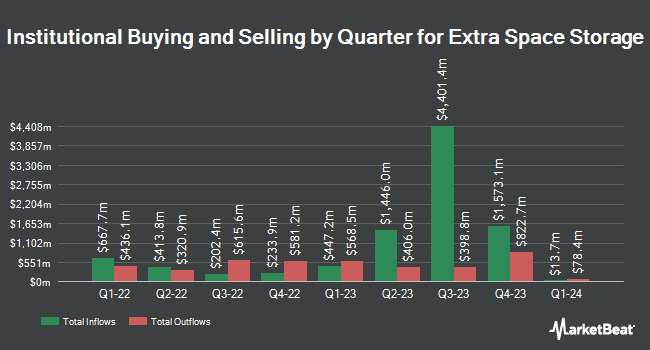

Van ECK Associates Corp boosted its stake in Extra Space Storage Inc. (NYSE:EXR - Free Report) by 11.6% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 96,609 shares of the real estate investment trust's stock after purchasing an additional 10,063 shares during the period. Van ECK Associates Corp's holdings in Extra Space Storage were worth $16,333,000 at the end of the most recent reporting period.

Other large investors have also recently added to or reduced their stakes in the company. EdgeRock Capital LLC bought a new position in Extra Space Storage in the second quarter worth about $25,000. Centerpoint Advisors LLC purchased a new position in Extra Space Storage during the 2nd quarter worth approximately $27,000. Blue Trust Inc. boosted its stake in shares of Extra Space Storage by 540.5% during the 2nd quarter. Blue Trust Inc. now owns 237 shares of the real estate investment trust's stock valued at $35,000 after buying an additional 200 shares during the period. Whittier Trust Co. of Nevada Inc. boosted its stake in shares of Extra Space Storage by 2,760.0% during the 2nd quarter. Whittier Trust Co. of Nevada Inc. now owns 286 shares of the real estate investment trust's stock valued at $44,000 after buying an additional 276 shares during the period. Finally, Massmutual Trust Co. FSB ADV boosted its stake in shares of Extra Space Storage by 19.7% during the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 461 shares of the real estate investment trust's stock valued at $72,000 after buying an additional 76 shares during the period. 99.11% of the stock is currently owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other news, EVP Gwyn Goodson Mcneal sold 2,823 shares of the company's stock in a transaction on Friday, August 23rd. The stock was sold at an average price of $177.01, for a total transaction of $499,699.23. Following the sale, the executive vice president now owns 32,855 shares of the company's stock, valued at approximately $5,815,663.55. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In related news, EVP William N. Springer sold 2,000 shares of the stock in a transaction on Wednesday, August 28th. The stock was sold at an average price of $175.33, for a total value of $350,660.00. Following the completion of the sale, the executive vice president now directly owns 11,919 shares in the company, valued at approximately $2,089,758.27. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Gwyn Goodson Mcneal sold 2,823 shares of the firm's stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $177.01, for a total value of $499,699.23. Following the sale, the executive vice president now owns 32,855 shares in the company, valued at approximately $5,815,663.55. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 18,970 shares of company stock valued at $3,367,307 in the last three months. 1.36% of the stock is currently owned by insiders.

Extra Space Storage Price Performance

EXR stock traded down $7.51 during trading on Wednesday, hitting $161.03. 1,678,538 shares of the company's stock traded hands, compared to its average volume of 1,041,286. The company has a debt-to-equity ratio of 0.77, a quick ratio of 0.20 and a current ratio of 0.23. Extra Space Storage Inc. has a 52 week low of $104.88 and a 52 week high of $184.87. The business has a fifty day simple moving average of $173.03 and a 200 day simple moving average of $161.17. The stock has a market capitalization of $34.13 billion, a price-to-earnings ratio of 42.15, a P/E/G ratio of 6.06 and a beta of 0.87.

Extra Space Storage (NYSE:EXR - Get Free Report) last issued its earnings results on Tuesday, October 29th. The real estate investment trust reported $0.91 earnings per share for the quarter, missing analysts' consensus estimates of $2.03 by ($1.12). Extra Space Storage had a net margin of 25.35% and a return on equity of 5.51%. The firm had revenue of $824.80 million for the quarter, compared to the consensus estimate of $826.93 million. During the same period last year, the firm earned $2.02 earnings per share. The company's revenue for the quarter was up 10.2% on a year-over-year basis. As a group, research analysts expect that Extra Space Storage Inc. will post 8.08 EPS for the current fiscal year.

Extra Space Storage Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Monday, September 30th. Shareholders of record on Monday, September 16th were paid a $1.62 dividend. This represents a $6.48 dividend on an annualized basis and a yield of 4.02%. The ex-dividend date of this dividend was Monday, September 16th. Extra Space Storage's dividend payout ratio (DPR) is 169.63%.

Wall Street Analyst Weigh In

EXR has been the subject of several analyst reports. Evercore ISI reduced their price objective on shares of Extra Space Storage from $170.00 to $168.00 and set an "in-line" rating for the company in a research note on Monday, October 14th. KeyCorp boosted their price target on shares of Extra Space Storage from $172.00 to $178.00 and gave the company an "overweight" rating in a research report on Monday, September 9th. Wells Fargo & Company reiterated an "equal weight" rating and set a $175.00 target price on shares of Extra Space Storage in a research report on Monday, October 21st. Jefferies Financial Group upgraded shares of Extra Space Storage from a "hold" rating to a "buy" rating and upped their target price for the stock from $162.00 to $204.00 in a research report on Wednesday, September 18th. Finally, Royal Bank of Canada initiated coverage on shares of Extra Space Storage in a report on Tuesday, September 10th. They issued a "sector perform" rating and a $180.00 price objective on the stock. Three analysts have rated the stock with a sell rating, seven have assigned a hold rating and six have issued a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Hold" and a consensus target price of $171.07.

Check Out Our Latest Stock Report on Extra Space Storage

Extra Space Storage Profile

(

Free Report)

Extra Space Storage Inc, headquartered in Salt Lake City, Utah, is a self-administered and self-managed REIT and a member of the S&P 500. As of December 31, 2023, the Company owned and/or operated 3,714 self-storage stores in 42 states and Washington, DC The Company's stores comprise approximately 2.6 million units and approximately 283.0 million square feet of rentable space operating under the Extra Space, Life Storage and Storage Express brands.

Featured Articles

Before you consider Extra Space Storage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Extra Space Storage wasn't on the list.

While Extra Space Storage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.