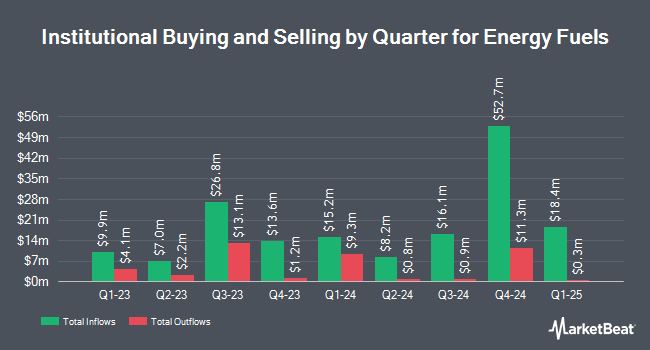

Vanguard Group Inc. lifted its position in Energy Fuels Inc. (NYSEAMERICAN:UUUU - Free Report) by 18.5% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 7,468,726 shares of the company's stock after buying an additional 1,164,973 shares during the quarter. Vanguard Group Inc. owned about 3.76% of Energy Fuels worth $38,316,000 as of its most recent SEC filing.

A number of other large investors have also recently added to or reduced their stakes in the company. AlphaMark Advisors LLC acquired a new stake in shares of Energy Fuels during the 4th quarter worth $25,000. Steward Partners Investment Advisory LLC increased its position in Energy Fuels by 65.7% in the 4th quarter. Steward Partners Investment Advisory LLC now owns 6,159 shares of the company's stock valued at $32,000 after acquiring an additional 2,442 shares during the period. Signaturefd LLC lifted its holdings in shares of Energy Fuels by 48.5% during the fourth quarter. Signaturefd LLC now owns 8,870 shares of the company's stock worth $46,000 after purchasing an additional 2,898 shares during the period. Wealthspan Partners LLC bought a new stake in shares of Energy Fuels in the fourth quarter worth $51,000. Finally, Accel Wealth Management bought a new position in Energy Fuels during the 4th quarter worth $52,000. Institutional investors and hedge funds own 48.24% of the company's stock.

Energy Fuels Price Performance

Shares of UUUU traded down $0.12 during trading hours on Tuesday, hitting $4.13. The stock had a trading volume of 5,466,034 shares, compared to its average volume of 7,812,384. The firm has a market capitalization of $820.59 million, a P/E ratio of -18.77 and a beta of 1.68. Energy Fuels Inc. has a 1-year low of $3.20 and a 1-year high of $7.47. The firm has a 50 day simple moving average of $4.52 and a 200-day simple moving average of $5.42.

Insider Transactions at Energy Fuels

In other Energy Fuels news, VP Daniel Kapostasy sold 12,350 shares of the stock in a transaction on Friday, March 14th. The stock was sold at an average price of $4.10, for a total transaction of $50,635.00. Following the sale, the vice president now owns 57,705 shares in the company, valued at $236,590.50. This represents a 17.63 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Bruce D. Hansen bought 6,000 shares of Energy Fuels stock in a transaction on Wednesday, March 19th. The shares were bought at an average cost of $4.25 per share, with a total value of $25,500.00. Following the acquisition, the director now directly owns 295,239 shares in the company, valued at approximately $1,254,765.75. This represents a 2.07 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Company insiders own 1.92% of the company's stock.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on the company. Roth Capital set a $5.75 price objective on Energy Fuels in a research note on Friday, February 28th. HC Wainwright reduced their price objective on shares of Energy Fuels from $11.00 to $10.75 and set a "buy" rating on the stock in a research note on Friday, February 28th. Finally, Roth Mkm upgraded shares of Energy Fuels from a "neutral" rating to a "buy" rating and set a $5.75 price objective for the company in a research report on Friday, February 28th.

Check Out Our Latest Report on UUUU

About Energy Fuels

(

Free Report)

Energy Fuels Inc, together with its subsidiaries, engages in the extraction, recovery, recycling, exploration, permitting, evaluation, and sale of uranium mineral properties in the United States. The company produces and sells vanadium pentoxide, rare earth elements, and heavy mineral sands, such as ilmenite, rutile, zircon, and monazite.

Featured Stories

Before you consider Energy Fuels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Energy Fuels wasn't on the list.

While Energy Fuels currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.