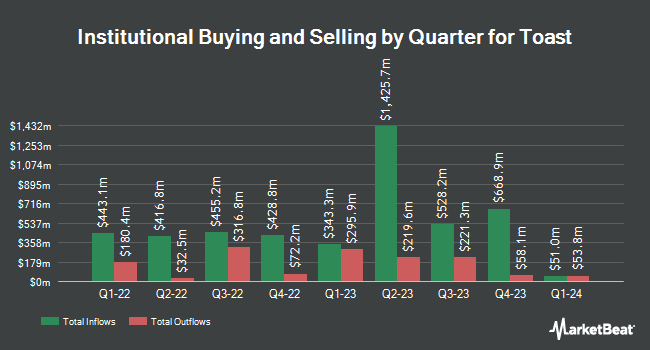

ValueAct Holdings L.P. acquired a new position in shares of Toast, Inc. (NYSE:TOST - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 15,482,200 shares of the company's stock, valued at approximately $438,301,000. Toast accounts for 10.0% of ValueAct Holdings L.P.'s portfolio, making the stock its 5th biggest position. ValueAct Holdings L.P. owned approximately 3.29% of Toast at the end of the most recent quarter.

A number of other large investors have also recently bought and sold shares of the business. West Branch Capital LLC bought a new stake in Toast in the 2nd quarter valued at about $26,000. Toth Financial Advisory Corp bought a new stake in shares of Toast during the third quarter valued at approximately $28,000. 1620 Investment Advisors Inc. acquired a new position in shares of Toast during the second quarter worth approximately $34,000. Raleigh Capital Management Inc. boosted its position in shares of Toast by 93.4% during the third quarter. Raleigh Capital Management Inc. now owns 1,491 shares of the company's stock worth $42,000 after buying an additional 720 shares during the period. Finally, Farther Finance Advisors LLC grew its holdings in Toast by 32.3% in the 3rd quarter. Farther Finance Advisors LLC now owns 2,033 shares of the company's stock worth $58,000 after buying an additional 496 shares in the last quarter. Institutional investors own 82.91% of the company's stock.

Analyst Upgrades and Downgrades

TOST has been the subject of a number of analyst reports. Bank of America boosted their price target on Toast from $26.00 to $28.00 and gave the stock a "neutral" rating in a research report on Tuesday, September 17th. Stephens upped their price objective on shares of Toast from $28.00 to $30.00 and gave the stock an "equal weight" rating in a report on Friday, October 18th. Piper Sandler raised their target price on shares of Toast from $25.00 to $35.00 and gave the company a "neutral" rating in a research note on Monday, November 11th. Robert W. Baird upped their price target on shares of Toast from $30.00 to $38.00 and gave the stock a "neutral" rating in a research note on Friday, November 8th. Finally, Wells Fargo & Company increased their price objective on shares of Toast from $23.00 to $25.00 and gave the company an "underweight" rating in a report on Friday, November 8th. One equities research analyst has rated the stock with a sell rating, twelve have given a hold rating and nine have given a buy rating to the company. According to MarketBeat, the company currently has an average rating of "Hold" and an average target price of $34.14.

Get Our Latest Research Report on TOST

Toast Trading Up 2.1 %

Shares of TOST traded up $0.79 during midday trading on Friday, hitting $38.81. The stock had a trading volume of 6,389,998 shares, compared to its average volume of 11,023,042. The business has a 50-day simple moving average of $34.32 and a two-hundred day simple moving average of $28.23. The firm has a market cap of $18.28 billion, a P/E ratio of -298.54, a price-to-earnings-growth ratio of 48.60 and a beta of 1.93. Toast, Inc. has a fifty-two week low of $14.75 and a fifty-two week high of $44.12.

Insider Activity at Toast

In other Toast news, President Stephen Fredette sold 211,686 shares of Toast stock in a transaction dated Tuesday, September 10th. The stock was sold at an average price of $23.57, for a total transaction of $4,989,439.02. Following the transaction, the president now owns 2,638,023 shares of the company's stock, valued at $62,178,202.11. The trade was a 7.43 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CEO Aman Narang sold 10,106 shares of the company's stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $27.77, for a total value of $280,643.62. Following the completion of the transaction, the chief executive officer now owns 968,095 shares in the company, valued at $26,883,998.15. This represents a 1.03 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 1,688,321 shares of company stock worth $52,160,120. 13.32% of the stock is owned by corporate insiders.

Toast Profile

(

Free Report)

Toast, Inc operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India. The company offers software products for restaurant operations and point of sale, such as Toast POS, Toast now, multi-location management, kitchen display system, Toast mobile order and pay, Toast catering and events, Toast invoicing, Toast tables, and restaurant retail; and hardware products, including Toast flex, Toast flex for guest, Toast go 2, Toast tap, kiosks, and Delphi by Toast.

See Also

Before you consider Toast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toast wasn't on the list.

While Toast currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.