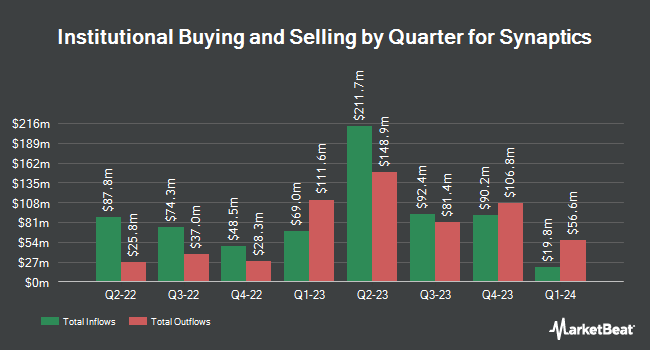

Vanguard Group Inc. increased its holdings in shares of Synaptics Incorporated (NASDAQ:SYNA - Free Report) by 1.9% in the fourth quarter, according to its most recent filing with the SEC. The fund owned 4,907,880 shares of the software maker's stock after acquiring an additional 93,155 shares during the period. Vanguard Group Inc. owned about 12.25% of Synaptics worth $374,569,000 at the end of the most recent quarter.

Other large investors also recently bought and sold shares of the company. TimesSquare Capital Management LLC raised its stake in shares of Synaptics by 46.0% during the fourth quarter. TimesSquare Capital Management LLC now owns 526,335 shares of the software maker's stock valued at $40,170,000 after acquiring an additional 165,866 shares in the last quarter. Peregrine Capital Management LLC raised its position in Synaptics by 210.0% during the 4th quarter. Peregrine Capital Management LLC now owns 204,829 shares of the software maker's stock valued at $15,633,000 after purchasing an additional 138,748 shares in the last quarter. Barclays PLC lifted its holdings in shares of Synaptics by 189.7% in the 3rd quarter. Barclays PLC now owns 81,330 shares of the software maker's stock worth $6,309,000 after buying an additional 53,252 shares during the period. Wealthfront Advisers LLC purchased a new position in shares of Synaptics during the fourth quarter valued at $3,625,000. Finally, BNP Paribas Financial Markets lifted its stake in Synaptics by 111.7% in the third quarter. BNP Paribas Financial Markets now owns 79,777 shares of the software maker's stock worth $6,189,000 after acquiring an additional 42,101 shares during the period. Hedge funds and other institutional investors own 99.43% of the company's stock.

Synaptics Trading Down 5.6 %

SYNA stock traded down $2.69 during midday trading on Monday, hitting $45.56. 1,912,933 shares of the company's stock were exchanged, compared to its average volume of 450,666. Synaptics Incorporated has a 1-year low of $44.35 and a 1-year high of $98.00. The company has a current ratio of 3.88, a quick ratio of 3.36 and a debt-to-equity ratio of 0.60. The stock has a market capitalization of $1.79 billion, a PE ratio of 10.77 and a beta of 1.60. The business has a 50-day simple moving average of $67.94 and a two-hundred day simple moving average of $73.68.

Insider Transactions at Synaptics

In other news, insider Ken Rizvi acquired 3,600 shares of the company's stock in a transaction on Monday, February 10th. The shares were bought at an average cost of $69.15 per share, with a total value of $248,940.00. Following the transaction, the insider now owns 27,630 shares in the company, valued at approximately $1,910,614.50. This trade represents a 14.98 % increase in their position. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Company insiders own 1.30% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts have recently weighed in on the stock. Needham & Company LLC reaffirmed a "buy" rating and issued a $90.00 price target on shares of Synaptics in a research report on Tuesday, February 4th. Susquehanna increased their target price on Synaptics from $95.00 to $105.00 and gave the company a "positive" rating in a research report on Wednesday, January 22nd. Craig Hallum raised Synaptics from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, January 29th. Mizuho decreased their price objective on Synaptics from $90.00 to $80.00 and set an "outperform" rating for the company in a research note on Monday, March 24th. Finally, Rosenblatt Securities reiterated a "buy" rating and issued a $105.00 target price on shares of Synaptics in a research note on Thursday, February 27th. Two investment analysts have rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $95.00.

View Our Latest Research Report on Synaptics

Synaptics Company Profile

(

Free Report)

Synaptics Incorporated develops, markets, and sells semiconductor products worldwide. The company offers AudioSmart for voice and audio processing; ConnectSmart for high-speed video/audio/data connectivity; DisplayLink for transmitting compressed video frames across low bandwidth connections; VideoSmart that enables set-top boxes, over-the-top, streaming devices, soundbars, surveillance cameras, and smart displays; and ImagingSmart solutions.

Featured Articles

Before you consider Synaptics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synaptics wasn't on the list.

While Synaptics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.