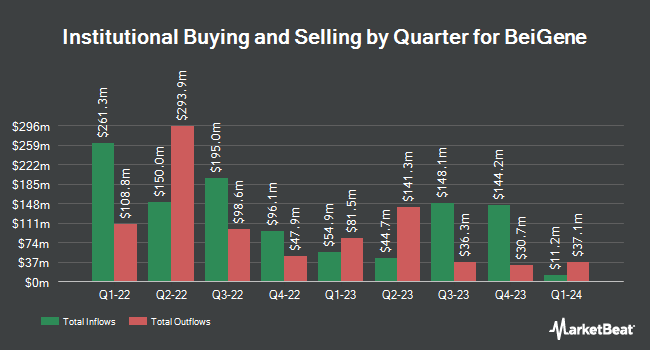

Van ECK Associates Corp trimmed its stake in BeiGene, Ltd. (NASDAQ:BGNE - Free Report) by 59.3% during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 38,888 shares of the company's stock after selling 56,689 shares during the period. Van ECK Associates Corp's holdings in BeiGene were worth $8,595,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in BGNE. Driehaus Capital Management LLC bought a new position in BeiGene during the second quarter worth $1,168,000. Swedbank AB bought a new position in shares of BeiGene in the first quarter valued at approximately $2,596,000. AIA Group Ltd grew its position in BeiGene by 38.9% during the 1st quarter. AIA Group Ltd now owns 18,497 shares of the company's stock worth $2,893,000 after acquiring an additional 5,181 shares during the last quarter. M&G Plc bought a new position in BeiGene in the 1st quarter valued at $29,649,000. Finally, The Manufacturers Life Insurance Company increased its stake in shares of BeiGene by 8.4% in the second quarter. The Manufacturers Life Insurance Company now owns 50,262 shares of the company's stock valued at $7,171,000 after buying an additional 3,915 shares in the last quarter. 48.55% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

BGNE has been the topic of several recent analyst reports. Citigroup lifted their target price on BeiGene from $269.00 to $288.00 and gave the stock a "buy" rating in a report on Thursday, August 8th. JPMorgan Chase & Co. lifted their target price on BeiGene from $200.00 to $235.00 and gave the company an "overweight" rating in a research report on Tuesday, October 22nd. Finally, JMP Securities began coverage on shares of BeiGene in a research note on Wednesday, September 18th. They set a "market outperform" rating and a $288.00 price objective on the stock. Three research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat.com, BeiGene currently has a consensus rating of "Moderate Buy" and an average target price of $246.21.

View Our Latest Stock Report on BGNE

BeiGene Stock Performance

Shares of BeiGene stock traded up $3.73 during trading on Thursday, reaching $206.46. The company's stock had a trading volume of 81,651 shares, compared to its average volume of 264,365. The company has a quick ratio of 1.75, a current ratio of 1.98 and a debt-to-equity ratio of 0.06. The business's 50-day moving average price is $211.97 and its 200-day moving average price is $179.69. BeiGene, Ltd. has a 52 week low of $126.97 and a 52 week high of $248.16. The firm has a market cap of $20.10 billion, a PE ratio of -39.91 and a beta of 0.63.

BeiGene (NASDAQ:BGNE - Get Free Report) last posted its quarterly earnings data on Wednesday, August 7th. The company reported ($1.15) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($2.27) by $1.12. BeiGene had a negative net margin of 16.91% and a negative return on equity of 14.93%. The firm had revenue of $929.20 million during the quarter, compared to the consensus estimate of $810.34 million. During the same quarter in the previous year, the firm posted ($3.64) EPS. The business's revenue for the quarter was up 56.1% compared to the same quarter last year. Equities analysts forecast that BeiGene, Ltd. will post -5 earnings per share for the current year.

Insiders Place Their Bets

In related news, COO Xiaobin Wu sold 5,556 shares of BeiGene stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $189.65, for a total transaction of $1,053,695.40. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. In related news, COO Xiaobin Wu sold 5,556 shares of the business's stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $189.65, for a total transaction of $1,053,695.40. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, insider Titus B. Ball sold 137 shares of BeiGene stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $189.94, for a total value of $26,021.78. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 23,070 shares of company stock valued at $4,901,050. 7.43% of the stock is currently owned by corporate insiders.

BeiGene Company Profile

(

Free Report)

BeiGene, Ltd., through its subsidiaries, engages in the development and commercialization of oncology medicines worldwide. Its products include BRUKINSA to treat various blood cancers; TEVIMBRA to treat various solid tumor and blood cancers; PARTRUVIX for the treatment of various solid tumor malignancies; XGEVA to treat bone metastases from solid tumors and multiple myeloma, as well as giant cell tumor of bone; BLINCYTO to treat acute lymphoblastic leukemia; KYPROLIS to treat R/R multiple myeloma; REVLIMID to treat multiple myeloma; VIDAZA to treat myelodysplastic syndromes, chronic myelomonocyte leukemia, and acute myeloid leukemia; SYLVANT to treat idiopathic multicentric castleman disease; QARZIBA to treat neuroblastoma; POBEVCY to treat metastatic colorectal cancer, liver cancer, and non-small cell lung cancer (NSCLC); BAITUOWEI, to treat breast and prostate cancers; TAFINLAR and MEKINIST to treat NSCLC and melanoma; VOTRIENT for advance renal cell carcinoma; AFINITOR for advance renal cell carcinoma, NET, SEGA, & breast cancers; and ZYKADIA to treat ALK + NSCLC.

Read More

Before you consider BeiGene, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BeiGene wasn't on the list.

While BeiGene currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.