TD Private Client Wealth LLC increased its stake in Vail Resorts, Inc. (NYSE:MTN - Free Report) by 25.1% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 14,053 shares of the company's stock after buying an additional 2,817 shares during the quarter. TD Private Client Wealth LLC's holdings in Vail Resorts were worth $2,449,000 as of its most recent SEC filing.

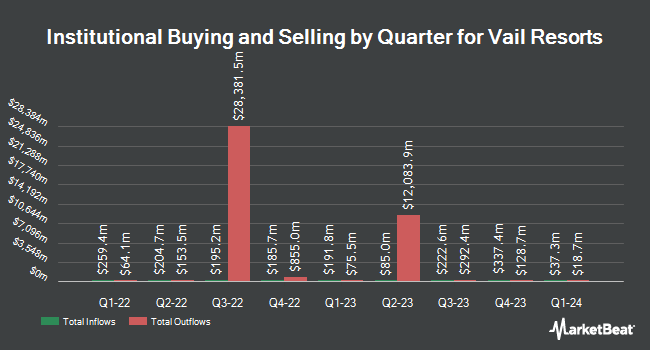

A number of other large investors have also recently added to or reduced their stakes in the company. Bamco Inc. NY boosted its stake in shares of Vail Resorts by 2.7% during the 3rd quarter. Bamco Inc. NY now owns 5,185,136 shares of the company's stock worth $903,717,000 after acquiring an additional 136,328 shares during the period. Charles Schwab Investment Management Inc. lifted its holdings in shares of Vail Resorts by 3.6% during the third quarter. Charles Schwab Investment Management Inc. now owns 1,154,759 shares of the company's stock worth $201,263,000 after buying an additional 40,643 shares in the last quarter. TPG GP A LLC boosted its holdings in Vail Resorts by 17.4% in the 2nd quarter. TPG GP A LLC now owns 899,446 shares of the company's stock valued at $162,017,000 after purchasing an additional 133,607 shares during the period. The Manufacturers Life Insurance Company grew its position in Vail Resorts by 8.1% during the third quarter. The Manufacturers Life Insurance Company now owns 686,984 shares of the company's stock worth $119,734,000 after buying an additional 51,438 shares in the last quarter. Finally, Geode Capital Management LLC increased its stake in Vail Resorts by 1.3% during the 3rd quarter. Geode Capital Management LLC now owns 649,624 shares of the company's stock worth $113,252,000 after acquiring an additional 8,422 shares during the period. Institutional investors and hedge funds own 94.94% of the company's stock.

Vail Resorts Stock Up 0.7 %

Shares of Vail Resorts stock traded up $1.36 during trading on Thursday, reaching $193.93. 638,315 shares of the company traded hands, compared to its average volume of 532,556. The firm has a market capitalization of $7.27 billion, a PE ratio of 32.16, a P/E/G ratio of 1.97 and a beta of 1.14. The company has a 50 day moving average price of $177.00 and a 200-day moving average price of $178.87. The company has a debt-to-equity ratio of 2.62, a current ratio of 0.82 and a quick ratio of 0.71. Vail Resorts, Inc. has a 1-year low of $165.00 and a 1-year high of $236.92.

Vail Resorts (NYSE:MTN - Get Free Report) last posted its quarterly earnings results on Monday, December 9th. The company reported ($4.61) earnings per share for the quarter, topping analysts' consensus estimates of ($4.99) by $0.38. The business had revenue of $260.28 million for the quarter, compared to the consensus estimate of $251.45 million. Vail Resorts had a return on equity of 20.76% and a net margin of 7.99%. The firm's revenue for the quarter was up .7% on a year-over-year basis. During the same period in the prior year, the business earned ($4.60) EPS. As a group, equities research analysts expect that Vail Resorts, Inc. will post 7.23 earnings per share for the current fiscal year.

Vail Resorts Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, January 9th. Shareholders of record on Thursday, December 26th will be paid a dividend of $2.22 per share. The ex-dividend date is Thursday, December 26th. This represents a $8.88 dividend on an annualized basis and a yield of 4.58%. Vail Resorts's dividend payout ratio (DPR) is presently 147.26%.

Insiders Place Their Bets

In other news, CFO Angela A. Korch purchased 165 shares of the business's stock in a transaction that occurred on Thursday, October 3rd. The shares were acquired at an average cost of $173.09 per share, for a total transaction of $28,559.85. Following the completion of the acquisition, the chief financial officer now owns 2,187 shares in the company, valued at $378,547.83. This trade represents a 8.16 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, insider Robert A. Katz sold 9,296 shares of the business's stock in a transaction that occurred on Wednesday, October 2nd. The stock was sold at an average price of $175.98, for a total value of $1,635,910.08. Following the completion of the transaction, the insider now owns 245,961 shares in the company, valued at $43,284,216.78. The trade was a 3.64 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 1.20% of the company's stock.

Wall Street Analysts Forecast Growth

MTN has been the subject of several analyst reports. Mizuho boosted their target price on shares of Vail Resorts from $222.00 to $227.00 and gave the company an "outperform" rating in a research report on Tuesday. StockNews.com upgraded shares of Vail Resorts from a "sell" rating to a "hold" rating in a research report on Monday, December 2nd. UBS Group began coverage on Vail Resorts in a research report on Thursday, November 14th. They issued a "neutral" rating and a $185.00 target price for the company. Deutsche Bank Aktiengesellschaft boosted their target price on shares of Vail Resorts from $185.00 to $196.00 and gave the stock a "hold" rating in a report on Monday. Finally, Truist Financial decreased their price target on Vail Resorts from $250.00 to $247.00 and set a "buy" rating for the company in a research note on Tuesday. Two analysts have rated the stock with a sell rating, six have issued a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, Vail Resorts currently has an average rating of "Hold" and an average price target of $205.50.

Get Our Latest Stock Report on MTN

Vail Resorts Profile

(

Free Report)

Vail Resorts, Inc, through its subsidiaries, operates mountain resorts and regional ski areas in the United States. It operates through three segments: Mountain, Lodging, and Real Estate. The Mountain segment operates 41 destination mountain resorts and regional ski areas. This segment is also involved in the ancillary activities, including ski school, dining, and retail/rental operations, as well as real estate brokerage activities.

Further Reading

Before you consider Vail Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vail Resorts wasn't on the list.

While Vail Resorts currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.