Unum Group (NYSE:UNM - Get Free Report) was upgraded by equities research analysts at Raymond James from a "market perform" rating to a "strong-buy" rating in a research report issued on Wednesday, Marketbeat reports. The brokerage presently has a $108.00 price objective on the financial services provider's stock. Raymond James' price target would suggest a potential upside of 36.62% from the stock's previous close.

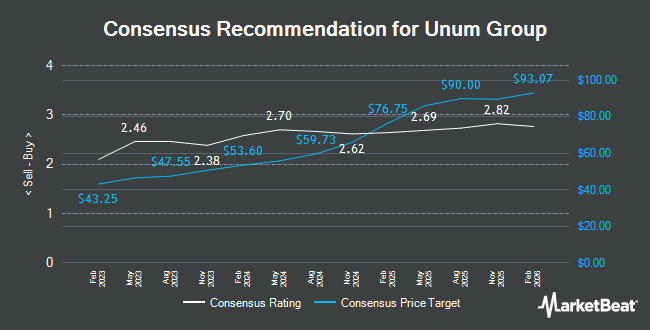

A number of other research firms have also recently commented on UNM. Wells Fargo & Company upped their price objective on shares of Unum Group from $81.00 to $91.00 and gave the company an "overweight" rating in a research report on Wednesday, February 19th. Morgan Stanley upped their price objective on shares of Unum Group from $80.00 to $84.00 and gave the company an "equal weight" rating in a research report on Friday, February 28th. Jefferies Financial Group upped their price objective on shares of Unum Group from $91.00 to $96.00 and gave the company a "buy" rating in a research report on Tuesday, December 10th. Evercore ISI upgraded shares of Unum Group from an "in-line" rating to an "outperform" rating and upped their price objective for the company from $67.00 to $84.00 in a research report on Thursday, November 14th. Finally, Keefe, Bruyette & Woods upped their price objective on shares of Unum Group from $90.00 to $103.00 and gave the company an "outperform" rating in a research report on Friday, February 28th. Five investment analysts have rated the stock with a hold rating, nine have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, Unum Group currently has a consensus rating of "Moderate Buy" and an average target price of $86.62.

View Our Latest Stock Analysis on Unum Group

Unum Group Trading Down 0.5 %

Shares of Unum Group stock traded down $0.41 on Wednesday, hitting $79.05. 1,274,457 shares of the company's stock traded hands, compared to its average volume of 1,147,299. The firm's 50-day moving average price is $75.59 and its two-hundred day moving average price is $68.52. The stock has a market capitalization of $13.97 billion, a PE ratio of 8.35, a price-to-earnings-growth ratio of 1.14 and a beta of 0.74. Unum Group has a one year low of $48.38 and a one year high of $83.96. The company has a debt-to-equity ratio of 0.32, a current ratio of 0.29 and a quick ratio of 0.28.

Unum Group (NYSE:UNM - Get Free Report) last issued its earnings results on Tuesday, February 4th. The financial services provider reported $2.03 EPS for the quarter, missing the consensus estimate of $2.14 by ($0.11). Unum Group had a net margin of 13.81% and a return on equity of 14.91%. On average, research analysts expect that Unum Group will post 9.14 EPS for the current fiscal year.

Unum Group announced that its Board of Directors has initiated a stock buyback plan on Tuesday, February 18th that permits the company to repurchase $1.00 billion in shares. This repurchase authorization permits the financial services provider to purchase up to 7.4% of its stock through open market purchases. Stock repurchase plans are often a sign that the company's board believes its stock is undervalued.

Insider Activity at Unum Group

In other Unum Group news, EVP Lisa G. Iglesias sold 7,000 shares of the firm's stock in a transaction that occurred on Monday, March 3rd. The shares were sold at an average price of $82.75, for a total transaction of $579,250.00. Following the completion of the sale, the executive vice president now directly owns 31,284 shares in the company, valued at $2,588,751. This trade represents a 18.28 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, CEO Richard P. Mckenney sold 50,000 shares of the firm's stock in a transaction that occurred on Monday, March 3rd. The stock was sold at an average price of $81.99, for a total transaction of $4,099,500.00. Following the sale, the chief executive officer now owns 980,637 shares of the company's stock, valued at $80,402,427.63. This trade represents a 4.85 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.93% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Unum Group

Hedge funds have recently bought and sold shares of the stock. Barrett & Company Inc. lifted its position in Unum Group by 300.0% during the fourth quarter. Barrett & Company Inc. now owns 396 shares of the financial services provider's stock worth $29,000 after acquiring an additional 297 shares during the last quarter. Kestra Investment Management LLC bought a new position in shares of Unum Group during the fourth quarter worth approximately $38,000. Capital Performance Advisors LLP bought a new position in shares of Unum Group during the third quarter worth approximately $31,000. Millstone Evans Group LLC bought a new position in shares of Unum Group during the fourth quarter worth approximately $45,000. Finally, Versant Capital Management Inc increased its holdings in shares of Unum Group by 26.4% during the fourth quarter. Versant Capital Management Inc now owns 766 shares of the financial services provider's stock worth $56,000 after purchasing an additional 160 shares during the period. 86.57% of the stock is currently owned by institutional investors and hedge funds.

Unum Group Company Profile

(

Get Free Report)

Unum Group, together with its subsidiaries, provides financial protection benefit solutions primarily in the United States, the United Kingdom, Poland, and internationally. It operates through Unum US, Unum International, Colonial Life, and Closed Block segment. The company offers group long-term and short-term disability, group life, and accidental death and dismemberment products; supplemental and voluntary products, such as individual disability, voluntary benefits, and dental and vision products; and accident, sickness, disability, life, and cancer and critical illness products.

Featured Articles

Before you consider Unum Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unum Group wasn't on the list.

While Unum Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.