Vanguard Group Inc. raised its position in The Bank of Nova Scotia (NYSE:BNS - Free Report) TSE: BNS by 1.9% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 51,363,146 shares of the bank's stock after purchasing an additional 969,488 shares during the quarter. Vanguard Group Inc. owned about 4.12% of Bank of Nova Scotia worth $2,758,150,000 as of its most recent filing with the Securities and Exchange Commission.

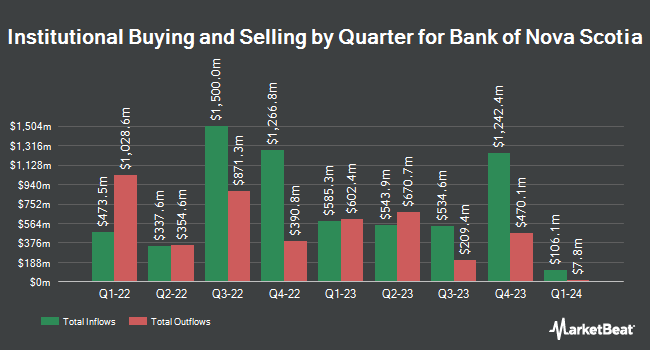

A number of other hedge funds also recently made changes to their positions in the business. Bank Julius Baer & Co. Ltd Zurich acquired a new stake in Bank of Nova Scotia in the 4th quarter valued at approximately $31,000. Allworth Financial LP grew its stake in shares of Bank of Nova Scotia by 121.1% in the fourth quarter. Allworth Financial LP now owns 639 shares of the bank's stock worth $33,000 after purchasing an additional 350 shares in the last quarter. BNP Paribas Financial Markets increased its holdings in shares of Bank of Nova Scotia by 1,588.2% during the third quarter. BNP Paribas Financial Markets now owns 861 shares of the bank's stock valued at $47,000 after purchasing an additional 810 shares during the period. Fortitude Family Office LLC bought a new stake in shares of Bank of Nova Scotia during the fourth quarter valued at about $73,000. Finally, Wilmington Savings Fund Society FSB acquired a new stake in Bank of Nova Scotia in the third quarter worth about $111,000. Institutional investors own 49.13% of the company's stock.

Wall Street Analyst Weigh In

Several research firms have commented on BNS. Royal Bank of Canada lowered their target price on shares of Bank of Nova Scotia from $83.00 to $81.00 and set a "sector perform" rating on the stock in a research note on Wednesday, February 26th. CIBC reiterated a "neutral" rating on shares of Bank of Nova Scotia in a research note on Tuesday, February 18th. Finally, Cibc World Mkts downgraded Bank of Nova Scotia from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, February 18th. One research analyst has rated the stock with a sell rating, four have given a hold rating and five have given a buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average target price of $81.00.

Check Out Our Latest Analysis on BNS

Bank of Nova Scotia Price Performance

Shares of NYSE:BNS traded down $0.60 during trading hours on Friday, hitting $47.74. 3,683,865 shares of the company's stock traded hands, compared to its average volume of 1,641,301. The company has a debt-to-equity ratio of 0.59, a quick ratio of 1.03 and a current ratio of 1.03. The company's fifty day simple moving average is $49.87 and its two-hundred day simple moving average is $52.33. The Bank of Nova Scotia has a 52 week low of $43.68 and a 52 week high of $57.07. The company has a market cap of $59.46 billion, a price-to-earnings ratio of 11.05, a price-to-earnings-growth ratio of 1.16 and a beta of 1.11.

Bank of Nova Scotia Cuts Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, April 28th. Shareholders of record on Tuesday, April 1st will be given a $0.7415 dividend. The ex-dividend date is Tuesday, April 1st. This represents a $2.97 annualized dividend and a yield of 6.21%. Bank of Nova Scotia's dividend payout ratio (DPR) is 82.77%.

Bank of Nova Scotia Profile

(

Free Report)

The Bank of Nova Scotia provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally. It operates through Canadian Banking, International Banking, Global Wealth Management, and Global Banking and Markets segments.

Further Reading

Before you consider Bank of Nova Scotia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of Nova Scotia wasn't on the list.

While Bank of Nova Scotia currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.