US Bancorp DE increased its position in Lloyds Banking Group plc (NYSE:LYG - Free Report) by 36.6% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 757,336 shares of the financial services provider's stock after acquiring an additional 202,862 shares during the quarter. US Bancorp DE's holdings in Lloyds Banking Group were worth $2,363,000 at the end of the most recent quarter.

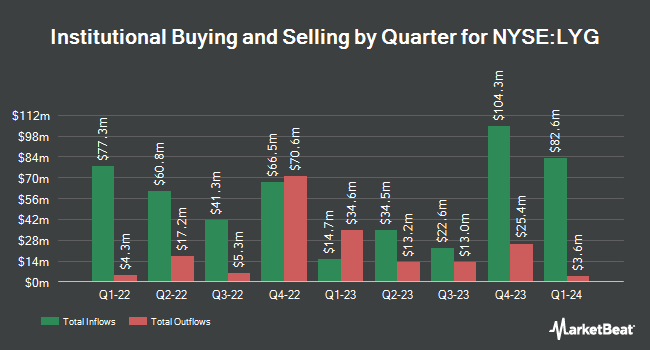

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Mondrian Investment Partners LTD raised its stake in Lloyds Banking Group by 39.2% during the 1st quarter. Mondrian Investment Partners LTD now owns 89,948,537 shares of the financial services provider's stock valued at $232,967,000 after purchasing an additional 25,351,270 shares during the period. Clearbridge Investments LLC purchased a new position in Lloyds Banking Group during the second quarter valued at $36,252,000. Envestnet Asset Management Inc. boosted its holdings in shares of Lloyds Banking Group by 49.6% during the 2nd quarter. Envestnet Asset Management Inc. now owns 8,577,101 shares of the financial services provider's stock valued at $23,415,000 after purchasing an additional 2,841,956 shares during the last quarter. O Shaughnessy Asset Management LLC grew its position in shares of Lloyds Banking Group by 195.8% during the first quarter. O Shaughnessy Asset Management LLC now owns 2,833,546 shares of the financial services provider's stock valued at $7,339,000 after purchasing an additional 1,875,688 shares in the last quarter. Finally, Raymond James & Associates lifted its position in shares of Lloyds Banking Group by 114.5% in the second quarter. Raymond James & Associates now owns 2,487,006 shares of the financial services provider's stock worth $6,790,000 after buying an additional 1,327,589 shares in the last quarter. Institutional investors own 2.15% of the company's stock.

Lloyds Banking Group Stock Performance

Shares of NYSE LYG remained flat at $2.82 during midday trading on Thursday. The stock had a trading volume of 8,773,690 shares, compared to its average volume of 9,676,133. The business's 50-day moving average price is $3.04 and its 200 day moving average price is $2.91. The firm has a market capitalization of $43.27 billion, a price-to-earnings ratio of 7.21 and a beta of 1.35. The company has a current ratio of 1.45, a quick ratio of 1.48 and a debt-to-equity ratio of 1.76. Lloyds Banking Group plc has a 12-month low of $1.99 and a 12-month high of $3.24.

Analyst Upgrades and Downgrades

LYG has been the topic of a number of research reports. Royal Bank of Canada downgraded Lloyds Banking Group from an "outperform" rating to a "sector perform" rating in a research note on Friday, July 26th. The Goldman Sachs Group began coverage on shares of Lloyds Banking Group in a research report on Friday, October 4th. They set a "neutral" rating for the company. Citigroup downgraded shares of Lloyds Banking Group from a "buy" rating to a "neutral" rating in a report on Monday, August 5th. Kepler Capital Markets began coverage on Lloyds Banking Group in a research note on Thursday, September 5th. They set a "hold" rating on the stock. Finally, Morgan Stanley lowered Lloyds Banking Group from an "overweight" rating to an "equal weight" rating in a research note on Wednesday, October 30th. Seven research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat, Lloyds Banking Group currently has an average rating of "Hold" and a consensus target price of $2.75.

View Our Latest Research Report on LYG

Lloyds Banking Group Profile

(

Free Report)

Lloyds Banking Group plc, together with its subsidiaries, provides a range of banking and financial services in the United Kingdom and internationally. It operates in three segments: Retail; Commercial Banking; and Insurance, Pensions and Investments. The Retail segment offers a range of financial service products, including current accounts, savings, mortgages, motor finance, unsecured loans, leasing solutions, and credit cards to personal customers.

See Also

Before you consider Lloyds Banking Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lloyds Banking Group wasn't on the list.

While Lloyds Banking Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.