Vaughan Nelson Investment Management L.P. grew its holdings in shares of RXO, Inc. (NYSE:RXO - Free Report) by 14.7% in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 1,867,080 shares of the company's stock after purchasing an additional 239,000 shares during the quarter. Vaughan Nelson Investment Management L.P. owned approximately 1.16% of RXO worth $52,278,000 as of its most recent filing with the Securities & Exchange Commission.

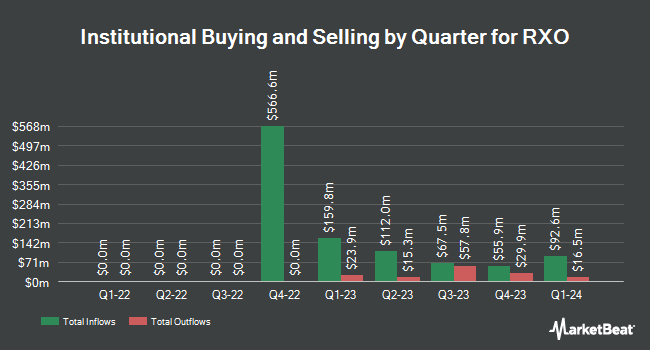

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. UniSuper Management Pty Ltd purchased a new stake in shares of RXO during the 1st quarter valued at about $542,000. Boston Partners increased its holdings in RXO by 150.0% in the 1st quarter. Boston Partners now owns 42,526 shares of the company's stock worth $930,000 after acquiring an additional 25,519 shares in the last quarter. State Board of Administration of Florida Retirement System increased its holdings in RXO by 225.4% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 108,847 shares of the company's stock worth $2,380,000 after acquiring an additional 75,395 shares in the last quarter. Swedbank AB purchased a new stake in RXO in the 1st quarter worth approximately $76,982,000. Finally, SG Americas Securities LLC increased its holdings in RXO by 1,407.4% in the 2nd quarter. SG Americas Securities LLC now owns 103,993 shares of the company's stock worth $2,719,000 after acquiring an additional 97,094 shares in the last quarter. Hedge funds and other institutional investors own 92.73% of the company's stock.

RXO Trading Down 0.9 %

NYSE:RXO traded down $0.24 during midday trading on Friday, hitting $27.25. 859,601 shares of the company traded hands, compared to its average volume of 883,965. The firm's fifty day moving average is $27.85 and its 200-day moving average is $26.09. RXO, Inc. has a 12-month low of $18.75 and a 12-month high of $32.82. The firm has a market capitalization of $4.38 billion, a P/E ratio of -13.76, a P/E/G ratio of 14.68 and a beta of 1.33. The company has a current ratio of 1.33, a quick ratio of 1.33 and a debt-to-equity ratio of 0.21.

RXO (NYSE:RXO - Get Free Report) last released its earnings results on Thursday, November 7th. The company reported $0.05 earnings per share for the quarter, topping analysts' consensus estimates of $0.04 by $0.01. RXO had a positive return on equity of 1.64% and a negative net margin of 6.81%. The business had revenue of $1.04 billion for the quarter, compared to analyst estimates of $956.19 million. During the same quarter last year, the firm posted $0.05 earnings per share. The business's revenue was up 6.6% compared to the same quarter last year. On average, sell-side analysts predict that RXO, Inc. will post 0.12 EPS for the current year.

Analyst Upgrades and Downgrades

Several equities research analysts recently issued reports on RXO shares. Citigroup lowered shares of RXO from a "buy" rating to a "neutral" rating and set a $33.00 target price for the company. in a report on Tuesday, November 12th. JPMorgan Chase & Co. upped their price target on RXO from $25.00 to $26.00 and gave the stock an "underweight" rating in a research note on Thursday, August 8th. UBS Group upped their price target on RXO from $22.00 to $31.00 and gave the stock a "neutral" rating in a research note on Thursday, August 8th. Morgan Stanley upped their price target on RXO from $19.00 to $26.00 and gave the stock an "equal weight" rating in a research note on Monday, August 12th. Finally, Jefferies Financial Group dropped their price target on RXO from $33.00 to $31.00 and set a "buy" rating for the company in a research note on Tuesday, August 13th. Two investment analysts have rated the stock with a sell rating, eleven have given a hold rating and three have given a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $26.29.

Read Our Latest Research Report on RXO

RXO Profile

(

Free Report)

RXO, Inc provides full truckload freight transportation brokering services. It also offers brokered services for managed transportation, last mile, and freight forwarding. The company was incorporated in 2022 and is based in Charlotte, North Carolina.

Recommended Stories

Before you consider RXO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RXO wasn't on the list.

While RXO currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.