Equities research analysts at Wolfe Research started coverage on shares of Veracyte (NASDAQ:VCYT - Get Free Report) in a research note issued to investors on Friday, Marketbeat Ratings reports. The brokerage set an "outperform" rating and a $50.00 price target on the biotechnology company's stock. Wolfe Research's target price points to a potential upside of 39.12% from the stock's current price.

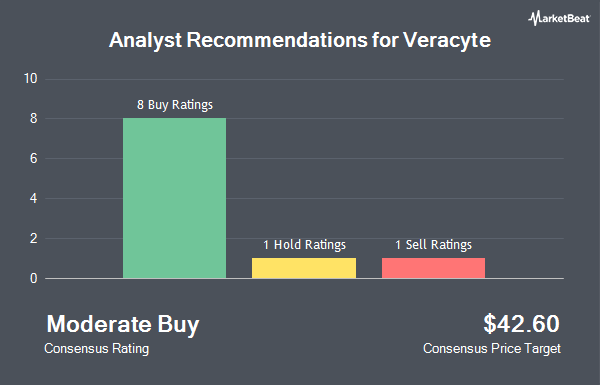

Several other research analysts also recently commented on the company. Leerink Partners lifted their price target on Veracyte from $35.00 to $40.00 and gave the stock an "outperform" rating in a research report on Thursday, October 17th. UBS Group upped their target price on shares of Veracyte from $43.00 to $46.00 and gave the company a "buy" rating in a research note on Thursday, November 7th. Scotiabank raised their price target on shares of Veracyte from $40.00 to $44.00 and gave the stock a "sector outperform" rating in a research report on Friday, November 8th. The Goldman Sachs Group upped their price objective on shares of Veracyte from $34.00 to $38.00 and gave the company a "buy" rating in a research report on Thursday, November 7th. Finally, Needham & Company LLC upped their price target on Veracyte from $37.00 to $44.00 and gave the company a "buy" rating in a report on Thursday, November 7th. One equities research analyst has rated the stock with a sell rating and eight have assigned a buy rating to the stock. According to data from MarketBeat.com, Veracyte presently has an average rating of "Moderate Buy" and an average target price of $41.00.

View Our Latest Analysis on VCYT

Veracyte Stock Down 3.0 %

Shares of NASDAQ:VCYT traded down $1.10 during trading on Friday, reaching $35.94. The stock had a trading volume of 1,626,863 shares, compared to its average volume of 771,503. The stock has a fifty day simple moving average of $33.92 and a two-hundred day simple moving average of $27.50. Veracyte has a 52 week low of $18.61 and a 52 week high of $41.43. The firm has a market capitalization of $2.79 billion, a price-to-earnings ratio of -239.60 and a beta of 1.67.

Veracyte (NASDAQ:VCYT - Get Free Report) last released its earnings results on Wednesday, November 6th. The biotechnology company reported $0.19 earnings per share for the quarter, topping analysts' consensus estimates of $0.03 by $0.16. The firm had revenue of $115.86 million during the quarter, compared to analyst estimates of $109.81 million. Veracyte had a negative net margin of 2.18% and a positive return on equity of 3.02%. The business's revenue was up 28.6% on a year-over-year basis. During the same quarter in the previous year, the business earned ($0.03) EPS. On average, analysts forecast that Veracyte will post 0.16 EPS for the current year.

Insider Transactions at Veracyte

In other Veracyte news, Director Evan/ Fa Jones sold 5,173 shares of the business's stock in a transaction on Thursday, September 19th. The stock was sold at an average price of $35.23, for a total value of $182,244.79. Following the transaction, the director now owns 34,343 shares of the company's stock, valued at approximately $1,209,903.89. The trade was a 13.09 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider John Leite sold 5,479 shares of the firm's stock in a transaction on Wednesday, September 4th. The shares were sold at an average price of $29.78, for a total value of $163,164.62. Following the completion of the sale, the insider now owns 76,174 shares of the company's stock, valued at approximately $2,268,461.72. This trade represents a 6.71 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.30% of the stock is currently owned by insiders.

Institutional Investors Weigh In On Veracyte

Hedge funds have recently added to or reduced their stakes in the stock. XTX Topco Ltd bought a new position in Veracyte in the 3rd quarter worth approximately $1,640,000. Zacks Investment Management bought a new stake in shares of Veracyte during the third quarter worth $1,123,000. Castleark Management LLC bought a new position in Veracyte in the third quarter valued at about $6,010,000. Jane Street Group LLC boosted its holdings in Veracyte by 276.4% in the third quarter. Jane Street Group LLC now owns 301,652 shares of the biotechnology company's stock valued at $10,268,000 after acquiring an additional 221,504 shares during the last quarter. Finally, Virtus Fund Advisers LLC raised its holdings in Veracyte by 32.9% during the 3rd quarter. Virtus Fund Advisers LLC now owns 4,798 shares of the biotechnology company's stock worth $163,000 after purchasing an additional 1,189 shares during the last quarter.

About Veracyte

(

Get Free Report)

Veracyte, Inc operates as a diagnostics company in the United States and internationally. The company offers Afirma Genomic Sequencing Classifier for cancerous thyroid nodules; Decipher Prostate Biopsy and Radical Prostatectomy for prostate cancer diagnosis; Prosigna Breast Cancer Assay for breast cancer diagnosis; Percepta Nasal Swab Test for lung cancer diagnosis; and Envisia Genomic Classifier for diagnosing interstitial lung disease, including idiopathic pulmonary fibrosis.

Featured Articles

Before you consider Veracyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veracyte wasn't on the list.

While Veracyte currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.