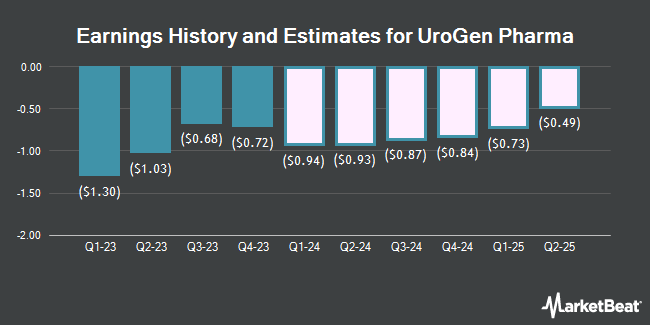

UroGen Pharma Ltd. (NASDAQ:URGN - Free Report) - HC Wainwright increased their FY2024 EPS estimates for shares of UroGen Pharma in a report released on Thursday, November 7th. HC Wainwright analyst R. Selvaraju now forecasts that the company will post earnings per share of ($3.01) for the year, up from their previous forecast of ($3.41). HC Wainwright has a "Buy" rating and a $60.00 price objective on the stock. The consensus estimate for UroGen Pharma's current full-year earnings is ($3.21) per share. HC Wainwright also issued estimates for UroGen Pharma's Q4 2024 earnings at ($0.65) EPS, Q1 2025 earnings at ($0.83) EPS, Q2 2025 earnings at ($0.79) EPS, Q3 2025 earnings at ($0.74) EPS, Q4 2025 earnings at ($0.70) EPS and FY2025 earnings at ($3.06) EPS.

UroGen Pharma (NASDAQ:URGN - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The company reported ($0.55) EPS for the quarter, beating the consensus estimate of ($0.84) by $0.29. The business had revenue of $25.20 million during the quarter, compared to analysts' expectations of $24.22 million. During the same period in the prior year, the business earned ($0.68) EPS.

URGN has been the topic of a number of other reports. Guggenheim started coverage on UroGen Pharma in a research note on Thursday, August 22nd. They issued a "buy" rating and a $40.00 price target on the stock. Oppenheimer restated an "outperform" rating and issued a $40.00 price target on shares of UroGen Pharma in a research note on Wednesday, October 16th. Finally, EF Hutton Acquisition Co. I upgraded UroGen Pharma to a "strong-buy" rating in a research note on Monday, October 14th. Four investment analysts have rated the stock with a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Buy" and a consensus price target of $48.38.

Read Our Latest Research Report on URGN

UroGen Pharma Stock Up 5.5 %

Shares of URGN traded up $0.67 during midday trading on Monday, reaching $12.79. The stock had a trading volume of 433,843 shares, compared to its average volume of 501,325. The company has a market cap of $299.93 million, a price-to-earnings ratio of -3.85 and a beta of 1.12. The company's fifty day simple moving average is $12.75 and its two-hundred day simple moving average is $14.17. UroGen Pharma has a 1-year low of $10.60 and a 1-year high of $20.70. The company has a debt-to-equity ratio of 4.77, a current ratio of 9.00 and a quick ratio of 7.93.

Institutional Trading of UroGen Pharma

A number of hedge funds and other institutional investors have recently made changes to their positions in URGN. BNP Paribas Financial Markets grew its holdings in shares of UroGen Pharma by 73.1% during the first quarter. BNP Paribas Financial Markets now owns 39,795 shares of the company's stock worth $597,000 after buying an additional 16,799 shares during the last quarter. Vanguard Group Inc. grew its holdings in shares of UroGen Pharma by 14.3% during the first quarter. Vanguard Group Inc. now owns 194,966 shares of the company's stock worth $2,924,000 after buying an additional 24,367 shares during the last quarter. Price T Rowe Associates Inc. MD purchased a new stake in UroGen Pharma in the 1st quarter valued at approximately $4,008,000. Tidal Investments LLC purchased a new stake in UroGen Pharma in the 1st quarter valued at approximately $425,000. Finally, Oak Ridge Investments LLC boosted its holdings in UroGen Pharma by 30.6% in the 2nd quarter. Oak Ridge Investments LLC now owns 79,929 shares of the company's stock valued at $1,341,000 after purchasing an additional 18,725 shares in the last quarter. Institutional investors and hedge funds own 91.29% of the company's stock.

UroGen Pharma Company Profile

(

Get Free Report)

UroGen Pharma Ltd., a biotechnology company, engages in the development and commercialization of solutions for urothelial and specialty cancers. It offers RTGel, a novel proprietary polymeric biocompatible, reverse thermal gelation hydrogel technology to improve therapeutic profiles of existing drugs; and Jelmyto for pyelocalyceal solution.

See Also

Before you consider UroGen Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UroGen Pharma wasn't on the list.

While UroGen Pharma currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.