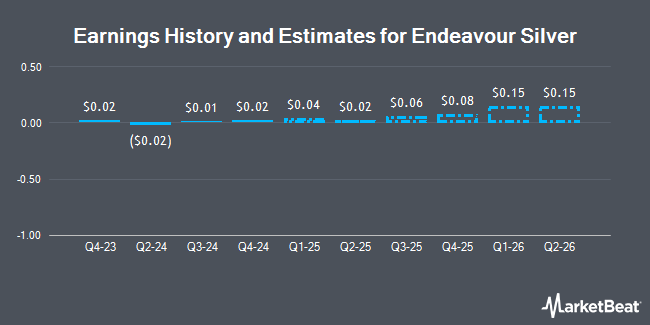

Endeavour Silver Corp. (NYSE:EXK - Free Report) TSE: EDR - Equities research analysts at Ventum Cap Mkts cut their FY2028 earnings per share estimates for shares of Endeavour Silver in a research note issued on Tuesday, March 11th. Ventum Cap Mkts analyst A. Terentiew now forecasts that the mining company will post earnings per share of $0.28 for the year, down from their prior forecast of $0.30. The consensus estimate for Endeavour Silver's current full-year earnings is ($0.07) per share.

EXK has been the topic of a number of other reports. Alliance Global Partners reissued a "buy" rating on shares of Endeavour Silver in a research note on Wednesday, March 12th. HC Wainwright raised their target price on shares of Endeavour Silver from $7.00 to $7.25 and gave the stock a "buy" rating in a research note on Wednesday, March 12th. StockNews.com raised shares of Endeavour Silver to a "sell" rating in a research note on Friday, February 28th. Finally, TD Securities raised shares of Endeavour Silver to a "strong-buy" rating in a research note on Monday, March 10th. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating, three have given a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $6.63.

Read Our Latest Stock Report on EXK

Endeavour Silver Price Performance

Endeavour Silver stock traded up $0.20 during midday trading on Friday, reaching $5.00. The company had a trading volume of 9,309,437 shares, compared to its average volume of 6,678,143. The company has a market capitalization of $1.31 billion, a P/E ratio of -38.42 and a beta of 1.55. Endeavour Silver has a 12-month low of $2.02 and a 12-month high of $5.67. The firm's fifty day simple moving average is $3.89 and its 200-day simple moving average is $4.06. The company has a debt-to-equity ratio of 0.20, a current ratio of 1.39 and a quick ratio of 1.07.

Endeavour Silver (NYSE:EXK - Get Free Report) TSE: EDR last issued its quarterly earnings results on Tuesday, March 11th. The mining company reported $0.02 earnings per share for the quarter, beating analysts' consensus estimates of ($0.01) by $0.03. The firm had revenue of $42.20 million for the quarter, compared to analyst estimates of $69.90 million. Endeavour Silver had a negative net margin of 13.04% and a positive return on equity of 0.97%.

Institutional Trading of Endeavour Silver

Several institutional investors have recently made changes to their positions in EXK. Tidal Investments LLC raised its position in shares of Endeavour Silver by 52.9% during the 4th quarter. Tidal Investments LLC now owns 11,178,812 shares of the mining company's stock valued at $40,914,000 after buying an additional 3,869,920 shares during the period. Connor Clark & Lunn Investment Management Ltd. raised its position in shares of Endeavour Silver by 122.1% during the 4th quarter. Connor Clark & Lunn Investment Management Ltd. now owns 6,515,836 shares of the mining company's stock valued at $23,858,000 after buying an additional 3,581,936 shares during the period. Millennium Management LLC purchased a new stake in shares of Endeavour Silver during the 4th quarter valued at approximately $7,930,000. American Century Companies Inc. raised its position in shares of Endeavour Silver by 268.9% during the 4th quarter. American Century Companies Inc. now owns 2,657,573 shares of the mining company's stock valued at $9,728,000 after buying an additional 1,937,150 shares during the period. Finally, Invesco Ltd. increased its holdings in Endeavour Silver by 529.5% in the 4th quarter. Invesco Ltd. now owns 2,116,652 shares of the mining company's stock valued at $7,747,000 after purchasing an additional 1,780,405 shares during the last quarter. Hedge funds and other institutional investors own 20.06% of the company's stock.

Endeavour Silver Company Profile

(

Get Free Report)

Endeavour Silver Corp., a silver mining company, engages in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Chile and the United States. It explores for gold and silver deposits, and precious metals. The company was formerly known as Endeavour Gold Corp.

Featured Articles

Before you consider Endeavour Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Endeavour Silver wasn't on the list.

While Endeavour Silver currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.