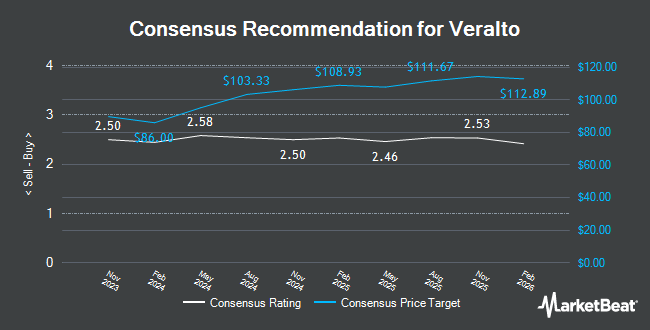

Veralto (NYSE:VLTO - Get Free Report) had its price objective dropped by stock analysts at Stifel Nicolaus from $116.00 to $110.00 in a report issued on Thursday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Stifel Nicolaus' price target suggests a potential upside of 10.13% from the company's current price.

Several other research analysts have also recently weighed in on the stock. Citigroup decreased their price objective on shares of Veralto from $118.00 to $116.00 and set a "neutral" rating for the company in a report on Monday, January 13th. Royal Bank of Canada raised their price objective on shares of Veralto from $108.00 to $111.00 and gave the company a "sector perform" rating in a research report on Friday, October 25th. Finally, Jefferies Financial Group initiated coverage on shares of Veralto in a report on Thursday, December 12th. They issued a "buy" rating and a $125.00 target price for the company. Six equities research analysts have rated the stock with a hold rating and five have given a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average target price of $112.55.

Check Out Our Latest Research Report on Veralto

Veralto Stock Up 1.1 %

VLTO traded up $1.07 during trading on Thursday, reaching $99.88. The stock had a trading volume of 1,461,047 shares, compared to its average volume of 1,449,629. Veralto has a one year low of $81.23 and a one year high of $115.00. The company has a current ratio of 1.92, a quick ratio of 1.87 and a debt-to-equity ratio of 1.27. The stock's 50 day moving average is $102.92 and its two-hundred day moving average is $106.34. The company has a market capitalization of $24.70 billion, a price-to-earnings ratio of 29.90, a P/E/G ratio of 4.21 and a beta of 1.06.

Veralto (NYSE:VLTO - Get Free Report) last issued its quarterly earnings results on Tuesday, February 4th. The company reported $0.95 earnings per share for the quarter, beating the consensus estimate of $0.90 by $0.05. Veralto had a return on equity of 49.29% and a net margin of 16.04%. As a group, analysts expect that Veralto will post 3.63 earnings per share for the current year.

Hedge Funds Weigh In On Veralto

Hedge funds have recently added to or reduced their stakes in the company. State Street Corp lifted its holdings in shares of Veralto by 9.8% in the 3rd quarter. State Street Corp now owns 9,599,499 shares of the company's stock worth $1,074,654,000 after buying an additional 860,608 shares during the period. Amundi boosted its stake in shares of Veralto by 2.3% during the fourth quarter. Amundi now owns 7,169,702 shares of the company's stock valued at $731,084,000 after purchasing an additional 158,342 shares in the last quarter. Geode Capital Management LLC increased its holdings in Veralto by 10.5% during the third quarter. Geode Capital Management LLC now owns 5,868,620 shares of the company's stock valued at $654,232,000 after buying an additional 558,393 shares during the period. Nordea Investment Management AB raised its stake in Veralto by 34.6% in the fourth quarter. Nordea Investment Management AB now owns 3,923,747 shares of the company's stock worth $400,928,000 after buying an additional 1,009,170 shares in the last quarter. Finally, FMR LLC lifted its holdings in Veralto by 5.1% during the third quarter. FMR LLC now owns 3,329,717 shares of the company's stock worth $372,462,000 after buying an additional 162,347 shares during the period. 91.28% of the stock is currently owned by institutional investors.

About Veralto

(

Get Free Report)

Veralto Corporation provides water analytics, water treatment, marking and coding, and packaging and color services worldwide. It operates through two segments, Water Quality (WQ) and Product Quality & Innovation (PQI). The WQ segment offers precision instrumentation and water treatment technologies to measure, analyze, and treat water in residential, commercial, municipal, industrial, research, and natural resource applications through the Hach, Trojan Technologies, and ChemTreat brands.

Read More

Before you consider Veralto, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veralto wasn't on the list.

While Veralto currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.