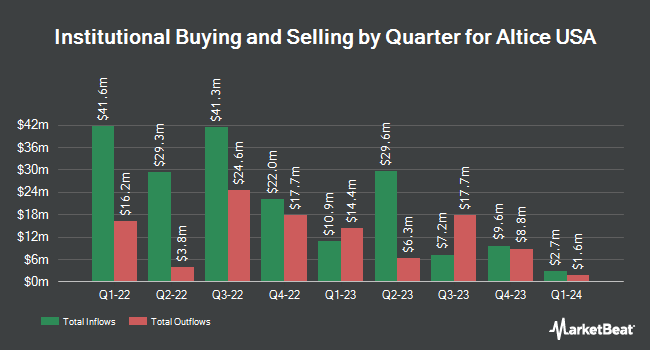

Vanguard Group Inc. raised its position in Altice USA, Inc. (NYSE:ATUS - Free Report) by 0.9% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 22,291,467 shares of the company's stock after buying an additional 208,478 shares during the period. Vanguard Group Inc. owned 4.83% of Altice USA worth $53,722,000 as of its most recent SEC filing.

Several other large investors have also recently added to or reduced their stakes in ATUS. LPL Financial LLC bought a new position in shares of Altice USA in the fourth quarter valued at approximately $25,000. Quadrature Capital Ltd acquired a new position in Altice USA in the third quarter worth $27,000. Raymond James Financial Inc. bought a new stake in shares of Altice USA during the fourth quarter worth $30,000. Wolverine Trading LLC acquired a new stake in shares of Altice USA in the third quarter valued at $39,000. Finally, KLP Kapitalforvaltning AS bought a new position in shares of Altice USA in the fourth quarter valued at about $105,000. 54.85% of the stock is owned by institutional investors.

Altice USA Trading Down 6.3 %

Shares of NYSE:ATUS traded down $0.16 during trading on Tuesday, hitting $2.31. 6,926,384 shares of the company's stock were exchanged, compared to its average volume of 3,145,945. The firm has a 50-day moving average price of $2.63 and a two-hundred day moving average price of $2.58. Altice USA, Inc. has a 1-year low of $1.52 and a 1-year high of $3.20. The firm has a market cap of $1.07 billion, a P/E ratio of -10.02 and a beta of 1.65.

Altice USA (NYSE:ATUS - Get Free Report) last issued its earnings results on Thursday, February 13th. The company reported ($0.12) EPS for the quarter, missing the consensus estimate of $0.04 by ($0.16). As a group, research analysts predict that Altice USA, Inc. will post -0.24 EPS for the current year.

Wall Street Analysts Forecast Growth

Separately, Raymond James raised shares of Altice USA from a "market perform" rating to an "outperform" rating and set a $3.50 price objective on the stock in a report on Tuesday, February 18th. Two investment analysts have rated the stock with a sell rating, three have given a hold rating and three have given a buy rating to the company. Based on data from MarketBeat.com, Altice USA currently has a consensus rating of "Hold" and an average target price of $2.44.

View Our Latest Stock Report on ATUS

About Altice USA

(

Free Report)

Altice USA, Inc, together with its subsidiaries, provides broadband communications and video services in the United States, Canada, Puerto Rico, and the Virgin Islands. It offers broadband, video, telephony, and mobile services to residential and business customers. The company's video services include delivery of broadcast stations and cable networks; over the top services; video-on-demand, high-definition channels, digital video recorder, and pay-per-view services; and platforms for video programming through mobile applications.

Featured Articles

Before you consider Altice USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altice USA wasn't on the list.

While Altice USA currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.