. 75.67% of the stock is currently owned by institutional investors.

Universal Technical Institute Price Performance

Shares of NYSE UTI traded up $0.15 during midday trading on Monday, hitting $25.44. 329,576 shares of the company's stock were exchanged, compared to its average volume of 532,048. The business's fifty day moving average price is $21.24 and its two-hundred day moving average price is $18.15. The company has a market cap of $1.37 billion, a price-to-earnings ratio of 34.38, a PEG ratio of 1.78 and a beta of 1.48. The company has a current ratio of 1.08, a quick ratio of 1.08 and a debt-to-equity ratio of 0.47. Universal Technical Institute, Inc. has a 12-month low of $12.12 and a 12-month high of $26.71.

Analyst Upgrades and Downgrades

A number of equities research analysts have commented on UTI shares. Truist Financial raised their price target on shares of Universal Technical Institute from $22.00 to $26.00 and gave the stock a "buy" rating in a report on Thursday, November 21st. B. Riley increased their target price on Universal Technical Institute from $22.00 to $25.00 and gave the stock a "buy" rating in a report on Thursday, November 7th. Lake Street Capital upped their price objective on shares of Universal Technical Institute from $19.00 to $22.00 and gave the stock a "buy" rating in a report on Thursday, November 21st. Barrington Research raised their target price on Universal Technical Institute from $22.00 to $25.00 and gave the company an "outperform" rating in a report on Thursday, November 21st. Finally, Northland Securities lifted their price objective on shares of Universal Technical Institute from $24.00 to $30.00 and gave the stock an "outperform" rating in a report on Thursday. Seven equities research analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock presently has a consensus rating of "Buy" and an average price target of $26.33.

Get Our Latest Research Report on UTI

Insider Buying and Selling at Universal Technical Institute

In related news, Director Kenneth R. Trammell sold 30,000 shares of the firm's stock in a transaction on Wednesday, November 27th. The stock was sold at an average price of $25.92, for a total value of $777,600.00. Following the completion of the sale, the director now owns 128,205 shares of the company's stock, valued at $3,323,073.60. This trade represents a 18.96 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Company insiders own 27.60% of the company's stock.

Universal Technical Institute Company Profile

(

Free Report)

Universal Technical Institute, Inc provides transportation, skilled trades, and healthcare education programs in the United States. The company operates in two segments, UTI and Concorde. It offers certificate, diploma, or degree programs under various brands, such as Universal Technical Institute, Motorcycle Mechanics Institute, Marine Mechanics Institute, NASCAR Technical Institute, and MIAT College of Technology.

See Also

Before you consider Universal Technical Institute, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Technical Institute wasn't on the list.

While Universal Technical Institute currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.