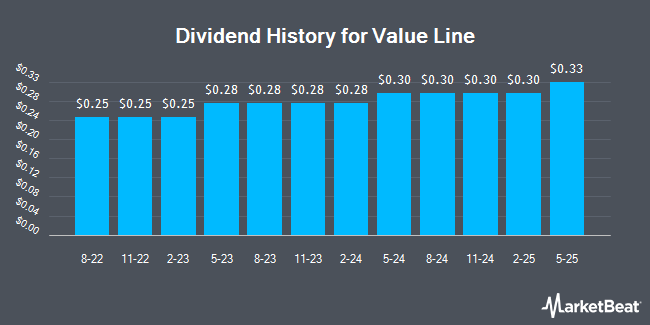

Value Line, Inc. (NASDAQ:VALU - Get Free Report) declared a quarterly dividend on Thursday, April 17th, RTT News reports. Investors of record on Monday, April 28th will be given a dividend of 0.325 per share by the financial services provider on Monday, May 12th. This represents a $1.30 dividend on an annualized basis and a dividend yield of 3.34%. The ex-dividend date is Monday, April 28th. This is a 8.3% increase from Value Line's previous quarterly dividend of $0.30.

Value Line has increased its dividend payment by an average of 10.9% per year over the last three years.

Value Line Stock Performance

NASDAQ:VALU traded down $0.75 on Friday, hitting $38.88. The stock had a trading volume of 730 shares, compared to its average volume of 8,042. Value Line has a 1 year low of $32.94 and a 1 year high of $57.68. The firm's fifty day simple moving average is $39.38 and its two-hundred day simple moving average is $45.37. The stock has a market cap of $366.02 million, a P/E ratio of 16.49 and a beta of 0.95.

Value Line (NASDAQ:VALU - Get Free Report) last issued its quarterly earnings results on Friday, March 14th. The financial services provider reported $0.55 EPS for the quarter. Value Line had a return on equity of 24.00% and a net margin of 62.02%. The company had revenue of $8.97 million during the quarter. During the same period in the previous year, the business posted $1.51 earnings per share.

Analyst Upgrades and Downgrades

Separately, StockNews.com cut Value Line from a "buy" rating to a "hold" rating in a research note on Thursday, February 27th.

Get Our Latest Report on VALU

Value Line Company Profile

(

Get Free Report)

Value Line, Inc produces and sells investment periodicals and related publications. Its investment periodicals and related publications cover a range of investments, including stocks, mutual funds, exchange traded funds (ETFs), and options. The company's research services include The Value Line Investment Survey, The Value Line Investment Survey - Small and Mid-Cap, The Value Line 600, and The Value Line Fund Advisor Plus that provide statistical and text coverage of various investment securities, with an emphasis placed on its proprietary research, analysis, and statistical ranks.

See Also

Before you consider Value Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Value Line wasn't on the list.

While Value Line currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.