Varonis Systems (NASDAQ:VRNS - Get Free Report) had its price target dropped by research analysts at JPMorgan Chase & Co. from $55.00 to $45.00 in a research note issued to investors on Monday,Benzinga reports. The firm presently has an "overweight" rating on the technology company's stock. JPMorgan Chase & Co.'s price objective would suggest a potential upside of 6.43% from the company's previous close.

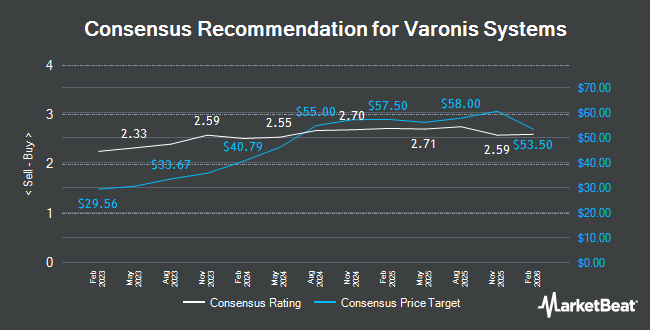

VRNS has been the topic of a number of other reports. StockNews.com lowered Varonis Systems from a "hold" rating to a "sell" rating in a research report on Friday, April 11th. Cantor Fitzgerald assumed coverage on shares of Varonis Systems in a report on Thursday, January 9th. They issued an "overweight" rating and a $60.00 price target on the stock. Wells Fargo & Company decreased their price objective on shares of Varonis Systems from $48.00 to $46.00 and set an "equal weight" rating for the company in a report on Wednesday, February 5th. Jefferies Financial Group cut their target price on shares of Varonis Systems from $50.00 to $45.00 and set a "hold" rating on the stock in a research note on Monday, March 31st. Finally, Wolfe Research raised Varonis Systems from a "peer perform" rating to an "outperform" rating and set a $50.00 price objective for the company in a report on Friday, March 28th. One analyst has rated the stock with a sell rating, five have given a hold rating, thirteen have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, Varonis Systems currently has an average rating of "Moderate Buy" and a consensus target price of $56.00.

View Our Latest Analysis on VRNS

Varonis Systems Stock Performance

Shares of VRNS opened at $42.28 on Monday. The stock has a market capitalization of $4.73 billion, a P/E ratio of -49.16 and a beta of 0.76. Varonis Systems has a 1 year low of $36.53 and a 1 year high of $60.58. The company's fifty day moving average is $41.13 and its two-hundred day moving average is $46.01. The company has a debt-to-equity ratio of 0.99, a quick ratio of 1.24 and a current ratio of 1.24.

Varonis Systems (NASDAQ:VRNS - Get Free Report) last posted its earnings results on Tuesday, February 4th. The technology company reported ($0.10) earnings per share for the quarter, missing the consensus estimate of $0.14 by ($0.24). Varonis Systems had a negative net margin of 17.38% and a negative return on equity of 20.35%. On average, sell-side analysts predict that Varonis Systems will post -0.83 earnings per share for the current year.

Varonis Systems declared that its Board of Directors has initiated a share repurchase program on Monday, February 10th that allows the company to repurchase $100.00 million in shares. This repurchase authorization allows the technology company to repurchase up to 2.1% of its shares through open market purchases. Shares repurchase programs are generally a sign that the company's board of directors believes its stock is undervalued.

Institutional Trading of Varonis Systems

Several hedge funds have recently added to or reduced their stakes in the business. Quarry LP bought a new stake in shares of Varonis Systems during the fourth quarter valued at about $36,000. Johnson Financial Group Inc. bought a new stake in shares of Varonis Systems during the 4th quarter worth about $61,000. Transce3nd LLC bought a new stake in shares of Varonis Systems during the 4th quarter worth about $62,000. New Age Alpha Advisors LLC acquired a new stake in shares of Varonis Systems in the 4th quarter worth approximately $70,000. Finally, NBC Securities Inc. boosted its holdings in shares of Varonis Systems by 100,200.0% in the first quarter. NBC Securities Inc. now owns 2,006 shares of the technology company's stock valued at $81,000 after acquiring an additional 2,004 shares in the last quarter. Institutional investors own 95.65% of the company's stock.

Varonis Systems Company Profile

(

Get Free Report)

Varonis Systems, Inc provides software products and services that allow enterprises to manage, analyze, alert, and secure enterprise data in North America, Europe, the Middle East, Africa, and internationally. Its software enables enterprises to protect data stored on premises and in the cloud, including sensitive files and emails; confidential personal data belonging to customers, and patients and employees' data; financial records; source code, strategic and product plans; and other intellectual property.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Varonis Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Varonis Systems wasn't on the list.

While Varonis Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.