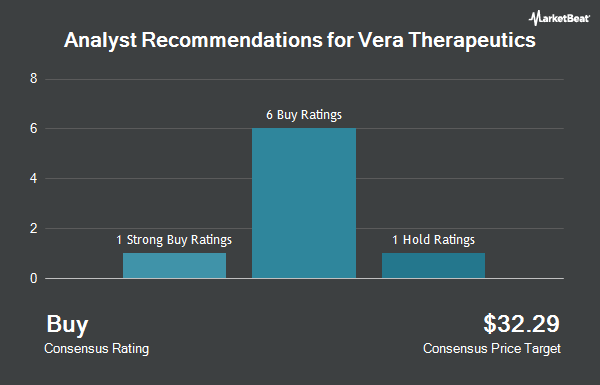

Shares of Vera Therapeutics, Inc. (NASDAQ:VERA - Get Free Report) have been assigned a consensus recommendation of "Buy" from the ten brokerages that are covering the firm, MarketBeat Ratings reports. One analyst has rated the stock with a hold rating, seven have given a buy rating and two have assigned a strong buy rating to the company. The average 1-year price target among brokers that have updated their coverage on the stock in the last year is $53.89.

A number of equities analysts have recently commented on VERA shares. Guggenheim raised their target price on shares of Vera Therapeutics from $56.00 to $64.00 and gave the stock a "buy" rating in a research report on Monday, October 28th. Scotiabank started coverage on Vera Therapeutics in a research note on Wednesday, October 16th. They set a "sector outperform" rating and a $60.00 price target on the stock. JPMorgan Chase & Co. raised their price target on shares of Vera Therapeutics from $72.00 to $75.00 and gave the stock an "overweight" rating in a research report on Tuesday. Evercore ISI upgraded shares of Vera Therapeutics to a "strong-buy" rating in a research report on Monday, September 16th. Finally, Cantor Fitzgerald reissued an "overweight" rating and issued a $107.00 price target on shares of Vera Therapeutics in a research note on Tuesday, October 1st.

View Our Latest Stock Analysis on VERA

Vera Therapeutics Price Performance

VERA traded up $1.13 during trading on Thursday, reaching $49.07. 921,487 shares of the company traded hands, compared to its average volume of 911,014. The company has a debt-to-equity ratio of 0.15, a quick ratio of 21.43 and a current ratio of 21.43. The company has a market cap of $2.69 billion, a P/E ratio of -21.69 and a beta of 1.03. The firm has a fifty day simple moving average of $41.08 and a 200 day simple moving average of $39.03. Vera Therapeutics has a 12-month low of $10.50 and a 12-month high of $50.78.

Vera Therapeutics (NASDAQ:VERA - Get Free Report) last announced its quarterly earnings results on Thursday, August 8th. The company reported ($0.62) EPS for the quarter, missing analysts' consensus estimates of ($0.56) by ($0.06). On average, equities analysts forecast that Vera Therapeutics will post -2.57 EPS for the current year.

Insider Buying and Selling

In related news, Director Beth C. Seidenberg sold 1,177 shares of the stock in a transaction on Wednesday, September 18th. The stock was sold at an average price of $42.01, for a total transaction of $49,445.77. Following the completion of the sale, the director now directly owns 160,376 shares of the company's stock, valued at $6,737,395.76. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. In other Vera Therapeutics news, CEO Marshall Fordyce sold 14,471 shares of the stock in a transaction dated Wednesday, August 21st. The shares were sold at an average price of $39.76, for a total value of $575,366.96. Following the completion of the transaction, the chief executive officer now directly owns 322,667 shares of the company's stock, valued at approximately $12,829,239.92. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Beth C. Seidenberg sold 1,177 shares of the business's stock in a transaction that occurred on Wednesday, September 18th. The stock was sold at an average price of $42.01, for a total value of $49,445.77. Following the sale, the director now directly owns 160,376 shares in the company, valued at $6,737,395.76. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 104,398 shares of company stock valued at $4,376,163 over the last three months. 21.70% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Vera Therapeutics

A number of large investors have recently bought and sold shares of the stock. Mirae Asset Global Investments Co. Ltd. lifted its position in shares of Vera Therapeutics by 21.4% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,983 shares of the company's stock valued at $86,000 after acquiring an additional 350 shares in the last quarter. Ameritas Investment Partners Inc. lifted its holdings in Vera Therapeutics by 20.8% in the 1st quarter. Ameritas Investment Partners Inc. now owns 4,000 shares of the company's stock valued at $172,000 after purchasing an additional 688 shares in the last quarter. Arizona State Retirement System boosted its stake in shares of Vera Therapeutics by 14.4% during the 2nd quarter. Arizona State Retirement System now owns 9,907 shares of the company's stock worth $358,000 after purchasing an additional 1,250 shares during the last quarter. Ensign Peak Advisors Inc grew its holdings in shares of Vera Therapeutics by 13.5% during the second quarter. Ensign Peak Advisors Inc now owns 11,750 shares of the company's stock worth $425,000 after buying an additional 1,400 shares in the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank raised its position in shares of Vera Therapeutics by 30.0% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 7,527 shares of the company's stock valued at $272,000 after buying an additional 1,737 shares during the last quarter. Institutional investors and hedge funds own 99.21% of the company's stock.

About Vera Therapeutics

(

Get Free ReportVera Therapeutics, Inc, a clinical stage biotechnology company, focuses on developing and commercializing treatments for patients with serious immunological diseases. Its lead product candidate is atacicept, a fusion protein self-administered as a subcutaneous injection that is in Phase III clinical trial for patients with immunoglobulin A nephropathy; and for treatment of lupus nephritis that is in Phase II clinical trial.

See Also

Before you consider Vera Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vera Therapeutics wasn't on the list.

While Vera Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.