MML Investors Services LLC lifted its stake in shares of Vanguard Russell 1000 Value (NASDAQ:VONV - Free Report) by 3.6% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 599,755 shares of the company's stock after acquiring an additional 20,703 shares during the quarter. MML Investors Services LLC owned approximately 0.53% of Vanguard Russell 1000 Value worth $49,978,000 at the end of the most recent reporting period.

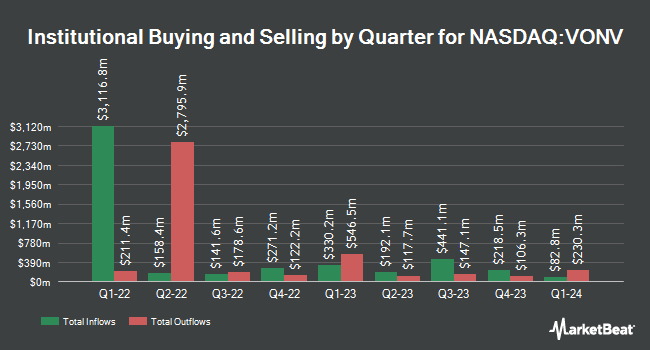

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. M3 Advisory Group LLC grew its holdings in Vanguard Russell 1000 Value by 0.7% during the 3rd quarter. M3 Advisory Group LLC now owns 19,320 shares of the company's stock valued at $1,610,000 after buying an additional 130 shares in the last quarter. Simplicity Wealth LLC boosted its position in shares of Vanguard Russell 1000 Value by 2.6% during the second quarter. Simplicity Wealth LLC now owns 5,331 shares of the company's stock worth $408,000 after acquiring an additional 135 shares during the last quarter. Golden Road Advisors LLC grew its stake in Vanguard Russell 1000 Value by 0.3% during the third quarter. Golden Road Advisors LLC now owns 52,316 shares of the company's stock valued at $4,359,000 after acquiring an additional 145 shares in the last quarter. Quotient Wealth Partners LLC increased its holdings in Vanguard Russell 1000 Value by 3.8% in the 3rd quarter. Quotient Wealth Partners LLC now owns 4,422 shares of the company's stock valued at $368,000 after acquiring an additional 162 shares during the last quarter. Finally, Cyndeo Wealth Partners LLC lifted its stake in Vanguard Russell 1000 Value by 2.0% in the 3rd quarter. Cyndeo Wealth Partners LLC now owns 9,054 shares of the company's stock worth $754,000 after purchasing an additional 179 shares in the last quarter.

Vanguard Russell 1000 Value Stock Performance

Shares of VONV traded down $0.29 during midday trading on Friday, hitting $86.01. 279,295 shares of the company traded hands, compared to its average volume of 364,028. The stock has a market cap of $9.76 billion, a price-to-earnings ratio of 17.49 and a beta of 0.95. The firm has a 50 day moving average of $84.70 and a 200-day moving average of $81.03. Vanguard Russell 1000 Value has a 52 week low of $69.24 and a 52 week high of $87.97.

Vanguard Russell 1000 Value Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Thursday, September 26th were paid a dividend of $0.437 per share. The ex-dividend date was Thursday, September 26th. This is a positive change from Vanguard Russell 1000 Value's previous quarterly dividend of $0.39. This represents a $1.75 dividend on an annualized basis and a yield of 2.03%.

Vanguard Russell 1000 Value Profile

(

Free Report)

The Vanguard Russell 1000 Value ETF (VONV) is an exchange-traded fund that is based on the Russell 1000 Value index. The fund tracks an index of value stocks selected from the 1,000 largest US companies. VONV was launched on Sep 20, 2010 and is managed by Vanguard.

Further Reading

Before you consider Vanguard Russell 1000 Value, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vanguard Russell 1000 Value wasn't on the list.

While Vanguard Russell 1000 Value currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.