Vaughan Nelson Investment Management L.P. lifted its position in PDD Holdings Inc. (NASDAQ:PDD - Free Report) by 84.6% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 22,435 shares of the company's stock after acquiring an additional 10,280 shares during the quarter. Vaughan Nelson Investment Management L.P.'s holdings in PDD were worth $3,024,000 as of its most recent SEC filing.

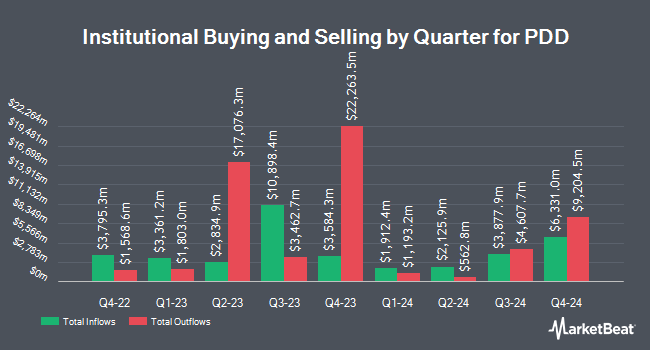

Other institutional investors have also made changes to their positions in the company. Comgest Global Investors S.A.S. raised its stake in PDD by 132.9% during the third quarter. Comgest Global Investors S.A.S. now owns 32,259 shares of the company's stock worth $4,349,000 after acquiring an additional 18,408 shares during the period. CIBC Asset Management Inc grew its holdings in shares of PDD by 4.5% during the third quarter. CIBC Asset Management Inc now owns 125,519 shares of the company's stock valued at $16,921,000 after purchasing an additional 5,378 shares during the last quarter. OneDigital Investment Advisors LLC lifted its holdings in shares of PDD by 6.8% in the 3rd quarter. OneDigital Investment Advisors LLC now owns 2,624 shares of the company's stock worth $354,000 after purchasing an additional 166 shares during the last quarter. CloudAlpha Capital Management Limited Hong Kong bought a new stake in shares of PDD in the 3rd quarter worth approximately $25,075,000. Finally, Fortis Capital Management LLC boosted its position in PDD by 13.1% during the 3rd quarter. Fortis Capital Management LLC now owns 1,784 shares of the company's stock valued at $241,000 after purchasing an additional 206 shares during the period. 29.07% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several equities analysts have recently commented on PDD shares. Daiwa America upgraded shares of PDD to a "strong-buy" rating in a research report on Tuesday, August 27th. Bank of America cut their price target on PDD from $206.00 to $170.00 and set a "buy" rating on the stock in a report on Tuesday, August 27th. Barclays decreased their price objective on PDD from $224.00 to $158.00 and set an "overweight" rating for the company in a report on Tuesday, August 27th. Macquarie raised PDD from a "neutral" rating to an "outperform" rating and lifted their target price for the company from $126.00 to $224.00 in a research note on Monday, October 7th. Finally, Nomura Securities raised PDD to a "strong-buy" rating in a research note on Tuesday, August 27th. One equities research analyst has rated the stock with a hold rating, nine have assigned a buy rating and two have given a strong buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Buy" and an average target price of $182.40.

View Our Latest Report on PDD

PDD Price Performance

NASDAQ PDD traded up $3.31 on Monday, reaching $117.31. The company's stock had a trading volume of 9,287,979 shares, compared to its average volume of 10,565,137. PDD Holdings Inc. has a twelve month low of $88.01 and a twelve month high of $164.69. The company has a debt-to-equity ratio of 0.02, a quick ratio of 2.11 and a current ratio of 2.11. The firm's 50 day moving average is $121.59 and its two-hundred day moving average is $130.61. The stock has a market cap of $161.40 billion, a PE ratio of 12.28, a PEG ratio of 0.27 and a beta of 0.71.

PDD (NASDAQ:PDD - Get Free Report) last issued its earnings results on Monday, August 26th. The company reported $23.24 earnings per share for the quarter, topping analysts' consensus estimates of $2.66 by $20.58. The firm had revenue of $97.06 billion during the quarter, compared to analysts' expectations of $100.17 billion. PDD had a net margin of 28.92% and a return on equity of 48.14%. The firm's revenue for the quarter was up 85.7% compared to the same quarter last year. During the same period last year, the firm posted $1.27 earnings per share. As a group, sell-side analysts predict that PDD Holdings Inc. will post 11.19 EPS for the current year.

PDD Profile

(

Free Report)

PDD Holdings Inc, a multinational commerce group, owns and operates a portfolio of businesses. It operates Pinduoduo, an e-commerce platform that offers products in various categories, including agricultural produce, apparel, shoes, bags, mother and childcare products, food and beverage, electronic appliances, furniture and household goods, cosmetics and other personal care, sports and fitness items and auto accessories; and Temu, an online marketplace.

Featured Stories

Before you consider PDD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDD wasn't on the list.

While PDD currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.