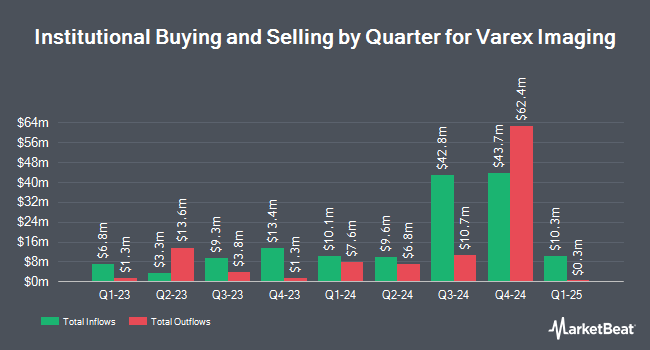

Royce & Associates LP trimmed its position in shares of Varex Imaging Co. (NASDAQ:VREX - Free Report) by 24.9% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 438,141 shares of the company's stock after selling 145,110 shares during the quarter. Royce & Associates LP owned approximately 1.07% of Varex Imaging worth $5,223,000 as of its most recent SEC filing.

Several other institutional investors have also recently made changes to their positions in the company. Russell Investments Group Ltd. increased its holdings in Varex Imaging by 424.3% in the 1st quarter. Russell Investments Group Ltd. now owns 81,847 shares of the company's stock worth $1,481,000 after acquiring an additional 66,235 shares in the last quarter. Vanguard Group Inc. increased its holdings in Varex Imaging by 0.6% in the 1st quarter. Vanguard Group Inc. now owns 4,612,324 shares of the company's stock worth $83,483,000 after acquiring an additional 29,511 shares in the last quarter. Price T Rowe Associates Inc. MD purchased a new stake in Varex Imaging in the 1st quarter worth $207,000. Hancock Whitney Corp purchased a new stake in Varex Imaging in the 1st quarter worth $296,000. Finally, Comerica Bank grew its holdings in shares of Varex Imaging by 98.1% during the first quarter. Comerica Bank now owns 37,586 shares of the company's stock worth $680,000 after buying an additional 18,615 shares in the last quarter.

Varex Imaging Trading Up 3.1 %

Shares of VREX stock traded up $0.44 on Tuesday, hitting $14.56. 1,277,780 shares of the stock traded hands, compared to its average volume of 489,539. The firm's 50-day moving average price is $12.35 and its two-hundred day moving average price is $13.46. The company has a debt-to-equity ratio of 0.67, a quick ratio of 1.89 and a current ratio of 3.34. The stock has a market capitalization of $595.50 million, a PE ratio of 19.89 and a beta of 0.53. Varex Imaging Co. has a twelve month low of $10.19 and a twelve month high of $21.50.

Analysts Set New Price Targets

Separately, B. Riley assumed coverage on shares of Varex Imaging in a report on Friday, August 23rd. They set a "buy" rating and a $21.00 target price for the company.

Get Our Latest Report on VREX

Varex Imaging Company Profile

(

Free Report)

Varex Imaging Corporation designs, manufactures, and sells X-ray imaging components. The company operates through two segments, Medical and Industrial. The Medical segment designs, manufactures, sells, and services X-ray imaging components, comprising X-ray tubes, digital detectors and accessories, ionization chambers, high voltage connectors, image-processing software and workstations, 3D reconstruction software, computer-aided diagnostic software, collimators, automatic exposure control devices, generators, and heat exchangers.

See Also

Before you consider Varex Imaging, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Varex Imaging wasn't on the list.

While Varex Imaging currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.