Upwork (NASDAQ:UPWK - Get Free Report) had its price target increased by analysts at JMP Securities from $14.00 to $18.00 in a report released on Thursday,Benzinga reports. The firm presently has a "market outperform" rating on the stock. JMP Securities' target price suggests a potential upside of 10.77% from the company's current price.

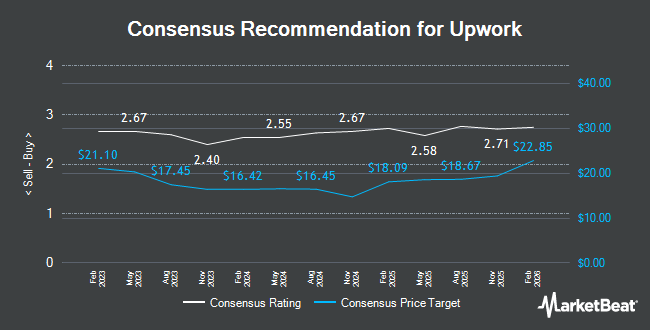

Other equities analysts have also issued research reports about the company. Canaccord Genuity Group reduced their target price on Upwork from $19.00 to $15.00 and set a "buy" rating for the company in a research note on Thursday, August 8th. Citigroup cut their price target on shares of Upwork from $13.00 to $11.00 and set a "neutral" rating on the stock in a report on Wednesday, September 25th. The Goldman Sachs Group boosted their target price on shares of Upwork from $21.00 to $24.00 and gave the company a "buy" rating in a research report on Thursday. Roth Mkm increased their price target on Upwork from $13.00 to $20.00 and gave the stock a "buy" rating in a research report on Thursday. Finally, Royal Bank of Canada dropped their target price on Upwork from $15.00 to $11.00 and set a "sector perform" rating on the stock in a report on Thursday, August 8th. Three analysts have rated the stock with a hold rating and eight have given a buy rating to the stock. According to data from MarketBeat, Upwork has an average rating of "Moderate Buy" and an average target price of $17.00.

Read Our Latest Stock Report on Upwork

Upwork Trading Up 11.5 %

Upwork stock traded up $1.67 during trading hours on Thursday, hitting $16.25. The company had a trading volume of 9,726,954 shares, compared to its average volume of 2,164,720. The firm has a market cap of $2.15 billion, a P/E ratio of 29.55 and a beta of 1.49. The company has a 50-day moving average price of $11.00 and a two-hundred day moving average price of $10.96. Upwork has a 1 year low of $8.43 and a 1 year high of $17.79. The company has a debt-to-equity ratio of 0.99, a quick ratio of 3.00 and a current ratio of 3.00.

Upwork (NASDAQ:UPWK - Get Free Report) last announced its quarterly earnings results on Wednesday, August 7th. The company reported $0.26 EPS for the quarter, beating the consensus estimate of $0.23 by $0.03. Upwork had a return on equity of 20.75% and a net margin of 10.00%. The firm had revenue of $193.13 million for the quarter, compared to analyst estimates of $193.05 million. During the same quarter last year, the firm posted ($0.03) earnings per share. The business's revenue for the quarter was up 14.5% on a year-over-year basis. On average, sell-side analysts anticipate that Upwork will post 0.51 earnings per share for the current year.

Insider Activity

In other news, Director Elizabeth A. Nelson sold 75,000 shares of the stock in a transaction that occurred on Wednesday, September 18th. The stock was sold at an average price of $10.54, for a total transaction of $790,500.00. Following the transaction, the director now owns 48,915 shares in the company, valued at $515,564.10. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In related news, CFO Erica Gessert sold 4,491 shares of Upwork stock in a transaction dated Wednesday, September 18th. The stock was sold at an average price of $10.57, for a total value of $47,469.87. Following the sale, the chief financial officer now directly owns 111,255 shares in the company, valued at approximately $1,175,965.35. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Director Elizabeth A. Nelson sold 75,000 shares of the stock in a transaction that occurred on Wednesday, September 18th. The shares were sold at an average price of $10.54, for a total value of $790,500.00. Following the transaction, the director now directly owns 48,915 shares of the company's stock, valued at $515,564.10. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 176,783 shares of company stock worth $1,800,221 over the last three months. 7.60% of the stock is currently owned by corporate insiders.

Institutional Trading of Upwork

Institutional investors have recently made changes to their positions in the company. KBC Group NV raised its stake in Upwork by 45.4% in the 3rd quarter. KBC Group NV now owns 4,791 shares of the company's stock valued at $50,000 after purchasing an additional 1,497 shares during the last quarter. ProShare Advisors LLC grew its holdings in shares of Upwork by 8.6% during the first quarter. ProShare Advisors LLC now owns 22,483 shares of the company's stock worth $276,000 after buying an additional 1,771 shares in the last quarter. Federated Hermes Inc. raised its position in shares of Upwork by 0.6% in the second quarter. Federated Hermes Inc. now owns 318,659 shares of the company's stock valued at $3,426,000 after buying an additional 1,996 shares during the last quarter. The Manufacturers Life Insurance Company lifted its stake in shares of Upwork by 3.2% in the second quarter. The Manufacturers Life Insurance Company now owns 66,809 shares of the company's stock worth $718,000 after buying an additional 2,063 shares in the last quarter. Finally, Quarry LP boosted its position in Upwork by 104.2% during the second quarter. Quarry LP now owns 4,350 shares of the company's stock worth $47,000 after acquiring an additional 2,220 shares during the last quarter. 77.71% of the stock is owned by institutional investors and hedge funds.

Upwork Company Profile

(

Get Free Report)

Upwork Inc, together with its subsidiaries, operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally. The company's work marketplace provides access to talent with various skills across a range of categories, including administrative support, sales and marketing, design and creative, and customer service, as well as web, mobile, and software development.

See Also

Before you consider Upwork, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Upwork wasn't on the list.

While Upwork currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.