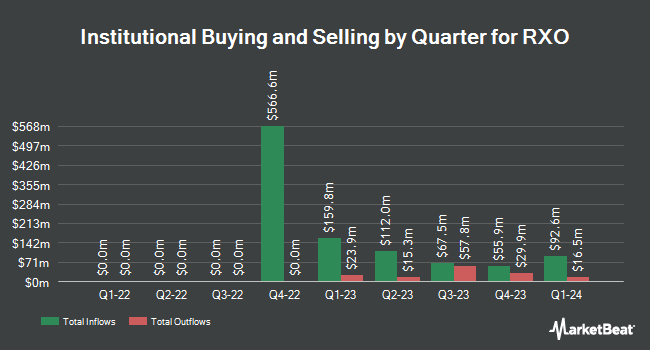

Vanguard Group Inc. grew its stake in shares of RXO, Inc. (NYSE:RXO - Free Report) by 13.2% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 17,203,721 shares of the company's stock after purchasing an additional 2,009,937 shares during the quarter. Vanguard Group Inc. owned 10.70% of RXO worth $410,137,000 at the end of the most recent quarter.

Other institutional investors and hedge funds also recently modified their holdings of the company. Blue Trust Inc. grew its holdings in RXO by 79.7% during the 4th quarter. Blue Trust Inc. now owns 1,150 shares of the company's stock valued at $27,000 after purchasing an additional 510 shares in the last quarter. Wilmington Savings Fund Society FSB purchased a new stake in shares of RXO during the third quarter worth about $28,000. Smartleaf Asset Management LLC lifted its stake in shares of RXO by 228.4% in the fourth quarter. Smartleaf Asset Management LLC now owns 1,248 shares of the company's stock worth $30,000 after acquiring an additional 868 shares in the last quarter. Nomura Asset Management Co. Ltd. boosted its holdings in RXO by 68.7% in the third quarter. Nomura Asset Management Co. Ltd. now owns 1,400 shares of the company's stock valued at $39,000 after purchasing an additional 570 shares during the last quarter. Finally, Thurston Springer Miller Herd & Titak Inc. grew its stake in RXO by 407.0% during the 4th quarter. Thurston Springer Miller Herd & Titak Inc. now owns 1,800 shares of the company's stock valued at $43,000 after purchasing an additional 1,445 shares in the last quarter. Hedge funds and other institutional investors own 92.73% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently commented on RXO shares. Wells Fargo & Company reduced their target price on RXO from $22.00 to $20.00 and set an "equal weight" rating for the company in a research note on Thursday, March 27th. Benchmark reissued a "hold" rating on shares of RXO in a report on Wednesday, January 15th. Deutsche Bank Aktiengesellschaft began coverage on shares of RXO in a research report on Friday, March 7th. They issued a "hold" rating and a $19.00 target price for the company. Jefferies Financial Group decreased their price target on RXO from $33.00 to $30.00 and set a "buy" rating for the company in a research note on Friday, January 10th. Finally, Susquehanna cut their price objective on RXO from $18.00 to $13.00 and set a "negative" rating on the stock in a research note on Wednesday, March 26th. Two equities research analysts have rated the stock with a sell rating, twelve have given a hold rating and three have issued a buy rating to the company's stock. Based on data from MarketBeat.com, RXO currently has a consensus rating of "Hold" and a consensus target price of $24.80.

Read Our Latest Stock Analysis on RXO

RXO Stock Performance

NYSE:RXO traded down $1.33 during mid-day trading on Friday, hitting $14.44. The stock had a trading volume of 3,000,423 shares, compared to its average volume of 1,062,067. The company has a current ratio of 1.26, a quick ratio of 1.33 and a debt-to-equity ratio of 0.22. The company has a 50 day simple moving average of $20.49 and a 200-day simple moving average of $24.91. The stock has a market capitalization of $2.37 billion, a price-to-earnings ratio of -6.81, a P/E/G ratio of 4.55 and a beta of 1.60. RXO, Inc. has a 52 week low of $13.77 and a 52 week high of $32.82.

RXO (NYSE:RXO - Get Free Report) last released its quarterly earnings results on Wednesday, February 5th. The company reported $0.06 earnings per share for the quarter, meeting analysts' consensus estimates of $0.06. RXO had a positive return on equity of 1.53% and a negative net margin of 6.26%. On average, research analysts expect that RXO, Inc. will post 0.31 earnings per share for the current fiscal year.

About RXO

(

Free Report)

RXO, Inc provides full truckload freight transportation brokering services. It also offers brokered services for managed transportation, last mile, and freight forwarding. The company was incorporated in 2022 and is based in Charlotte, North Carolina.

Further Reading

Before you consider RXO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RXO wasn't on the list.

While RXO currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.