American Century Companies Inc. boosted its stake in shares of Uranium Energy Corp. (NYSEAMERICAN:UEC - Free Report) by 194.6% in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,143,327 shares of the basic materials company's stock after purchasing an additional 755,285 shares during the quarter. American Century Companies Inc. owned approximately 0.27% of Uranium Energy worth $7,649,000 at the end of the most recent reporting period.

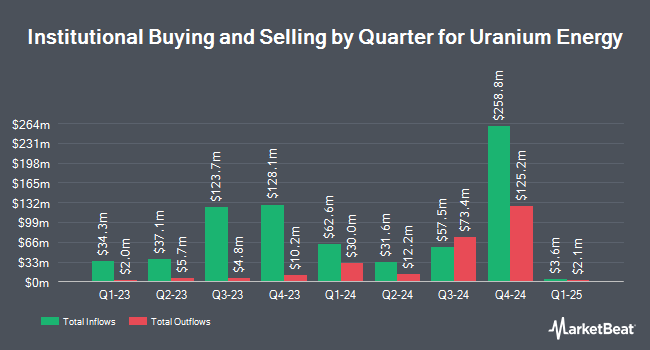

A number of other institutional investors have also recently added to or reduced their stakes in UEC. Segra Capital Management LLC boosted its position in shares of Uranium Energy by 81.0% during the third quarter. Segra Capital Management LLC now owns 4,036,529 shares of the basic materials company's stock worth $24,926,000 after buying an additional 1,806,529 shares during the period. Van ECK Associates Corp raised its stake in Uranium Energy by 33.2% during the 4th quarter. Van ECK Associates Corp now owns 6,602,890 shares of the basic materials company's stock valued at $44,174,000 after acquiring an additional 1,645,919 shares in the last quarter. Wellington Management Group LLP acquired a new position in Uranium Energy during the 3rd quarter worth $4,512,000. CloudAlpha Capital Management Limited Hong Kong bought a new position in shares of Uranium Energy in the fourth quarter worth $3,947,000. Finally, Barclays PLC increased its holdings in shares of Uranium Energy by 394.5% during the third quarter. Barclays PLC now owns 697,045 shares of the basic materials company's stock valued at $4,329,000 after purchasing an additional 556,081 shares during the period. 62.28% of the stock is currently owned by institutional investors.

Uranium Energy Stock Performance

Shares of NYSEAMERICAN:UEC traded down $0.10 during midday trading on Tuesday, reaching $4.00. The company had a trading volume of 11,718,998 shares, compared to its average volume of 7,627,473. The company has a fifty day simple moving average of $5.83 and a two-hundred day simple moving average of $6.67. The firm has a market cap of $1.69 billion, a price-to-earnings ratio of -33.33 and a beta of 1.88. Uranium Energy Corp. has a 1-year low of $3.85 and a 1-year high of $8.93.

Wall Street Analyst Weigh In

Several equities research analysts recently weighed in on UEC shares. National Bank Financial started coverage on shares of Uranium Energy in a report on Wednesday, February 12th. They issued an "outperform" rating and a $10.00 price objective for the company. HC Wainwright reaffirmed a "buy" rating and issued a $12.25 price target on shares of Uranium Energy in a research note on Thursday, March 13th. National Bankshares set a $10.00 price objective on shares of Uranium Energy and gave the company an "outperform" rating in a research note on Wednesday, February 12th. Stifel Nicolaus set a $10.50 target price on Uranium Energy in a research report on Wednesday, March 12th. Finally, Stifel Canada upgraded shares of Uranium Energy to a "strong-buy" rating in a research report on Tuesday, March 11th. Four research analysts have rated the stock with a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Buy" and a consensus target price of $10.60.

Check Out Our Latest Research Report on UEC

Uranium Energy Company Profile

(

Free Report)

Uranium Energy Corp., together with its subsidiaries, engages in exploration, pre-extraction, extraction, and processing uranium and titanium concentrates in the United States, Canada, and Paraguay. It owns interests in the Palangana mine, Goliad, Burke Hollow, Longhorn, and Salvo projects located in Texas; Anderson, Workman Creek, and Los Cuatros projects situated in Arizona; Dalton Pass and C de Baca project located in New Mexico; Roughrider, Shea Creek, Christie Lake, Horseshoe-Raven, Hidden Bay, Diabase, West Bear, JCU, and other project located in Canada; and Yuty, Oviedo, and Alto Paraná titanium projects in Paraguay.

Further Reading

Before you consider Uranium Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uranium Energy wasn't on the list.

While Uranium Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.