Van ECK Associates Corp trimmed its position in Baidu, Inc. (NASDAQ:BIDU - Free Report) by 22.2% in the third quarter, according to its most recent filing with the SEC. The institutional investor owned 22,599 shares of the information services provider's stock after selling 6,435 shares during the period. Van ECK Associates Corp's holdings in Baidu were worth $2,379,000 as of its most recent SEC filing.

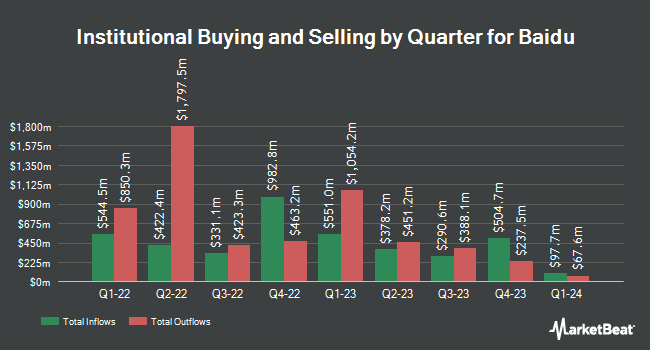

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in BIDU. Janney Montgomery Scott LLC bought a new position in Baidu during the first quarter valued at about $209,000. Sei Investments Co. raised its holdings in shares of Baidu by 0.7% in the 1st quarter. Sei Investments Co. now owns 282,324 shares of the information services provider's stock worth $29,723,000 after purchasing an additional 1,863 shares during the period. Avantax Advisory Services Inc. grew its holdings in Baidu by 12.1% during the first quarter. Avantax Advisory Services Inc. now owns 4,702 shares of the information services provider's stock valued at $495,000 after purchasing an additional 506 shares during the period. BNP PARIBAS ASSET MANAGEMENT Holding S.A. bought a new position in Baidu during the first quarter valued at $526,000. Finally, Monaco Asset Management SAM raised its stake in shares of Baidu by 60.5% in the first quarter. Monaco Asset Management SAM now owns 75,000 shares of the information services provider's stock valued at $7,896,000 after buying an additional 28,264 shares during the period.

Wall Street Analysts Forecast Growth

Several research analysts have recently weighed in on BIDU shares. HSBC downgraded Baidu from a "buy" rating to a "hold" rating and set a $100.00 price target for the company. in a research note on Tuesday, September 24th. Hsbc Global Res lowered shares of Baidu from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, September 24th. Benchmark reduced their price objective on shares of Baidu from $180.00 to $135.00 and set a "buy" rating for the company in a research note on Wednesday, July 31st. Citigroup lowered their target price on shares of Baidu from $170.00 to $155.00 and set a "buy" rating on the stock in a report on Monday, July 15th. Finally, Barclays cut their price target on Baidu from $125.00 to $115.00 and set an "overweight" rating for the company in a report on Friday, August 23rd. Seven investment analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $128.36.

Get Our Latest Research Report on Baidu

Baidu Price Performance

NASDAQ:BIDU traded down $0.68 during midday trading on Monday, hitting $88.28. The company had a trading volume of 3,321,357 shares, compared to its average volume of 3,630,822. The stock's fifty day moving average price is $93.36 and its 200-day moving average price is $94.01. Baidu, Inc. has a 52-week low of $79.68 and a 52-week high of $126.23. The company has a quick ratio of 2.32, a current ratio of 2.32 and a debt-to-equity ratio of 0.19. The company has a market capitalization of $30.96 billion, a PE ratio of 11.63 and a beta of 0.51.

Baidu Company Profile

(

Free Report)

Baidu, Inc engages in the provision of internet search services in China. It operates through two segments: Baidu Core and iQIYI. The company offers Baidu App to access search, feed, and other services using mobile devices; Baidu Search to access its search and other services; Baidu Feed that provides users with personalized timeline based on their demographics and interests; Baidu Health that helps users to find the doctor and hospital for healthcare needs; and Haokan, a short video app.

Read More

Before you consider Baidu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baidu wasn't on the list.

While Baidu currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.