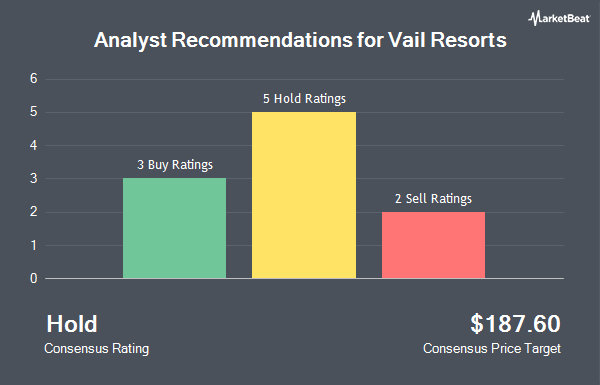

Shares of Vail Resorts, Inc. (NYSE:MTN - Get Free Report) have earned a consensus rating of "Hold" from the ten analysts that are covering the firm, MarketBeat Ratings reports. Two equities research analysts have rated the stock with a sell recommendation, five have given a hold recommendation and three have given a buy recommendation to the company. The average 1 year target price among brokers that have issued ratings on the stock in the last year is $205.90.

MTN has been the topic of a number of research reports. UBS Group initiated coverage on Vail Resorts in a report on Thursday, November 14th. They set a "neutral" rating and a $185.00 price objective on the stock. Deutsche Bank Aktiengesellschaft decreased their price target on shares of Vail Resorts from $218.00 to $194.00 and set a "hold" rating on the stock in a research note on Monday, September 16th. Stifel Nicolaus cut their price objective on shares of Vail Resorts from $223.00 to $216.00 and set a "buy" rating for the company in a research note on Friday, September 27th. StockNews.com cut shares of Vail Resorts from a "hold" rating to a "sell" rating in a research report on Tuesday, November 12th. Finally, Barclays cut their price target on shares of Vail Resorts from $161.00 to $155.00 and set an "underweight" rating for the company in a research report on Friday, September 27th.

Check Out Our Latest Research Report on MTN

Insider Buying and Selling at Vail Resorts

In other news, insider Robert A. Katz sold 9,296 shares of the firm's stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $175.98, for a total value of $1,635,910.08. Following the completion of the sale, the insider now directly owns 245,961 shares of the company's stock, valued at approximately $43,284,216.78. This trade represents a 3.64 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, CFO Angela A. Korch purchased 165 shares of Vail Resorts stock in a transaction that occurred on Thursday, October 3rd. The shares were bought at an average price of $173.09 per share, for a total transaction of $28,559.85. Following the transaction, the chief financial officer now directly owns 2,187 shares of the company's stock, valued at $378,547.83. This trade represents a 8.16 % increase in their ownership of the stock. The disclosure for this purchase can be found here. 1.20% of the stock is currently owned by corporate insiders.

Institutional Trading of Vail Resorts

Several institutional investors and hedge funds have recently bought and sold shares of MTN. Russell Investments Group Ltd. lifted its stake in shares of Vail Resorts by 78.3% in the 1st quarter. Russell Investments Group Ltd. now owns 9,882 shares of the company's stock valued at $2,198,000 after purchasing an additional 4,340 shares during the period. Orion Portfolio Solutions LLC boosted its holdings in shares of Vail Resorts by 44.8% during the 1st quarter. Orion Portfolio Solutions LLC now owns 6,523 shares of the company's stock valued at $1,454,000 after buying an additional 2,017 shares in the last quarter. UniSuper Management Pty Ltd grew its position in shares of Vail Resorts by 66.7% in the 1st quarter. UniSuper Management Pty Ltd now owns 500 shares of the company's stock worth $111,000 after buying an additional 200 shares during the period. CANADA LIFE ASSURANCE Co grew its position in shares of Vail Resorts by 66.0% in the 1st quarter. CANADA LIFE ASSURANCE Co now owns 45,233 shares of the company's stock worth $10,082,000 after buying an additional 17,976 shares during the period. Finally, Vident Advisory LLC increased its stake in shares of Vail Resorts by 28.6% in the 1st quarter. Vident Advisory LLC now owns 60,699 shares of the company's stock worth $13,526,000 after acquiring an additional 13,493 shares in the last quarter. 94.94% of the stock is currently owned by hedge funds and other institutional investors.

Vail Resorts Price Performance

MTN stock traded down $0.20 during midday trading on Wednesday, reaching $174.75. The company had a trading volume of 59,193 shares, compared to its average volume of 518,615. The firm has a 50-day moving average price of $175.35 and a 200-day moving average price of $180.16. The company has a market capitalization of $6.55 billion, a P/E ratio of 29.02, a P/E/G ratio of 1.69 and a beta of 1.13. Vail Resorts has a 1 year low of $165.00 and a 1 year high of $236.92. The company has a debt-to-equity ratio of 2.62, a current ratio of 0.82 and a quick ratio of 0.71.

Vail Resorts (NYSE:MTN - Get Free Report) last announced its earnings results on Thursday, September 26th. The company reported ($4.67) earnings per share (EPS) for the quarter, missing the consensus estimate of ($4.28) by ($0.39). Vail Resorts had a return on equity of 20.76% and a net margin of 7.99%. The company had revenue of $265.39 million during the quarter, compared to analysts' expectations of $264.84 million. During the same quarter last year, the firm posted ($3.35) earnings per share. The firm's revenue was down 1.6% on a year-over-year basis. On average, research analysts anticipate that Vail Resorts will post 7.27 earnings per share for the current fiscal year.

Vail Resorts Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 24th. Investors of record on Tuesday, October 8th were issued a dividend of $2.22 per share. The ex-dividend date of this dividend was Tuesday, October 8th. This represents a $8.88 dividend on an annualized basis and a yield of 5.08%. Vail Resorts's dividend payout ratio is presently 147.26%.

Vail Resorts Company Profile

(

Get Free ReportVail Resorts, Inc, through its subsidiaries, operates mountain resorts and regional ski areas in the United States. It operates through three segments: Mountain, Lodging, and Real Estate. The Mountain segment operates 41 destination mountain resorts and regional ski areas. This segment is also involved in the ancillary activities, including ski school, dining, and retail/rental operations, as well as real estate brokerage activities.

Recommended Stories

Before you consider Vail Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vail Resorts wasn't on the list.

While Vail Resorts currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.