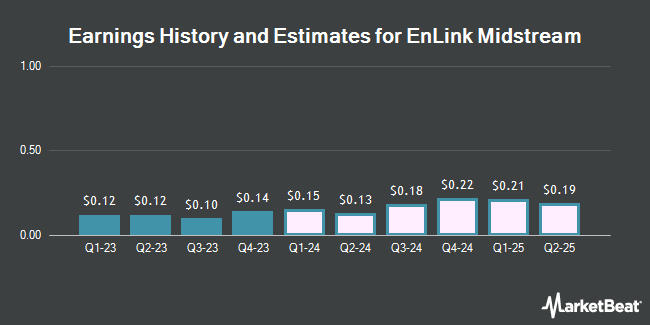

EnLink Midstream, LLC (NYSE:ENLC - Free Report) - US Capital Advisors dropped their FY2024 earnings per share estimates for EnLink Midstream in a research report issued to clients and investors on Tuesday, November 26th. US Capital Advisors analyst J. Carreker now anticipates that the pipeline company will post earnings of $0.50 per share for the year, down from their previous estimate of $0.63. US Capital Advisors has a "Hold" rating on the stock. The consensus estimate for EnLink Midstream's current full-year earnings is $0.55 per share. US Capital Advisors also issued estimates for EnLink Midstream's Q4 2024 earnings at $0.24 EPS and Q4 2025 earnings at $0.28 EPS.

Several other equities analysts have also weighed in on ENLC. Capital One Financial reissued an "equal weight" rating and set a $16.00 price objective on shares of EnLink Midstream in a report on Tuesday, September 3rd. Tudor, Pickering, Holt & Co. upgraded EnLink Midstream from a "hold" rating to a "buy" rating and set a $15.00 price target for the company in a research note on Friday, August 16th. Morgan Stanley cut EnLink Midstream from an "overweight" rating to an "equal weight" rating and set a $16.00 price objective on the stock. in a research note on Monday, September 16th. StockNews.com upgraded shares of EnLink Midstream from a "hold" rating to a "buy" rating in a research report on Tuesday, September 10th. Finally, Raymond James lowered shares of EnLink Midstream from an "outperform" rating to a "market perform" rating in a research report on Friday, November 8th. Ten investment analysts have rated the stock with a hold rating, three have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $15.40.

Read Our Latest Report on EnLink Midstream

EnLink Midstream Stock Performance

Shares of EnLink Midstream stock traded down $0.06 on Wednesday, reaching $15.85. 1,582,919 shares of the company traded hands, compared to its average volume of 2,135,347. The company has a debt-to-equity ratio of 2.30, a current ratio of 0.42 and a quick ratio of 0.42. The firm has a market capitalization of $7.24 billion, a PE ratio of 75.48 and a beta of 2.41. The company has a 50 day moving average of $14.96 and a 200 day moving average of $13.99. EnLink Midstream has a 52 week low of $11.53 and a 52 week high of $16.40.

EnLink Midstream (NYSE:ENLC - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The pipeline company reported ($0.03) earnings per share for the quarter, missing the consensus estimate of $0.13 by ($0.16). The company had revenue of $1.61 billion for the quarter, compared to the consensus estimate of $1.98 billion. EnLink Midstream had a net margin of 1.96% and a return on equity of 9.51%. EnLink Midstream's quarterly revenue was down 7.9% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.10 EPS.

EnLink Midstream Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, November 14th. Stockholders of record on Friday, November 1st were given a dividend of $0.1325 per share. The ex-dividend date of this dividend was Friday, November 1st. This represents a $0.53 dividend on an annualized basis and a dividend yield of 3.34%. EnLink Midstream's dividend payout ratio (DPR) is currently 252.38%.

Insider Transactions at EnLink Midstream

In related news, major shareholder Infrastructure Investor Global sold 200,340,753 shares of the company's stock in a transaction that occurred on Tuesday, October 15th. The shares were sold at an average price of $14.90, for a total value of $2,985,077,219.70. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. Insiders own 0.84% of the company's stock.

Hedge Funds Weigh In On EnLink Midstream

A number of hedge funds and other institutional investors have recently bought and sold shares of the stock. Chickasaw Capital Management LLC boosted its holdings in shares of EnLink Midstream by 5.5% in the 2nd quarter. Chickasaw Capital Management LLC now owns 14,602,011 shares of the pipeline company's stock worth $200,924,000 after purchasing an additional 759,994 shares in the last quarter. Dimensional Fund Advisors LP lifted its position in EnLink Midstream by 2.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 6,823,891 shares of the pipeline company's stock worth $93,884,000 after buying an additional 133,327 shares during the last quarter. Merewether Investment Management LP purchased a new stake in EnLink Midstream in the third quarter worth approximately $64,477,000. Brookfield Corp ON grew its position in EnLink Midstream by 97.1% during the third quarter. Brookfield Corp ON now owns 3,603,351 shares of the pipeline company's stock valued at $52,285,000 after acquiring an additional 1,775,203 shares during the last quarter. Finally, CUSHING ASSET MANAGEMENT LP dba NXG INVESTMENT MANAGEMENT raised its stake in shares of EnLink Midstream by 32.4% during the third quarter. CUSHING ASSET MANAGEMENT LP dba NXG INVESTMENT MANAGEMENT now owns 3,324,324 shares of the pipeline company's stock worth $48,236,000 after acquiring an additional 812,767 shares in the last quarter. Hedge funds and other institutional investors own 45.87% of the company's stock.

EnLink Midstream Company Profile

(

Get Free Report)

EnLink Midstream, LLC provides midstream energy services in the United States. The company operates through Permian, Louisiana, Oklahoma, North Texas, and Corporate segments. It is involved in gathering, compressing, treating, processing, transporting, storing, and selling natural gas; fractionating, transporting, storing, and selling natural gas liquids; and gathering, transporting, stabilizing, storing, trans-loading, and selling crude oil and condensate, as well as providing brine disposal services.

Read More

Before you consider EnLink Midstream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EnLink Midstream wasn't on the list.

While EnLink Midstream currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.