Cerity Partners LLC boosted its stake in shares of Veralto Co. (NYSE:VLTO - Free Report) by 34.3% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 66,482 shares of the company's stock after purchasing an additional 16,977 shares during the quarter. Cerity Partners LLC's holdings in Veralto were worth $7,437,000 at the end of the most recent quarter.

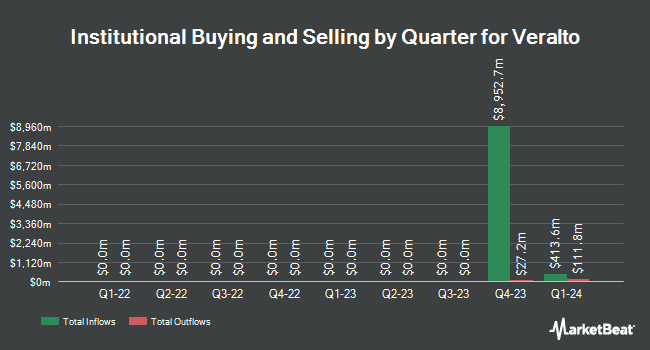

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Oregon Public Employees Retirement Fund lifted its position in shares of Veralto by 0.5% during the 2nd quarter. Oregon Public Employees Retirement Fund now owns 18,861 shares of the company's stock worth $1,801,000 after purchasing an additional 100 shares during the last quarter. Tokio Marine Asset Management Co. Ltd. lifted its holdings in shares of Veralto by 1.4% during the third quarter. Tokio Marine Asset Management Co. Ltd. now owns 7,338 shares of the company's stock worth $821,000 after buying an additional 100 shares during the last quarter. Strategic Blueprint LLC boosted its position in shares of Veralto by 4.5% in the third quarter. Strategic Blueprint LLC now owns 2,394 shares of the company's stock valued at $268,000 after acquiring an additional 102 shares during the period. Graypoint LLC grew its stake in shares of Veralto by 2.4% in the third quarter. Graypoint LLC now owns 4,514 shares of the company's stock worth $505,000 after acquiring an additional 107 shares during the last quarter. Finally, Sentry Investment Management LLC increased its position in Veralto by 1.8% during the third quarter. Sentry Investment Management LLC now owns 5,999 shares of the company's stock worth $671,000 after acquiring an additional 108 shares during the period. Institutional investors and hedge funds own 91.28% of the company's stock.

Insider Buying and Selling

In related news, SVP Surekha Trivedi sold 753 shares of the firm's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $111.10, for a total value of $83,658.30. Following the transaction, the senior vice president now owns 11,918 shares in the company, valued at $1,324,089.80. This trade represents a 5.94 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Jennifer Honeycutt sold 13,191 shares of the business's stock in a transaction dated Friday, August 30th. The stock was sold at an average price of $111.98, for a total value of $1,477,128.18. Following the sale, the chief executive officer now directly owns 138,546 shares of the company's stock, valued at $15,514,381.08. This represents a 8.69 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 28,639 shares of company stock worth $3,175,803 in the last 90 days. Corporate insiders own 0.31% of the company's stock.

Veralto Price Performance

NYSE:VLTO traded up $0.01 on Thursday, reaching $107.97. The stock had a trading volume of 675,082 shares, compared to its average volume of 1,537,581. The company has a market capitalization of $26.70 billion and a P/E ratio of 33.32. The stock has a fifty day moving average price of $108.02 and a 200-day moving average price of $104.72. The company has a quick ratio of 1.87, a current ratio of 2.13 and a debt-to-equity ratio of 1.35. Veralto Co. has a 1-year low of $72.85 and a 1-year high of $115.00.

Veralto (NYSE:VLTO - Get Free Report) last released its quarterly earnings results on Wednesday, October 23rd. The company reported $0.89 EPS for the quarter, topping analysts' consensus estimates of $0.85 by $0.04. Veralto had a return on equity of 52.85% and a net margin of 15.69%. The business had revenue of $1.31 billion for the quarter, compared to analyst estimates of $1.30 billion. During the same period in the prior year, the company earned $0.75 EPS. Veralto's revenue for the quarter was up 4.7% on a year-over-year basis. Research analysts forecast that Veralto Co. will post 3.48 EPS for the current year.

Veralto Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Investors of record on Friday, September 27th were issued a $0.09 dividend. The ex-dividend date was Friday, September 27th. This represents a $0.36 dividend on an annualized basis and a dividend yield of 0.33%. Veralto's dividend payout ratio is 11.11%.

Analyst Upgrades and Downgrades

A number of brokerages have weighed in on VLTO. Royal Bank of Canada increased their price target on shares of Veralto from $108.00 to $111.00 and gave the company a "sector perform" rating in a report on Friday, October 25th. UBS Group initiated coverage on Veralto in a research report on Tuesday, August 13th. They set a "neutral" rating and a $118.00 target price on the stock. Stifel Nicolaus raised their target price on Veralto from $117.00 to $119.00 and gave the stock a "buy" rating in a research report on Wednesday, October 16th. Finally, BMO Capital Markets boosted their price target on shares of Veralto from $117.00 to $119.00 and gave the company an "outperform" rating in a report on Monday, September 30th. Seven equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average price target of $108.27.

Check Out Our Latest Report on Veralto

Veralto Profile

(

Free Report)

Veralto Corporation provides water analytics, water treatment, marking and coding, and packaging and color services worldwide. It operates through two segments, Water Quality (WQ) and Product Quality & Innovation (PQI). The WQ segment offers precision instrumentation and water treatment technologies to measure, analyze, and treat water in residential, commercial, municipal, industrial, research, and natural resource applications through the Hach, Trojan Technologies, and ChemTreat brands.

Recommended Stories

Before you consider Veralto, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veralto wasn't on the list.

While Veralto currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.