Vanguard Group Inc. grew its stake in shares of Brookline Bancorp, Inc. (NASDAQ:BRKL - Free Report) by 0.5% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 9,570,964 shares of the bank's stock after purchasing an additional 45,448 shares during the period. Vanguard Group Inc. owned approximately 10.74% of Brookline Bancorp worth $112,937,000 as of its most recent SEC filing.

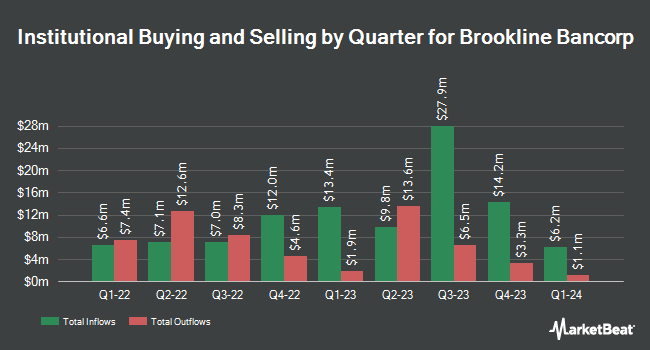

Several other hedge funds and other institutional investors also recently modified their holdings of the stock. State Street Corp grew its holdings in shares of Brookline Bancorp by 0.5% during the 3rd quarter. State Street Corp now owns 4,129,487 shares of the bank's stock worth $41,667,000 after acquiring an additional 21,345 shares during the period. Jennison Associates LLC grew its stake in Brookline Bancorp by 7.7% in the fourth quarter. Jennison Associates LLC now owns 3,133,365 shares of the bank's stock worth $36,974,000 after purchasing an additional 224,888 shares during the period. Geode Capital Management LLC raised its holdings in Brookline Bancorp by 1.3% in the third quarter. Geode Capital Management LLC now owns 2,089,187 shares of the bank's stock worth $21,084,000 after purchasing an additional 26,714 shares in the last quarter. American Century Companies Inc. raised its holdings in Brookline Bancorp by 17.0% in the fourth quarter. American Century Companies Inc. now owns 1,903,813 shares of the bank's stock worth $22,465,000 after purchasing an additional 276,025 shares in the last quarter. Finally, Assenagon Asset Management S.A. lifted its position in Brookline Bancorp by 36.7% during the fourth quarter. Assenagon Asset Management S.A. now owns 878,717 shares of the bank's stock valued at $10,369,000 after buying an additional 236,066 shares during the period. Hedge funds and other institutional investors own 78.91% of the company's stock.

Analysts Set New Price Targets

Several research analysts recently issued reports on the stock. StockNews.com started coverage on shares of Brookline Bancorp in a research note on Wednesday. They issued a "hold" rating for the company. Keefe, Bruyette & Woods lowered shares of Brookline Bancorp from an "outperform" rating to a "market perform" rating and set a $14.50 target price for the company. in a report on Tuesday, December 24th. Finally, Raymond James upgraded Brookline Bancorp from a "market perform" rating to a "strong-buy" rating and set a $16.00 price target on the stock in a research note on Friday, December 20th.

Check Out Our Latest Stock Analysis on Brookline Bancorp

Brookline Bancorp Stock Up 0.4 %

Brookline Bancorp stock traded up $0.04 during mid-day trading on Friday, reaching $9.57. The stock had a trading volume of 690,625 shares, compared to its average volume of 580,732. Brookline Bancorp, Inc. has a one year low of $8.01 and a one year high of $13.15. The company has a 50-day moving average price of $11.19 and a two-hundred day moving average price of $11.50. The company has a market capitalization of $860.92 million, a price-to-earnings ratio of 12.43 and a beta of 0.71. The company has a debt-to-equity ratio of 1.24, a current ratio of 1.12 and a quick ratio of 1.13.

Brookline Bancorp (NASDAQ:BRKL - Get Free Report) last issued its earnings results on Wednesday, January 29th. The bank reported $0.23 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.24 by ($0.01). Brookline Bancorp had a return on equity of 5.94% and a net margin of 10.51%. On average, analysts expect that Brookline Bancorp, Inc. will post 1.35 EPS for the current fiscal year.

Brookline Bancorp Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, February 28th. Shareholders of record on Friday, February 14th were issued a $0.135 dividend. This represents a $0.54 dividend on an annualized basis and a dividend yield of 5.64%. The ex-dividend date of this dividend was Friday, February 14th. Brookline Bancorp's payout ratio is 70.13%.

Brookline Bancorp Profile

(

Free Report)

Brookline Bancorp, Inc operates as a bank holding company for the Brookline Bank that provide commercial, business, and retail banking services to corporate, municipal, and retail customers in the United States. Its deposit products include demand checking, NOW, money market, and savings accounts. The company's loan portfolio primarily comprises first mortgage loans secured by commercial, multi-family, and residential real estate properties; loans to business entities comprising commercial lines of credit; loans to condominium associations; loans and leases used to finance equipment for small businesses; financing for construction and development projects; and home equity and other consumer loans.

See Also

Before you consider Brookline Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookline Bancorp wasn't on the list.

While Brookline Bancorp currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.