Van ECK Associates Corp cut its stake in Applied Digital Co. (NASDAQ:APLD - Free Report) by 28.2% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 2,059,741 shares of the company's stock after selling 810,239 shares during the period. Van ECK Associates Corp owned 0.96% of Applied Digital worth $17,734,000 at the end of the most recent quarter.

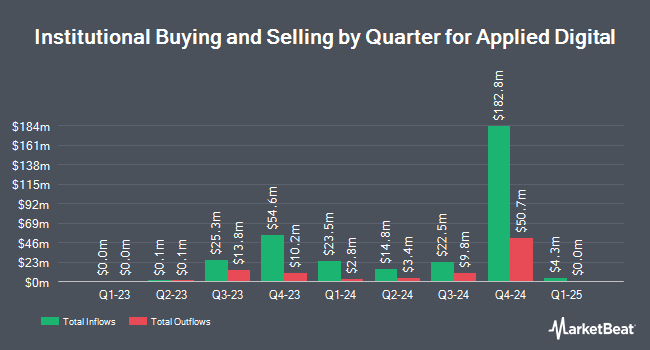

Other institutional investors have also added to or reduced their stakes in the company. Principal Financial Group Inc. bought a new position in shares of Applied Digital in the 1st quarter worth about $50,000. Headlands Technologies LLC increased its holdings in Applied Digital by 381.8% in the second quarter. Headlands Technologies LLC now owns 8,749 shares of the company's stock worth $52,000 after purchasing an additional 6,933 shares in the last quarter. ARS Investment Partners LLC acquired a new position in Applied Digital in the second quarter valued at approximately $60,000. Wealth Enhancement Advisory Services LLC bought a new position in shares of Applied Digital during the 3rd quarter worth approximately $88,000. Finally, Price T Rowe Associates Inc. MD grew its position in shares of Applied Digital by 15.3% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 24,018 shares of the company's stock worth $103,000 after buying an additional 3,182 shares during the period. 65.67% of the stock is currently owned by institutional investors.

Applied Digital Stock Up 11.0 %

NASDAQ APLD traded up $0.70 during trading hours on Wednesday, hitting $7.07. The company's stock had a trading volume of 14,713,685 shares, compared to its average volume of 7,262,426. The company has a market capitalization of $1.52 billion, a PE ratio of -6.04 and a beta of 4.65. The company has a current ratio of 0.22, a quick ratio of 0.22 and a debt-to-equity ratio of 0.62. Applied Digital Co. has a 52 week low of $2.36 and a 52 week high of $9.48. The company's 50-day simple moving average is $6.80 and its two-hundred day simple moving average is $5.35.

Applied Digital (NASDAQ:APLD - Get Free Report) last posted its earnings results on Wednesday, October 9th. The company reported ($0.15) earnings per share for the quarter, beating analysts' consensus estimates of ($0.28) by $0.13. Applied Digital had a negative return on equity of 88.87% and a negative net margin of 74.95%. The company had revenue of $60.70 million for the quarter, compared to analyst estimates of $54.85 million. During the same quarter last year, the company earned ($0.10) earnings per share. The company's revenue for the quarter was up 67.2% on a year-over-year basis. Research analysts anticipate that Applied Digital Co. will post -0.4 EPS for the current fiscal year.

Analyst Ratings Changes

APLD has been the topic of a number of research reports. Roth Mkm reiterated a "buy" rating and set a $10.00 target price on shares of Applied Digital in a research report on Thursday, October 10th. HC Wainwright upped their price objective on shares of Applied Digital from $5.00 to $10.00 and gave the company a "buy" rating in a report on Wednesday, October 16th. Needham & Company LLC restated a "buy" rating and issued a $11.00 target price on shares of Applied Digital in a research note on Friday, November 1st. Craig Hallum upped their price target on Applied Digital from $10.00 to $12.00 and gave the stock a "buy" rating in a research note on Thursday, October 10th. Finally, B. Riley increased their price target on Applied Digital from $8.00 to $9.00 and gave the stock a "buy" rating in a report on Friday, September 13th. Six investment analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the stock presently has a consensus rating of "Buy" and a consensus target price of $10.50.

Check Out Our Latest Analysis on Applied Digital

Insiders Place Their Bets

In other news, Director Richard N. Nottenburg sold 80,000 shares of the stock in a transaction dated Monday, October 14th. The shares were sold at an average price of $7.37, for a total value of $589,600.00. Following the completion of the sale, the director now owns 433,686 shares in the company, valued at $3,196,265.82. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. In other Applied Digital news, Director Douglas S. Miller sold 10,000 shares of the business's stock in a transaction on Thursday, October 17th. The stock was sold at an average price of $8.01, for a total value of $80,100.00. Following the transaction, the director now owns 208,506 shares of the company's stock, valued at approximately $1,670,133.06. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Richard N. Nottenburg sold 80,000 shares of the company's stock in a transaction on Monday, October 14th. The shares were sold at an average price of $7.37, for a total value of $589,600.00. Following the completion of the transaction, the director now owns 433,686 shares of the company's stock, valued at $3,196,265.82. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 100,000 shares of company stock valued at $724,700 in the last three months. 11.81% of the stock is currently owned by insiders.

Applied Digital Company Profile

(

Free Report)

Applied Digital Corporation designs, develops, and operates datacenters in North America. Its datacenters provide digital infrastructure solutions to the high-performance computing industry. The company also provides artificial intelligence cloud services, high performance computing datacenter hosting, and crypto datacenter hosting services.

Featured Stories

Before you consider Applied Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Digital wasn't on the list.

While Applied Digital currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.