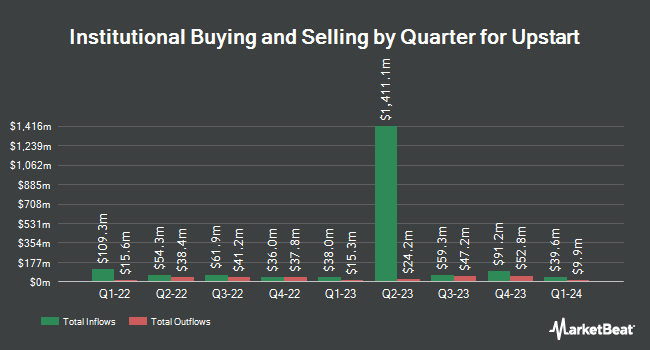

Geode Capital Management LLC lifted its position in Upstart Holdings, Inc. (NASDAQ:UPST - Free Report) by 1.6% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,816,774 shares of the company's stock after acquiring an additional 29,482 shares during the period. Geode Capital Management LLC owned 1.99% of Upstart worth $72,702,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors have also recently made changes to their positions in the company. Point72 Asia Singapore Pte. Ltd. acquired a new stake in Upstart during the 3rd quarter worth $35,000. BNP Paribas purchased a new position in shares of Upstart in the third quarter worth about $37,000. Blue Trust Inc. boosted its position in Upstart by 125.3% during the third quarter. Blue Trust Inc. now owns 989 shares of the company's stock worth $40,000 after acquiring an additional 550 shares during the last quarter. Hollencrest Capital Management purchased a new stake in Upstart during the 3rd quarter valued at about $40,000. Finally, Indiana Trust & Investment Management Co acquired a new stake in Upstart in the 3rd quarter valued at about $43,000. 63.01% of the stock is owned by institutional investors and hedge funds.

Upstart Stock Up 1.7 %

Shares of UPST traded up $1.17 during trading on Friday, reaching $68.40. 6,618,301 shares of the company traded hands, compared to its average volume of 6,887,657. The stock has a 50-day simple moving average of $65.86 and a 200-day simple moving average of $43.81. The stock has a market cap of $6.24 billion, a PE ratio of -35.44 and a beta of 2.19. Upstart Holdings, Inc. has a twelve month low of $20.60 and a twelve month high of $88.95.

Insider Buying and Selling

In other news, CTO Paul Gu sold 87,600 shares of the stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $69.39, for a total transaction of $6,078,564.00. Following the sale, the chief technology officer now owns 863,065 shares of the company's stock, valued at approximately $59,888,080.35. This represents a 9.21 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Scott Darling sold 6,200 shares of Upstart stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $39.67, for a total transaction of $245,954.00. Following the completion of the transaction, the insider now owns 161,043 shares of the company's stock, valued at $6,388,575.81. This trade represents a 3.71 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 533,368 shares of company stock valued at $32,813,134. Company insiders own 18.06% of the company's stock.

Analyst Ratings Changes

Several brokerages have recently weighed in on UPST. JPMorgan Chase & Co. cut Upstart from a "neutral" rating to an "underweight" rating and boosted their target price for the stock from $45.00 to $57.00 in a report on Monday, December 2nd. Citigroup upgraded Upstart from a "neutral" rating to a "buy" rating and upped their target price for the company from $56.00 to $87.00 in a report on Friday, November 8th. Redburn Atlantic upgraded Upstart from a "neutral" rating to a "buy" rating and lifted their price target for the stock from $37.00 to $95.00 in a report on Tuesday, December 3rd. Wedbush upped their price objective on shares of Upstart from $60.00 to $75.00 and gave the company a "neutral" rating in a report on Monday, December 2nd. Finally, BTIG Research upgraded shares of Upstart from a "sell" rating to a "neutral" rating in a research report on Monday, November 11th. Two research analysts have rated the stock with a sell rating, four have given a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat.com, Upstart has a consensus rating of "Hold" and an average price target of $61.80.

View Our Latest Stock Report on UPST

Upstart Company Profile

(

Free Report)

Upstart Holdings, Inc, together with its subsidiaries, operates a cloud-based artificial intelligence (AI) lending platform in the United States. Its platform includes personal loans, automotive retail and refinance loans, home equity lines of credit, and small dollar loans that connects consumer demand for loans to its to bank and credit unions.

Read More

Before you consider Upstart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Upstart wasn't on the list.

While Upstart currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.