MESIROW FINANCIAL INVESTMENT MANAGEMENT Fixed Income lessened its stake in Vanguard Russell 1000 Value (NASDAQ:VONV - Free Report) by 5.2% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 86,807 shares of the company's stock after selling 4,728 shares during the quarter. Vanguard Russell 1000 Value accounts for approximately 7.2% of MESIROW FINANCIAL INVESTMENT MANAGEMENT Fixed Income's holdings, making the stock its 5th biggest position. MESIROW FINANCIAL INVESTMENT MANAGEMENT Fixed Income owned approximately 0.07% of Vanguard Russell 1000 Value worth $7,053,000 at the end of the most recent reporting period.

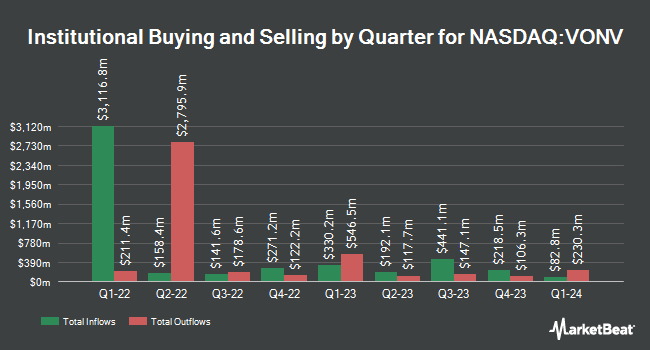

Other hedge funds also recently bought and sold shares of the company. TIAA Trust National Association lifted its holdings in shares of Vanguard Russell 1000 Value by 2.2% during the fourth quarter. TIAA Trust National Association now owns 3,973,639 shares of the company's stock valued at $322,858,000 after purchasing an additional 87,421 shares in the last quarter. SageView Advisory Group LLC lifted its stake in Vanguard Russell 1000 Value by 18.3% during the 4th quarter. SageView Advisory Group LLC now owns 2,369,344 shares of the company's stock valued at $192,509,000 after acquiring an additional 366,318 shares during the period. Envestnet Asset Management Inc. boosted its holdings in shares of Vanguard Russell 1000 Value by 1.3% during the 4th quarter. Envestnet Asset Management Inc. now owns 2,216,616 shares of the company's stock valued at $180,100,000 after acquiring an additional 27,759 shares during the last quarter. LPL Financial LLC grew its stake in shares of Vanguard Russell 1000 Value by 6.4% in the fourth quarter. LPL Financial LLC now owns 1,526,119 shares of the company's stock worth $123,997,000 after acquiring an additional 92,108 shares during the period. Finally, Commonwealth Equity Services LLC raised its holdings in shares of Vanguard Russell 1000 Value by 5.1% during the fourth quarter. Commonwealth Equity Services LLC now owns 1,331,241 shares of the company's stock valued at $108,163,000 after purchasing an additional 64,052 shares during the last quarter.

Vanguard Russell 1000 Value Price Performance

Vanguard Russell 1000 Value stock traded up $0.65 during midday trading on Wednesday, reaching $78.33. 411,912 shares of the company traded hands, compared to its average volume of 912,773. Vanguard Russell 1000 Value has a 12 month low of $71.68 and a 12 month high of $87.97. The business has a 50 day moving average of $81.11 and a two-hundred day moving average of $83.10. The firm has a market capitalization of $10.87 billion, a price-to-earnings ratio of 18.43 and a beta of 0.95.

Vanguard Russell 1000 Value Cuts Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, March 27th. Stockholders of record on Tuesday, March 25th were paid a $0.3843 dividend. The ex-dividend date was Tuesday, March 25th. This represents a $1.54 dividend on an annualized basis and a dividend yield of 1.96%.

About Vanguard Russell 1000 Value

(

Free Report)

The Vanguard Russell 1000 Value ETF (VONV) is an exchange-traded fund that is based on the Russell 1000 Value index. The fund tracks an index of value stocks selected from the 1,000 largest US companies. VONV was launched on Sep 20, 2010 and is managed by Vanguard.

See Also

Before you consider Vanguard Russell 1000 Value, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vanguard Russell 1000 Value wasn't on the list.

While Vanguard Russell 1000 Value currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.