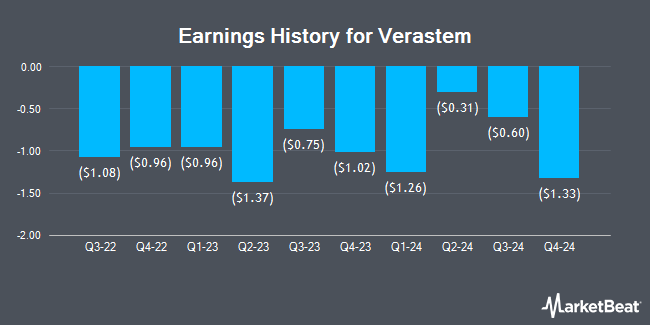

Verastem (NASDAQ:VSTM - Get Free Report) posted its quarterly earnings data on Thursday. The biopharmaceutical company reported ($1.33) earnings per share for the quarter, missing the consensus estimate of ($0.76) by ($0.57), Zacks reports.

Verastem Price Performance

Shares of VSTM stock traded up $0.23 on Monday, hitting $6.88. 703,955 shares of the company's stock were exchanged, compared to its average volume of 913,647. The company has a 50 day moving average of $6.01 and a 200 day moving average of $4.64. The stock has a market cap of $306.21 million, a P/E ratio of -2.16 and a beta of 0.60. The company has a debt-to-equity ratio of 2.77, a current ratio of 3.23 and a quick ratio of 3.23. Verastem has a 12 month low of $2.10 and a 12 month high of $13.52.

Insider Buying and Selling at Verastem

In other news, CEO Dan Paterson sold 8,568 shares of the firm's stock in a transaction that occurred on Monday, January 13th. The shares were sold at an average price of $5.24, for a total value of $44,896.32. Following the sale, the chief executive officer now directly owns 347,581 shares in the company, valued at approximately $1,821,324.44. This trade represents a 2.41 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Insiders have sold a total of 9,988 shares of company stock worth $53,608 over the last 90 days. Insiders own 2.20% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have weighed in on the stock. BTIG Research lifted their price objective on shares of Verastem from $13.00 to $20.00 and gave the stock a "buy" rating in a research note on Tuesday, December 31st. B. Riley lifted their price target on shares of Verastem from $7.00 to $9.00 and gave the company a "buy" rating in a research report on Friday, January 31st. Royal Bank of Canada reduced their price target on Verastem from $16.00 to $14.00 and set an "outperform" rating on the stock in a research report on Friday. Guggenheim lifted their price objective on Verastem from $13.00 to $14.00 and gave the company a "buy" rating in a report on Monday. Finally, HC Wainwright increased their target price on Verastem from $7.00 to $10.00 and gave the stock a "buy" rating in a report on Monday. One equities research analyst has rated the stock with a sell rating and nine have given a buy rating to the company's stock. Based on data from MarketBeat, Verastem currently has a consensus rating of "Moderate Buy" and an average target price of $13.88.

Check Out Our Latest Stock Report on VSTM

Verastem Company Profile

(

Get Free Report)

Verastem, Inc, a development-stage biopharmaceutical company, focuses on developing and commercializing drugs for the treatment of cancer in the United States. Its product candidates are Avutometinib, an orally available small molecule RAF/MEK clamp that inhibits the ras sarcoma RAF/MEK, ERK mitogen activated pathway kinase pathway which is involved in cell proliferation, migration, transformation, and survival of tumor cells; and Defactinib, an oral small molecule inhibitor of FAK and proline-rich tyrosine kinase for various solid tumors.

Featured Articles

Before you consider Verastem, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verastem wasn't on the list.

While Verastem currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.