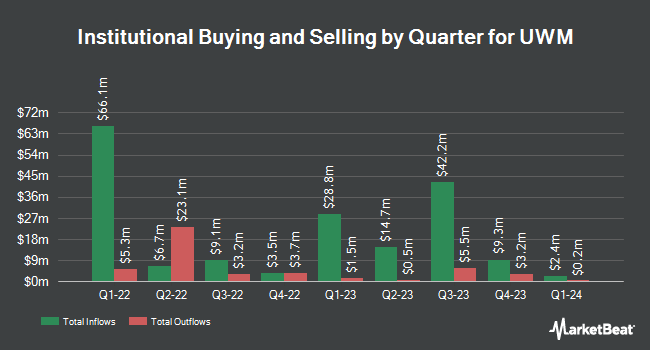

GSA Capital Partners LLP increased its position in UWM Holdings Co. (NYSE:UWMC - Free Report) by 59.9% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 230,455 shares of the company's stock after purchasing an additional 86,356 shares during the period. GSA Capital Partners LLP owned 0.24% of UWM worth $1,963,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds also recently made changes to their positions in UWMC. Susquehanna Fundamental Investments LLC bought a new stake in shares of UWM during the first quarter worth $375,000. Bleakley Financial Group LLC boosted its holdings in shares of UWM by 18.0% in the first quarter. Bleakley Financial Group LLC now owns 30,215 shares of the company's stock valued at $219,000 after purchasing an additional 4,612 shares during the period. SageView Advisory Group LLC purchased a new position in UWM during the 1st quarter worth $55,000. Quadrature Capital Ltd lifted its holdings in shares of UWM by 124.3% in the 1st quarter. Quadrature Capital Ltd now owns 54,778 shares of the company's stock worth $397,000 after buying an additional 30,361 shares during the period. Finally, Price T Rowe Associates Inc. MD grew its position in shares of UWM by 5.9% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 57,948 shares of the company's stock worth $421,000 after buying an additional 3,207 shares in the last quarter. Hedge funds and other institutional investors own 53.59% of the company's stock.

Insider Activity at UWM

In related news, CEO Ishbia Mat sold 1,200,000 shares of the stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $8.45, for a total value of $10,140,000.00. Following the completion of the transaction, the chief executive officer now directly owns 171,520 shares of the company's stock, valued at $1,449,344. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. 94.11% of the stock is currently owned by insiders.

Analyst Ratings Changes

A number of equities research analysts recently weighed in on UWMC shares. BTIG Research upped their price objective on UWM from $8.00 to $10.00 and gave the stock a "buy" rating in a research note on Tuesday, August 6th. UBS Group upped their target price on shares of UWM from $4.50 to $4.75 and gave the stock a "sell" rating in a report on Thursday, September 5th. Barclays upgraded shares of UWM from an "underweight" rating to an "equal weight" rating and boosted their price target for the stock from $6.00 to $8.00 in a research report on Tuesday, October 8th. Morgan Stanley began coverage on shares of UWM in a research note on Tuesday, November 5th. They issued an "equal weight" rating and a $7.50 target price on the stock. Finally, The Goldman Sachs Group increased their price target on UWM from $7.50 to $8.50 and gave the company a "neutral" rating in a report on Thursday, August 8th. One analyst has rated the stock with a sell rating, six have given a hold rating and one has assigned a buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $7.66.

Check Out Our Latest Research Report on UWM

UWM Trading Down 2.0 %

Shares of NYSE UWMC traded down $0.12 on Wednesday, hitting $5.90. The company's stock had a trading volume of 4,014,538 shares, compared to its average volume of 1,952,515. The company has a quick ratio of 1.40, a current ratio of 1.40 and a debt-to-equity ratio of 1.06. The stock has a 50 day moving average of $7.64 and a 200-day moving average of $7.70. UWM Holdings Co. has a 12-month low of $5.42 and a 12-month high of $9.74.

UWM Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 9th. Investors of record on Thursday, December 19th will be issued a $0.10 dividend. The ex-dividend date is Thursday, December 19th. This represents a $0.40 dividend on an annualized basis and a dividend yield of 6.78%. UWM's dividend payout ratio (DPR) is presently -173.91%.

UWM Company Profile

(

Free Report)

UWM Holdings Corporation engages in the residential mortgage lending business in the United States. The company offers mortgage loans through wholesale channel. It originates primarily conforming and government loans. UWM Holdings Corporation was founded in 1986 and is headquartered in Pontiac, Michigan.

Recommended Stories

Before you consider UWM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UWM wasn't on the list.

While UWM currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.