Van ECK Associates Corp reduced its position in Sarepta Therapeutics, Inc. (NASDAQ:SRPT - Free Report) by 18.0% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 68,176 shares of the biotechnology company's stock after selling 14,930 shares during the period. Van ECK Associates Corp owned approximately 0.07% of Sarepta Therapeutics worth $8,854,000 as of its most recent SEC filing.

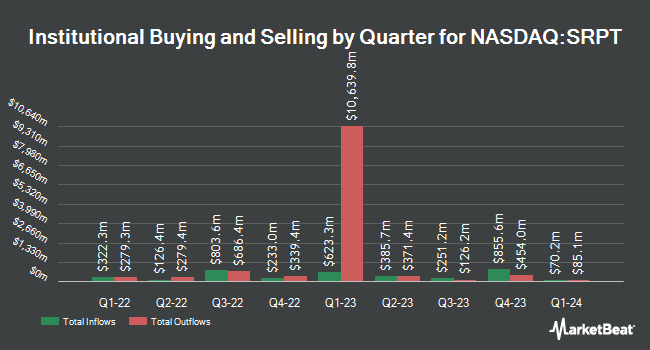

Other hedge funds and other institutional investors have also made changes to their positions in the company. Innealta Capital LLC bought a new position in shares of Sarepta Therapeutics during the second quarter valued at approximately $31,000. New Covenant Trust Company N.A. acquired a new position in Sarepta Therapeutics in the first quarter worth approximately $32,000. Nkcfo LLC purchased a new stake in shares of Sarepta Therapeutics during the second quarter valued at $43,000. Riggs Asset Managment Co. Inc. increased its position in shares of Sarepta Therapeutics by 33.3% in the second quarter. Riggs Asset Managment Co. Inc. now owns 300 shares of the biotechnology company's stock worth $47,000 after acquiring an additional 75 shares in the last quarter. Finally, UMB Bank n.a. boosted its position in Sarepta Therapeutics by 105.9% during the 3rd quarter. UMB Bank n.a. now owns 383 shares of the biotechnology company's stock worth $48,000 after acquiring an additional 197 shares during the period. Institutional investors and hedge funds own 86.68% of the company's stock.

Sarepta Therapeutics Price Performance

Shares of NASDAQ SRPT traded down $9.48 during mid-day trading on Thursday, reaching $118.49. The company had a trading volume of 1,618,636 shares, compared to its average volume of 1,229,789. The firm has a market cap of $11.30 billion, a price-to-earnings ratio of 264.54 and a beta of 0.81. The business's 50-day simple moving average is $126.54 and its 200 day simple moving average is $132.85. Sarepta Therapeutics, Inc. has a one year low of $75.85 and a one year high of $173.25. The company has a debt-to-equity ratio of 1.05, a quick ratio of 3.19 and a current ratio of 3.90.

Sarepta Therapeutics (NASDAQ:SRPT - Get Free Report) last issued its earnings results on Wednesday, August 7th. The biotechnology company reported $0.07 earnings per share for the quarter, beating analysts' consensus estimates of $0.01 by $0.06. Sarepta Therapeutics had a return on equity of 5.32% and a net margin of 3.14%. The firm had revenue of $362.90 million for the quarter, compared to the consensus estimate of $394.38 million. During the same quarter last year, the business posted ($0.27) EPS. The company's revenue was up 38.9% compared to the same quarter last year. On average, research analysts predict that Sarepta Therapeutics, Inc. will post 1.48 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several brokerages recently issued reports on SRPT. Raymond James reiterated an "outperform" rating and set a $150.00 price objective on shares of Sarepta Therapeutics in a report on Thursday, October 10th. Evercore ISI lowered their target price on shares of Sarepta Therapeutics from $179.00 to $170.00 and set an "outperform" rating on the stock in a report on Thursday. Citigroup dropped their price objective on shares of Sarepta Therapeutics from $176.00 to $160.00 and set a "neutral" rating for the company in a report on Thursday, August 8th. Piper Sandler decreased their target price on Sarepta Therapeutics from $205.00 to $200.00 and set an "overweight" rating on the stock in a report on Thursday, August 8th. Finally, Jefferies Financial Group started coverage on shares of Sarepta Therapeutics in a research report on Monday, October 21st. They issued a "buy" rating and a $165.00 price objective for the company. One investment analyst has rated the stock with a hold rating, twenty have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Buy" and a consensus price target of $181.33.

Read Our Latest Analysis on SRPT

Insider Buying and Selling at Sarepta Therapeutics

In other news, CFO Ian Michael Estepan sold 5,985 shares of the firm's stock in a transaction that occurred on Friday, August 30th. The shares were sold at an average price of $137.36, for a total value of $822,099.60. Following the sale, the chief financial officer now directly owns 33,946 shares in the company, valued at approximately $4,662,822.56. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other Sarepta Therapeutics news, CFO Ian Michael Estepan sold 5,985 shares of the stock in a transaction dated Friday, August 30th. The stock was sold at an average price of $137.36, for a total value of $822,099.60. Following the completion of the transaction, the chief financial officer now directly owns 33,946 shares in the company, valued at approximately $4,662,822.56. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Michael Andrew Chambers purchased 37,038 shares of Sarepta Therapeutics stock in a transaction dated Friday, August 16th. The shares were purchased at an average price of $133.80 per share, for a total transaction of $4,955,684.40. Following the completion of the acquisition, the director now owns 284,034 shares of the company's stock, valued at approximately $38,003,749.20. The trade was a 0.00 % increase in their position. The disclosure for this purchase can be found here. Company insiders own 7.70% of the company's stock.

Sarepta Therapeutics Profile

(

Free Report)

Sarepta Therapeutics, Inc, a commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases. It offers EXONDYS 51 injection to treat duchenne muscular dystrophy (duchenne) in patients with confirmed mutation of the dystrophin gene that is amenable to exon 51 skipping; VYONDYS 53 for the treatment of duchenne in patients with confirmed mutation of the dystrophin gene that is amenable to exon 53 skipping; AMONDYS 45 for the treatment of duchenne in patients with confirmed mutation of the dystrophin gene; and ELEVIDYS, an adeno-associated virus based gene therapy for the treatment of ambulatory pediatric patients aged 4 through 5 years with duchenne with a confirmed mutation in the duchenne gene.

Featured Articles

Before you consider Sarepta Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sarepta Therapeutics wasn't on the list.

While Sarepta Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.