Van ECK Associates Corp increased its position in Nextracker Inc. (NASDAQ:NXT - Free Report) by 30.7% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 60,613 shares of the company's stock after buying an additional 14,249 shares during the quarter. Van ECK Associates Corp's holdings in Nextracker were worth $2,272,000 as of its most recent filing with the Securities & Exchange Commission.

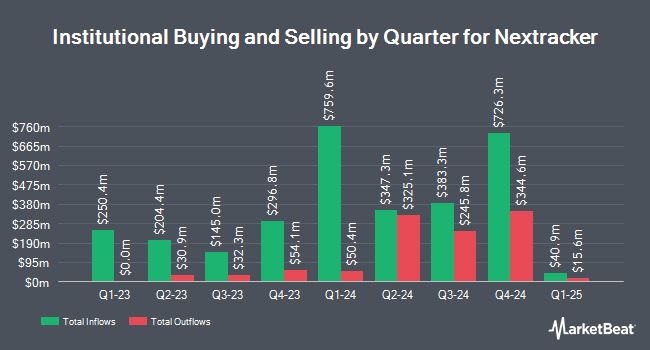

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. GAMMA Investing LLC increased its stake in shares of Nextracker by 73.2% during the second quarter. GAMMA Investing LLC now owns 660 shares of the company's stock valued at $31,000 after buying an additional 279 shares during the period. TFC Financial Management Inc. bought a new stake in Nextracker during the 2nd quarter valued at approximately $32,000. Fifth Third Bancorp raised its position in shares of Nextracker by 1,602.5% in the 2nd quarter. Fifth Third Bancorp now owns 681 shares of the company's stock worth $32,000 after acquiring an additional 641 shares in the last quarter. Rothschild Investment LLC purchased a new position in shares of Nextracker in the 2nd quarter valued at approximately $35,000. Finally, Edmond DE Rothschild Holding S.A. bought a new stake in shares of Nextracker during the first quarter valued at approximately $44,000. 67.41% of the stock is currently owned by institutional investors.

Nextracker Stock Performance

NXT traded down $0.56 during trading on Monday, hitting $39.58. The company's stock had a trading volume of 2,353,680 shares, compared to its average volume of 3,767,610. The business's 50 day simple moving average is $36.19 and its 200-day simple moving average is $43.51. The firm has a market cap of $5.76 billion, a PE ratio of 10.01 and a beta of 2.32. Nextracker Inc. has a one year low of $30.93 and a one year high of $62.31. The company has a quick ratio of 1.99, a current ratio of 2.21 and a debt-to-equity ratio of 0.11.

Analyst Upgrades and Downgrades

A number of research analysts recently issued reports on the stock. Guggenheim lowered their price target on shares of Nextracker from $60.00 to $55.00 and set a "buy" rating for the company in a research report on Friday, August 16th. Cantor Fitzgerald restated an "overweight" rating and issued a $55.00 price target on shares of Nextracker in a research note on Friday, August 2nd. Roth Mkm lowered their price objective on Nextracker from $70.00 to $65.00 and set a "buy" rating for the company in a research note on Friday, August 2nd. BMO Capital Markets cut their price objective on shares of Nextracker from $56.00 to $44.00 and set a "market perform" rating on the stock in a research report on Monday, October 14th. Finally, Jefferies Financial Group initiated coverage on shares of Nextracker in a research report on Wednesday, September 4th. They set a "hold" rating and a $46.00 price target for the company. Five research analysts have rated the stock with a hold rating and fifteen have issued a buy rating to the company. According to data from MarketBeat.com, Nextracker currently has an average rating of "Moderate Buy" and a consensus price target of $54.95.

Get Our Latest Stock Report on Nextracker

Nextracker Company Profile

(

Free Report)

Nextracker Inc, an energy solutions company, provides solar tracker and software solutions for utility-scale and distributed generation solar projects in the United States and internationally. The company offers tracking solutions, which includes NX Horizon, a solar tracking solution; and NX Horizon-XTR, a terrain-following tracker designed to expand the addressable market for trackers on sites with sloped, uneven, and challenging terrain.

Read More

Before you consider Nextracker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nextracker wasn't on the list.

While Nextracker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.