Valmont Industries (NYSE:VMI - Get Free Report) issued an update on its FY 2025 earnings guidance on Tuesday morning. The company provided earnings per share guidance of 17.200-18.800 for the period, compared to the consensus earnings per share estimate of 18.080. The company issued revenue guidance of $4.0 billion-$4.2 billion, compared to the consensus revenue estimate of $4.1 billion.

Analyst Ratings Changes

A number of research firms recently commented on VMI. DA Davidson lowered Valmont Industries from a "buy" rating to a "neutral" rating and set a $380.00 price target for the company. in a research report on Wednesday, February 19th. William Blair raised shares of Valmont Industries from a "market perform" rating to an "outperform" rating in a research note on Wednesday. Stifel Nicolaus upped their price target on Valmont Industries from $343.00 to $345.00 and gave the company a "buy" rating in a research report on Wednesday. Finally, StockNews.com lowered Valmont Industries from a "strong-buy" rating to a "buy" rating in a research report on Saturday, March 29th.

Read Our Latest Stock Analysis on Valmont Industries

Valmont Industries Stock Performance

NYSE:VMI traded down $2.04 during mid-day trading on Friday, hitting $294.46. 2,322 shares of the company traded hands, compared to its average volume of 148,551. The stock's fifty day moving average price is $308.37 and its 200-day moving average price is $319.02. Valmont Industries has a one year low of $202.01 and a one year high of $379.22. The firm has a market cap of $5.91 billion, a price-to-earnings ratio of 17.12 and a beta of 1.07. The company has a quick ratio of 1.55, a current ratio of 2.07 and a debt-to-equity ratio of 0.47.

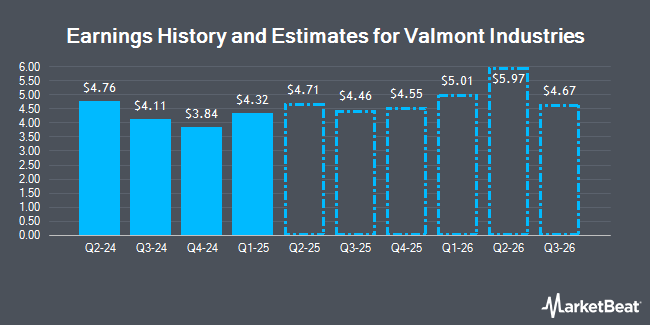

Valmont Industries (NYSE:VMI - Get Free Report) last issued its quarterly earnings data on Tuesday, April 22nd. The industrial products company reported $4.32 earnings per share for the quarter, topping the consensus estimate of $4.24 by $0.08. Valmont Industries had a return on equity of 23.15% and a net margin of 8.55%. The company had revenue of $969.31 million for the quarter, compared to analysts' expectations of $976.04 million. Research analysts anticipate that Valmont Industries will post 18.07 earnings per share for the current fiscal year.

Valmont Industries Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, April 15th. Investors of record on Friday, March 28th were given a dividend of $0.68 per share. The ex-dividend date of this dividend was Friday, March 28th. This is an increase from Valmont Industries's previous quarterly dividend of $0.60. This represents a $2.72 dividend on an annualized basis and a yield of 0.92%. Valmont Industries's payout ratio is currently 15.83%.

About Valmont Industries

(

Get Free Report)

Valmont Industries, Inc operates as manufacturer of products and services for infrastructure and agriculture markets in the United States, Australia, Brazil, and internationally. It operates through two segments, Infrastructure and Agriculture. The company manufactures and distributes steel, pre-stressed concrete, composite structures for electrical transmission, substation, and distribution applications; and designs, engineers, and manufactures metal, steel, wood, aluminum, and composite poles and structures for lighting and transportation applications.

Featured Stories

Before you consider Valmont Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valmont Industries wasn't on the list.

While Valmont Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.