Federated Hermes Inc. lessened its holdings in Varonis Systems, Inc. (NASDAQ:VRNS - Free Report) by 7.4% during the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 304,241 shares of the technology company's stock after selling 24,354 shares during the period. Federated Hermes Inc. owned about 0.27% of Varonis Systems worth $13,517,000 at the end of the most recent reporting period.

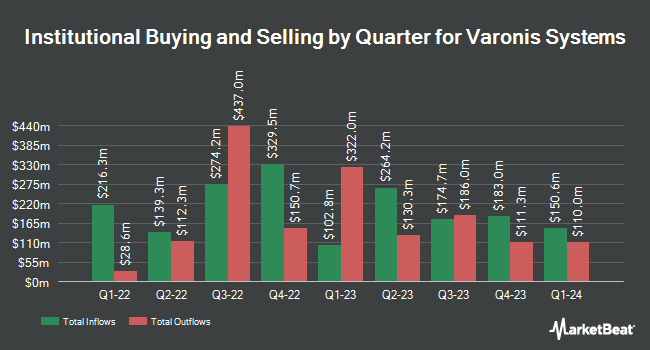

Several other large investors also recently added to or reduced their stakes in the business. Virtue Capital Management LLC raised its stake in Varonis Systems by 2.3% during the 3rd quarter. Virtue Capital Management LLC now owns 16,264 shares of the technology company's stock worth $919,000 after acquiring an additional 364 shares during the period. Bailard Inc. raised its holdings in Varonis Systems by 0.4% during the fourth quarter. Bailard Inc. now owns 93,627 shares of the technology company's stock valued at $4,160,000 after acquiring an additional 417 shares during the period. Franklin Resources Inc. lifted its position in shares of Varonis Systems by 1.1% in the fourth quarter. Franklin Resources Inc. now owns 40,209 shares of the technology company's stock valued at $1,786,000 after acquiring an additional 424 shares in the last quarter. Arizona State Retirement System raised its stake in Varonis Systems by 1.3% during the 4th quarter. Arizona State Retirement System now owns 32,531 shares of the technology company's stock valued at $1,445,000 after purchasing an additional 425 shares during the period. Finally, Hillsdale Investment Management Inc. grew its holdings in Varonis Systems by 0.8% during the 4th quarter. Hillsdale Investment Management Inc. now owns 75,440 shares of the technology company's stock valued at $3,352,000 after buying an additional 600 shares in the last quarter. 95.65% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

VRNS has been the subject of a number of research analyst reports. Wolfe Research upgraded Varonis Systems from a "peer perform" rating to an "outperform" rating and set a $50.00 price objective for the company in a research report on Friday, March 28th. Wells Fargo & Company decreased their price target on shares of Varonis Systems from $48.00 to $46.00 and set an "equal weight" rating on the stock in a research note on Wednesday, February 5th. Citigroup reduced their price objective on Varonis Systems from $57.00 to $46.00 and set a "neutral" rating on the stock in a research note on Friday, January 17th. Jefferies Financial Group cut their target price on Varonis Systems from $50.00 to $45.00 and set a "hold" rating on the stock in a research report on Monday, March 31st. Finally, Barclays dropped their price objective on shares of Varonis Systems from $60.00 to $52.00 and set an "overweight" rating for the company in a research note on Monday. One research analyst has rated the stock with a sell rating, five have assigned a hold rating, thirteen have given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, Varonis Systems currently has a consensus rating of "Moderate Buy" and an average target price of $57.76.

Read Our Latest Research Report on VRNS

Varonis Systems Stock Up 0.7 %

Shares of VRNS traded up $0.31 during midday trading on Tuesday, hitting $41.97. 217,130 shares of the company's stock traded hands, compared to its average volume of 1,734,711. Varonis Systems, Inc. has a 1 year low of $36.53 and a 1 year high of $60.58. The firm's fifty day moving average is $41.48 and its 200-day moving average is $46.99. The company has a current ratio of 1.24, a quick ratio of 1.24 and a debt-to-equity ratio of 0.99. The stock has a market capitalization of $4.72 billion, a price-to-earnings ratio of -48.80 and a beta of 0.76.

Varonis Systems (NASDAQ:VRNS - Get Free Report) last issued its quarterly earnings results on Tuesday, February 4th. The technology company reported ($0.10) earnings per share for the quarter, missing analysts' consensus estimates of $0.14 by ($0.24). Varonis Systems had a negative return on equity of 20.35% and a negative net margin of 17.38%. As a group, sell-side analysts anticipate that Varonis Systems, Inc. will post -0.83 earnings per share for the current year.

Varonis Systems declared that its Board of Directors has authorized a share repurchase plan on Monday, February 10th that permits the company to repurchase $100.00 million in outstanding shares. This repurchase authorization permits the technology company to repurchase up to 2.1% of its shares through open market purchases. Shares repurchase plans are usually a sign that the company's board believes its shares are undervalued.

About Varonis Systems

(

Free Report)

Varonis Systems, Inc provides software products and services that allow enterprises to manage, analyze, alert, and secure enterprise data in North America, Europe, the Middle East, Africa, and internationally. Its software enables enterprises to protect data stored on premises and in the cloud, including sensitive files and emails; confidential personal data belonging to customers, and patients and employees' data; financial records; source code, strategic and product plans; and other intellectual property.

Further Reading

Before you consider Varonis Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Varonis Systems wasn't on the list.

While Varonis Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.