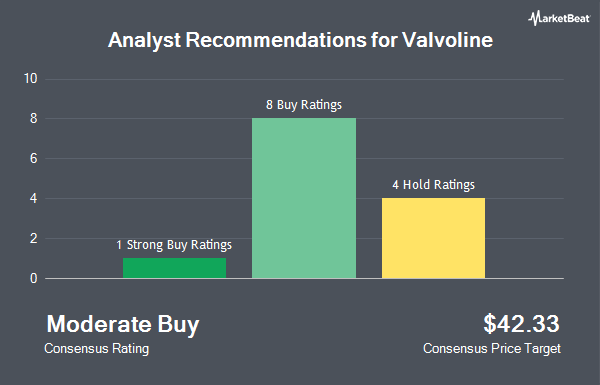

Shares of Valvoline Inc. (NYSE:VVV - Get Free Report) have been given an average recommendation of "Buy" by the nine analysts that are currently covering the stock, Marketbeat.com reports. One investment analyst has rated the stock with a hold rating, seven have given a buy rating and one has issued a strong buy rating on the company. The average 1-year price objective among brokers that have issued a report on the stock in the last year is $47.75.

A number of equities analysts recently commented on the company. Royal Bank of Canada decreased their price target on Valvoline from $54.00 to $48.00 and set an "outperform" rating for the company in a research note on Thursday, August 8th. Wells Fargo & Company dropped their target price on shares of Valvoline from $50.00 to $46.00 and set an "overweight" rating on the stock in a report on Thursday, August 8th. Stephens initiated coverage on shares of Valvoline in a report on Tuesday, October 15th. They issued an "overweight" rating and a $49.00 price target for the company. Robert W. Baird initiated coverage on shares of Valvoline in a research note on Thursday, August 15th. They set an "outperform" rating and a $48.00 price objective on the stock. Finally, Baird R W upgraded Valvoline to a "strong-buy" rating in a research note on Thursday, August 15th.

View Our Latest Stock Report on Valvoline

Hedge Funds Weigh In On Valvoline

Institutional investors have recently bought and sold shares of the stock. Coldstream Capital Management Inc. grew its holdings in shares of Valvoline by 11.8% during the third quarter. Coldstream Capital Management Inc. now owns 7,209 shares of the basic materials company's stock valued at $302,000 after buying an additional 760 shares in the last quarter. Geode Capital Management LLC grew its stake in Valvoline by 2.5% during the 3rd quarter. Geode Capital Management LLC now owns 2,226,769 shares of the basic materials company's stock valued at $93,215,000 after acquiring an additional 54,545 shares in the last quarter. Barclays PLC increased its holdings in shares of Valvoline by 52.4% in the 3rd quarter. Barclays PLC now owns 53,580 shares of the basic materials company's stock valued at $2,242,000 after purchasing an additional 18,414 shares during the period. Public Employees Retirement System of Ohio lifted its position in shares of Valvoline by 212.0% in the third quarter. Public Employees Retirement System of Ohio now owns 158,983 shares of the basic materials company's stock worth $6,653,000 after purchasing an additional 108,020 shares in the last quarter. Finally, MML Investors Services LLC boosted its holdings in shares of Valvoline by 17.6% during the third quarter. MML Investors Services LLC now owns 13,624 shares of the basic materials company's stock worth $570,000 after purchasing an additional 2,035 shares during the period. Hedge funds and other institutional investors own 96.13% of the company's stock.

Valvoline Stock Up 0.0 %

NYSE VVV traded up $0.01 during trading hours on Monday, reaching $42.33. 2,180,501 shares of the company traded hands, compared to its average volume of 1,177,825. The stock has a market capitalization of $5.46 billion, a PE ratio of 34.41 and a beta of 1.46. The company has a current ratio of 0.73, a quick ratio of 0.62 and a debt-to-equity ratio of 10.57. Valvoline has a 12 month low of $33.86 and a 12 month high of $48.26. The company has a 50 day moving average of $41.37 and a two-hundred day moving average of $42.03.

Valvoline announced that its Board of Directors has authorized a stock buyback plan on Tuesday, July 30th that permits the company to repurchase $400.00 million in shares. This repurchase authorization permits the basic materials company to reacquire up to 7.6% of its stock through open market purchases. Stock repurchase plans are usually an indication that the company's leadership believes its stock is undervalued.

Valvoline Company Profile

(

Get Free ReportValvoline Inc engages in the operation and franchising of vehicle service centers and retail stores in the United States and Canada. The company, through its service centers, provides fluid exchange for motor oil, transmission and differential fluid, and coolant; parts replacement for batteries, filters, wiper blades, and belts; and safety services, such as tire inflation and rotation, bulbs, and safety checks.

Further Reading

Before you consider Valvoline, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valvoline wasn't on the list.

While Valvoline currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.