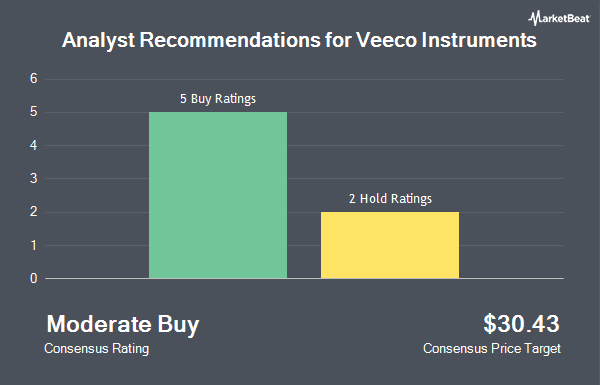

Shares of Veeco Instruments Inc. (NASDAQ:VECO - Get Free Report) have earned a consensus recommendation of "Moderate Buy" from the seven analysts that are currently covering the stock, MarketBeat reports. Three research analysts have rated the stock with a hold rating and four have given a buy rating to the company. The average twelve-month price target among analysts that have issued a report on the stock in the last year is $42.14.

VECO has been the subject of several recent analyst reports. Benchmark dropped their target price on shares of Veeco Instruments from $42.00 to $38.00 and set a "buy" rating for the company in a report on Thursday, November 7th. The Goldman Sachs Group dropped their price objective on Veeco Instruments from $35.00 to $30.00 and set a "neutral" rating for the company in a research note on Thursday, November 7th. StockNews.com raised Veeco Instruments from a "sell" rating to a "hold" rating in a research note on Friday, December 6th. Finally, Oppenheimer dropped their price target on Veeco Instruments from $45.00 to $40.00 and set an "outperform" rating for the company in a research note on Thursday, November 7th.

View Our Latest Stock Analysis on VECO

Insider Activity at Veeco Instruments

In related news, CFO John P. Kiernan sold 2,500 shares of the company's stock in a transaction on Thursday, October 10th. The shares were sold at an average price of $32.63, for a total transaction of $81,575.00. Following the sale, the chief financial officer now owns 82,642 shares of the company's stock, valued at $2,696,608.46. This represents a 2.94 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 2.40% of the stock is owned by corporate insiders.

Institutional Trading of Veeco Instruments

Large investors have recently made changes to their positions in the business. Signaturefd LLC increased its position in shares of Veeco Instruments by 130.6% during the 3rd quarter. Signaturefd LLC now owns 1,328 shares of the semiconductor company's stock valued at $44,000 after purchasing an additional 752 shares during the last quarter. 272 Capital LP bought a new position in Veeco Instruments during the third quarter valued at $50,000. KBC Group NV increased its position in Veeco Instruments by 46.8% during the third quarter. KBC Group NV now owns 2,088 shares of the semiconductor company's stock valued at $69,000 after acquiring an additional 666 shares during the last quarter. nVerses Capital LLC raised its stake in shares of Veeco Instruments by 733.3% in the second quarter. nVerses Capital LLC now owns 2,500 shares of the semiconductor company's stock valued at $117,000 after acquiring an additional 2,200 shares during the period. Finally, GAMMA Investing LLC lifted its holdings in shares of Veeco Instruments by 116.2% in the 3rd quarter. GAMMA Investing LLC now owns 3,626 shares of the semiconductor company's stock worth $120,000 after acquiring an additional 1,949 shares during the last quarter. 98.46% of the stock is currently owned by institutional investors.

Veeco Instruments Stock Performance

Shares of NASDAQ VECO traded down $0.06 during trading on Friday, hitting $27.68. The company had a trading volume of 556,255 shares, compared to its average volume of 656,591. Veeco Instruments has a 12 month low of $25.52 and a 12 month high of $49.25. The company has a debt-to-equity ratio of 0.33, a quick ratio of 2.41 and a current ratio of 3.54. The firm has a market capitalization of $1.57 billion, a P/E ratio of 20.50 and a beta of 1.15. The stock has a 50 day simple moving average of $29.05 and a 200 day simple moving average of $35.64.

Veeco Instruments (NASDAQ:VECO - Get Free Report) last released its earnings results on Wednesday, November 6th. The semiconductor company reported $0.46 EPS for the quarter, topping analysts' consensus estimates of $0.45 by $0.01. The company had revenue of $184.80 million for the quarter, compared to analysts' expectations of $180.57 million. Veeco Instruments had a net margin of 11.34% and a return on equity of 10.92%. The firm's revenue was up 4.2% compared to the same quarter last year. During the same quarter last year, the business earned $0.41 EPS. As a group, analysts anticipate that Veeco Instruments will post 1.12 earnings per share for the current year.

About Veeco Instruments

(

Get Free ReportVeeco Instruments Inc, together with its subsidiaries, develops, manufactures, sells, and supports semiconductor and thin film process equipment primarily to make electronic devices in the United States, Europe, the Middle East, and Africa, China, Rest of the Asia-Pacific, and internationally. The company offers laser annealing, ion beam deposition and etch, metal organic chemical vapor deposition, single wafer wet processing and surface preparation, molecular beam epitaxy, advanced packaging lithography, atomic layer deposition, and other deposition systems.

Further Reading

Before you consider Veeco Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veeco Instruments wasn't on the list.

While Veeco Instruments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.