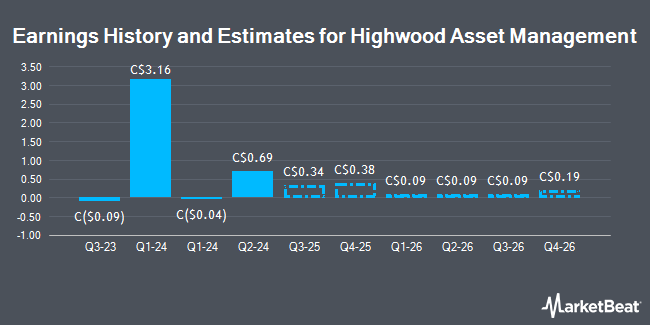

Highwood Asset Management Ltd. (CVE:HAM - Free Report) - Research analysts at Ventum Cap Mkts boosted their Q1 2025 earnings per share estimates for Highwood Asset Management in a research note issued to investors on Monday, March 24th. Ventum Cap Mkts analyst A. Gill now expects that the company will post earnings per share of $0.40 for the quarter, up from their previous estimate of $0.30. The consensus estimate for Highwood Asset Management's current full-year earnings is $1.78 per share. Ventum Cap Mkts also issued estimates for Highwood Asset Management's Q1 2026 earnings at $0.23 EPS, Q2 2026 earnings at $0.20 EPS, Q3 2026 earnings at $0.25 EPS and Q4 2026 earnings at $0.30 EPS.

Highwood Asset Management Stock Down 1.0 %

Shares of HAM stock traded down C$0.06 during mid-day trading on Tuesday, reaching C$6.25. The company's stock had a trading volume of 972 shares, compared to its average volume of 6,930. The firm has a market capitalization of C$92.75 million, a PE ratio of 1.15 and a beta of -0.90. The company's 50 day simple moving average is C$5.81 and its 200-day simple moving average is C$5.87. Highwood Asset Management has a 12-month low of C$4.85 and a 12-month high of C$7.59.

About Highwood Asset Management

(

Get Free Report)

Highwood Asset Management Ltd., together with its subsidiary, engages in the acquisition, exploration, development, and production of oil and gas reserves in the Western Canadian Sedimentary basin. The company operates through Metallic Minerals, Midstream Operations, and Upstream Operations segments.

See Also

Before you consider Highwood Asset Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Highwood Asset Management wasn't on the list.

While Highwood Asset Management currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.