Jump Financial LLC lowered its stake in shares of Varex Imaging Co. (NASDAQ:VREX - Free Report) by 77.2% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 22,004 shares of the company's stock after selling 74,435 shares during the quarter. Jump Financial LLC owned about 0.05% of Varex Imaging worth $321,000 at the end of the most recent quarter.

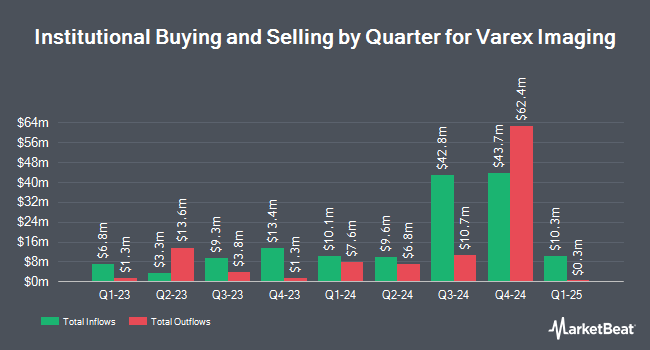

Several other large investors have also modified their holdings of the stock. Barclays PLC increased its position in Varex Imaging by 15.3% during the third quarter. Barclays PLC now owns 97,883 shares of the company's stock worth $1,166,000 after purchasing an additional 12,966 shares during the last quarter. Geode Capital Management LLC increased its holdings in shares of Varex Imaging by 0.5% during the 3rd quarter. Geode Capital Management LLC now owns 929,004 shares of the company's stock worth $11,076,000 after buying an additional 4,211 shares during the last quarter. Empowered Funds LLC raised its position in shares of Varex Imaging by 5.1% in the 4th quarter. Empowered Funds LLC now owns 166,977 shares of the company's stock worth $2,436,000 after buying an additional 8,104 shares during the period. Savant Capital LLC acquired a new position in Varex Imaging in the fourth quarter valued at $237,000. Finally, Principal Financial Group Inc. boosted its holdings in Varex Imaging by 10.5% in the fourth quarter. Principal Financial Group Inc. now owns 41,144 shares of the company's stock valued at $600,000 after acquiring an additional 3,914 shares during the last quarter.

Insider Activity

In other news, SVP Kimberley E. Honeysett sold 4,007 shares of Varex Imaging stock in a transaction dated Thursday, March 20th. The stock was sold at an average price of $12.81, for a total transaction of $51,329.67. Following the sale, the senior vice president now directly owns 4,002 shares of the company's stock, valued at approximately $51,265.62. The trade was a 50.03 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Sunny Sanyal sold 8,749 shares of the stock in a transaction dated Wednesday, April 2nd. The shares were sold at an average price of $11.24, for a total value of $98,338.76. Following the completion of the transaction, the chief executive officer now directly owns 190,193 shares of the company's stock, valued at $2,137,769.32. This represents a 4.40 % decrease in their position. The disclosure for this sale can be found here. Insiders own 4.30% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have recently commented on the company. B. Riley restated a "buy" rating and issued a $22.00 price objective (up from $21.00) on shares of Varex Imaging in a report on Friday, February 7th. StockNews.com upgraded shares of Varex Imaging from a "hold" rating to a "buy" rating in a report on Friday, February 7th. Finally, Oppenheimer decreased their price objective on shares of Varex Imaging from $30.00 to $23.00 and set an "outperform" rating for the company in a research note on Friday, February 7th.

Get Our Latest Research Report on VREX

Varex Imaging Trading Up 3.7 %

Shares of VREX opened at $8.62 on Friday. The company has a debt-to-equity ratio of 1.02, a current ratio of 4.36 and a quick ratio of 2.50. Varex Imaging Co. has a 12 month low of $6.97 and a 12 month high of $17.09. The stock has a market cap of $355.14 million, a PE ratio of -7.37 and a beta of 0.65. The stock's 50-day moving average is $10.79 and its two-hundred day moving average is $12.97.

Varex Imaging (NASDAQ:VREX - Get Free Report) last released its quarterly earnings results on Thursday, February 6th. The company reported $0.07 EPS for the quarter, topping the consensus estimate of $0.04 by $0.03. Varex Imaging had a positive return on equity of 4.00% and a negative net margin of 5.79%. Equities analysts forecast that Varex Imaging Co. will post 0.53 earnings per share for the current fiscal year.

Varex Imaging Profile

(

Free Report)

Varex Imaging Corporation designs, manufactures, and sells X-ray imaging components. The company operates through two segments, Medical and Industrial. The Medical segment designs, manufactures, sells, and services X-ray imaging components, comprising X-ray tubes, digital detectors and accessories, ionization chambers, high voltage connectors, image-processing software and workstations, 3D reconstruction software, computer-aided diagnostic software, collimators, automatic exposure control devices, generators, and heat exchangers.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Varex Imaging, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Varex Imaging wasn't on the list.

While Varex Imaging currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.