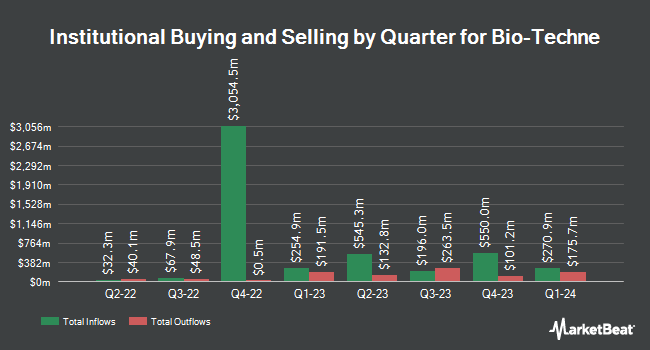

Van ECK Associates Corp trimmed its position in Bio-Techne Co. (NASDAQ:TECH - Free Report) by 14.2% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The fund owned 121,983 shares of the biotechnology company's stock after selling 20,226 shares during the period. Van ECK Associates Corp owned about 0.08% of Bio-Techne worth $9,750,000 as of its most recent SEC filing.

Other large investors have also made changes to their positions in the company. Private Advisor Group LLC lifted its stake in shares of Bio-Techne by 29.1% during the 1st quarter. Private Advisor Group LLC now owns 10,031 shares of the biotechnology company's stock valued at $706,000 after buying an additional 2,259 shares in the last quarter. Janney Montgomery Scott LLC lifted its stake in Bio-Techne by 2.3% in the 1st quarter. Janney Montgomery Scott LLC now owns 10,164 shares of the biotechnology company's stock worth $715,000 after purchasing an additional 227 shares in the last quarter. Daiwa Securities Group Inc. boosted its holdings in shares of Bio-Techne by 7.9% during the 1st quarter. Daiwa Securities Group Inc. now owns 15,559 shares of the biotechnology company's stock valued at $1,095,000 after purchasing an additional 1,137 shares during the last quarter. BI Asset Management Fondsmaeglerselskab A S increased its holdings in shares of Bio-Techne by 54.5% in the first quarter. BI Asset Management Fondsmaeglerselskab A S now owns 6,900 shares of the biotechnology company's stock worth $486,000 after purchasing an additional 2,435 shares during the last quarter. Finally, Mediolanum International Funds Ltd purchased a new stake in shares of Bio-Techne in the first quarter worth about $396,000. 98.95% of the stock is currently owned by institutional investors.

Bio-Techne Stock Up 0.8 %

Shares of TECH stock traded up $0.61 on Thursday, hitting $76.44. The stock had a trading volume of 288,208 shares, compared to its average volume of 1,013,193. Bio-Techne Co. has a one year low of $55.63 and a one year high of $85.57. The business has a 50 day moving average price of $74.06 and a 200 day moving average price of $74.97. The company has a market cap of $12.13 billion, a PE ratio of 80.67, a P/E/G ratio of 5.47 and a beta of 1.28. The company has a quick ratio of 3.26, a current ratio of 4.56 and a debt-to-equity ratio of 0.14.

Bio-Techne (NASDAQ:TECH - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The biotechnology company reported $0.42 earnings per share for the quarter, topping the consensus estimate of $0.38 by $0.04. The firm had revenue of $289.46 million during the quarter, compared to analysts' expectations of $280.22 million. Bio-Techne had a net margin of 12.86% and a return on equity of 12.76%. The company's revenue was up 4.5% compared to the same quarter last year. During the same quarter in the prior year, the company earned $0.35 EPS. Research analysts anticipate that Bio-Techne Co. will post 1.7 earnings per share for the current fiscal year.

Bio-Techne Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, November 22nd. Shareholders of record on Monday, November 11th will be paid a $0.08 dividend. This represents a $0.32 dividend on an annualized basis and a yield of 0.42%. The ex-dividend date of this dividend is Friday, November 8th. Bio-Techne's dividend payout ratio (DPR) is presently 34.04%.

Wall Street Analyst Weigh In

TECH has been the topic of several recent research reports. Robert W. Baird upped their price objective on Bio-Techne from $82.00 to $84.00 and gave the stock an "outperform" rating in a report on Thursday, October 31st. StockNews.com upgraded shares of Bio-Techne from a "hold" rating to a "buy" rating in a report on Friday, November 1st. Benchmark reiterated a "buy" rating and issued a $95.00 price target on shares of Bio-Techne in a research report on Tuesday, August 13th. Royal Bank of Canada cut their price objective on shares of Bio-Techne from $72.00 to $70.00 and set a "sector perform" rating on the stock in a research report on Thursday, August 8th. Finally, Scotiabank boosted their target price on Bio-Techne from $83.00 to $88.00 and gave the company a "sector outperform" rating in a research report on Thursday, October 31st. Three equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $81.78.

Read Our Latest Report on TECH

Bio-Techne Company Profile

(

Free Report)

Bio-Techne Corporation, together with its subsidiaries, develops, manufactures, and sells life science reagents, instruments, and services for the research and clinical diagnostic markets in the United States, the United Kingdom, rest of Europe, Middle East, and Africa, Greater China, rest of Asia-Pacific, and internationally.

Further Reading

Before you consider Bio-Techne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bio-Techne wasn't on the list.

While Bio-Techne currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.