US Bancorp DE lowered its holdings in Installed Building Products, Inc. (NYSE:IBP - Free Report) by 61.1% in the fourth quarter, according to the company in its most recent disclosure with the SEC. The firm owned 1,093 shares of the construction company's stock after selling 1,716 shares during the quarter. US Bancorp DE's holdings in Installed Building Products were worth $192,000 as of its most recent filing with the SEC.

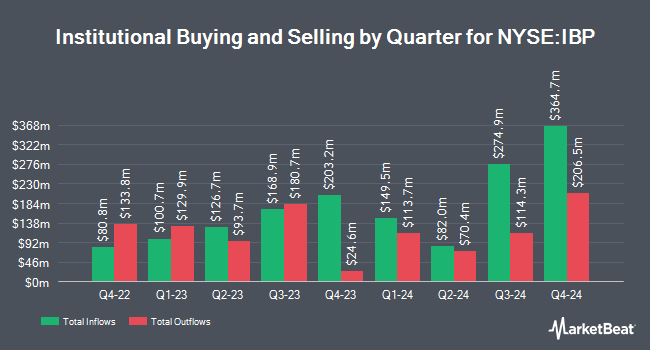

A number of other hedge funds and other institutional investors also recently bought and sold shares of IBP. Teachers Retirement System of The State of Kentucky increased its position in shares of Installed Building Products by 121.1% in the third quarter. Teachers Retirement System of The State of Kentucky now owns 16,094 shares of the construction company's stock valued at $3,963,000 after buying an additional 8,815 shares in the last quarter. Summit Partners Public Asset Management LLC purchased a new position in shares of Installed Building Products in the third quarter valued at $54,499,000. Natixis Advisors LLC increased its position in shares of Installed Building Products by 6.4% in the third quarter. Natixis Advisors LLC now owns 74,252 shares of the construction company's stock valued at $18,286,000 after buying an additional 4,451 shares in the last quarter. Citigroup Inc. increased its position in shares of Installed Building Products by 54.0% in the third quarter. Citigroup Inc. now owns 47,235 shares of the construction company's stock valued at $11,633,000 after buying an additional 16,569 shares in the last quarter. Finally, Geode Capital Management LLC increased its position in shares of Installed Building Products by 3.9% in the third quarter. Geode Capital Management LLC now owns 623,003 shares of the construction company's stock valued at $153,452,000 after buying an additional 23,179 shares in the last quarter. Institutional investors and hedge funds own 99.61% of the company's stock.

Wall Street Analysts Forecast Growth

IBP has been the subject of a number of research analyst reports. The Goldman Sachs Group dropped their price target on Installed Building Products from $262.00 to $228.00 and set a "buy" rating for the company in a research report on Tuesday, January 14th. StockNews.com cut Installed Building Products from a "buy" rating to a "hold" rating in a research report on Friday, February 28th. DA Davidson dropped their price objective on Installed Building Products from $260.00 to $225.00 and set a "buy" rating for the company in a research report on Friday, February 28th. Benchmark dropped their price objective on Installed Building Products from $250.00 to $210.00 and set a "buy" rating for the company in a research report on Monday, March 3rd. Finally, JPMorgan Chase & Co. lifted their price objective on Installed Building Products from $236.00 to $241.00 and gave the stock a "neutral" rating in a research report on Friday, November 22nd. Two research analysts have rated the stock with a sell rating, six have given a hold rating and four have assigned a buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $219.40.

Read Our Latest Research Report on Installed Building Products

Installed Building Products Trading Up 1.8 %

IBP traded up $3.01 during midday trading on Friday, hitting $171.64. The company's stock had a trading volume of 433,934 shares, compared to its average volume of 308,451. The company has a current ratio of 2.99, a quick ratio of 2.50 and a debt-to-equity ratio of 1.18. The firm has a market cap of $4.76 billion, a P/E ratio of 19.07 and a beta of 2.05. The firm has a 50-day moving average price of $182.38 and a two-hundred day moving average price of $205.46. Installed Building Products, Inc. has a 52-week low of $159.77 and a 52-week high of $281.04.

Installed Building Products Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, March 31st. Shareholders of record on Friday, March 14th will be issued a $0.37 dividend. This is a boost from Installed Building Products's previous quarterly dividend of $0.35. The ex-dividend date is Friday, March 14th. This represents a $1.48 annualized dividend and a yield of 0.86%. Installed Building Products's payout ratio is 16.26%.

Installed Building Products Company Profile

(

Free Report)

Installed Building Products, Inc, together with its subsidiaries, engages in the installation of insulation, waterproofing, fire-stopping, fireproofing, garage doors, rain gutters, window blinds, shower doors, closet shelving and mirrors, and other products in the United States. It operates through Installation, Distribution, and Manufacturing operation segments.

Featured Articles

Before you consider Installed Building Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Installed Building Products wasn't on the list.

While Installed Building Products currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.